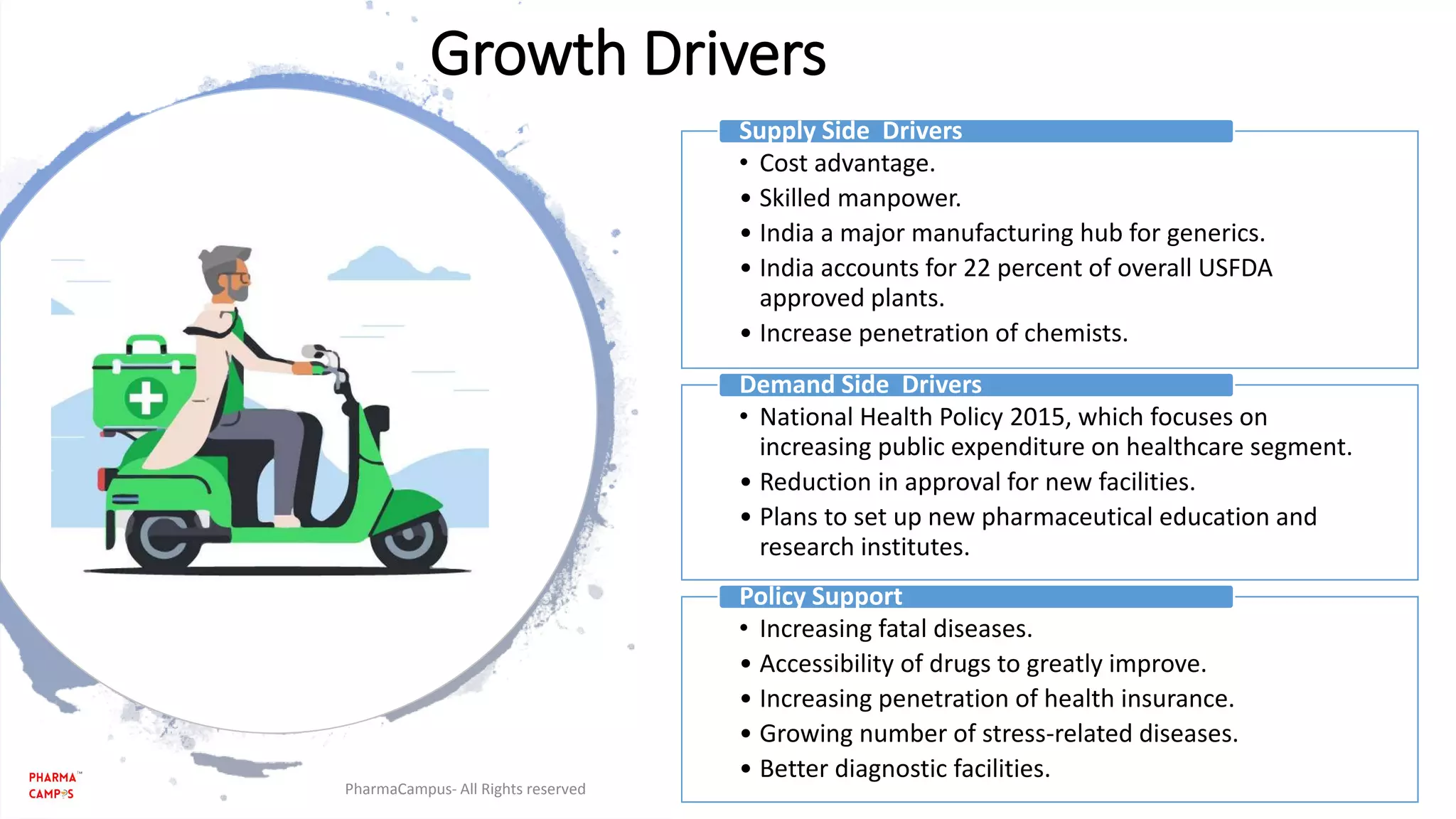

The Indian pharmaceutical industry is driven by supply-side factors such as cost advantages and skilled manpower, along with demand-side factors including the rise in fatal diseases and access to drugs. The industry is expected to grow significantly due to policy support like the National Health Policy 2015, increased healthcare spending, and the launch of patented drugs. Furthermore, the generics market dominates, with India being the largest global provider, and expected market growth in over-the-counter drugs and medical infrastructure development.