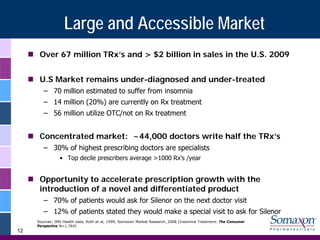

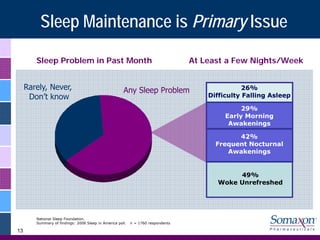

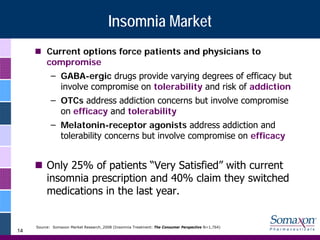

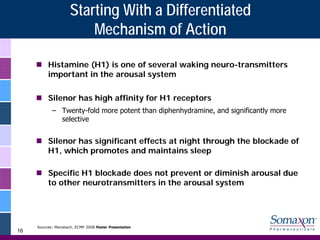

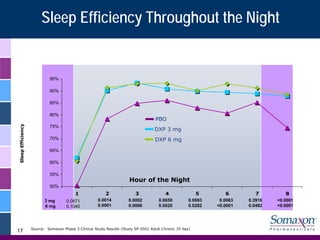

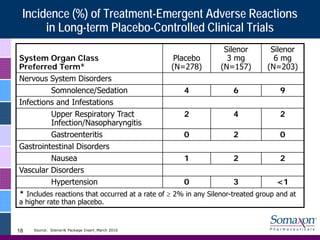

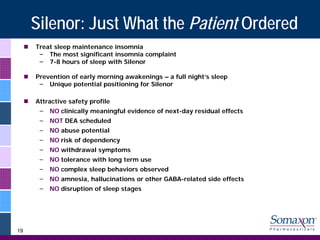

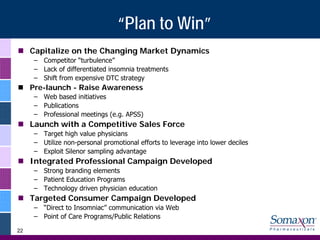

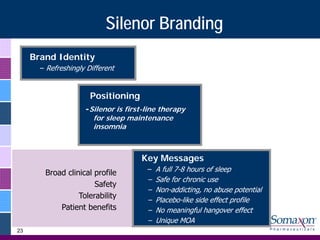

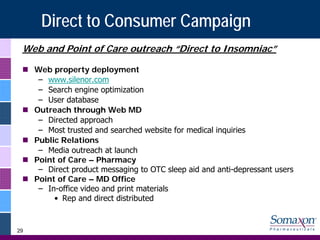

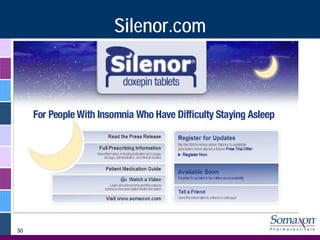

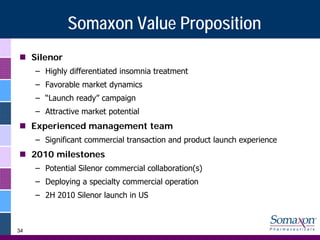

Somaxon Pharmaceuticals is preparing to launch Silenor, a new insomnia treatment approved by the FDA in March 2010. Silenor is differentiated from other insomnia treatments by its novel mechanism of action targeting histamine receptors. Somaxon plans to deploy a targeted US sales force and establish commercial partnerships to effectively launch Silenor in the second half of 2010. The large and growing insomnia market represents an opportunity for Silenor to gain market share by addressing unmet needs around sleep maintenance and safety concerns with current treatments. Somaxon believes Silenor's efficacy, safety and tolerability profile position it as a first-line therapy for insomnia.