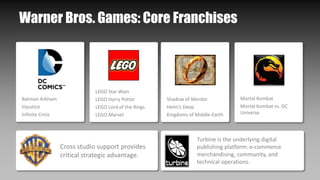

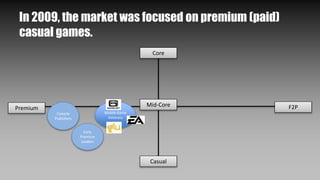

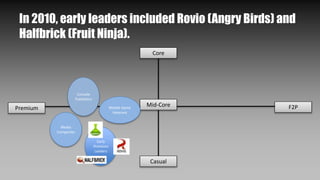

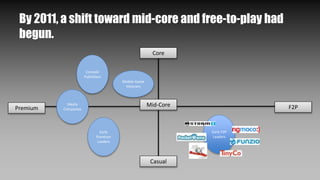

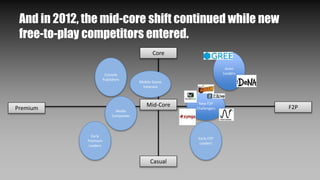

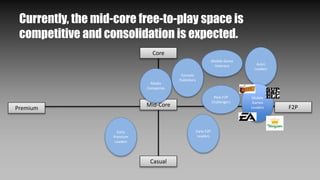

Warner Bros. Games is a significant player in the $40+ billion entertainment industry, with successful franchises like Batman and Mortal Kombat. The mobile games market is rapidly growing, particularly in Russia, which is seeing substantial revenue and competitive shifts towards mid-core and free-to-play models. With rising production and marketing costs, larger publishers, including Warner Bros., are expected to consolidate and strengthen their market positions through acquisitions.