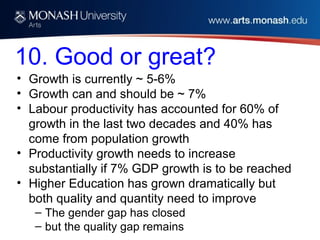

This document discusses Indonesia's economic development opportunities and challenges after 2014. Key points include:

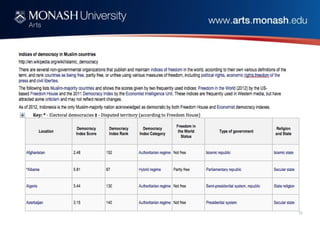

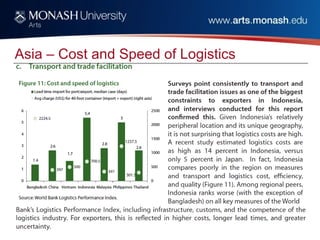

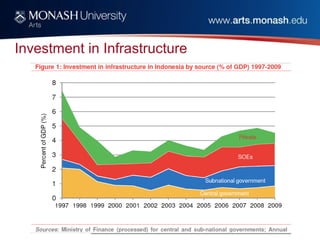

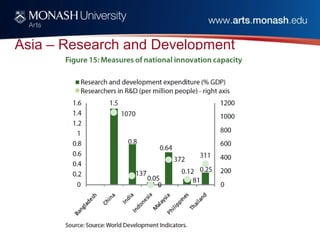

1) Indonesia has experienced a successful democratic transition and political/social stability since 1997 but faces challenges in developing innovation and improving infrastructure.

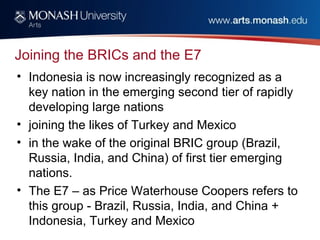

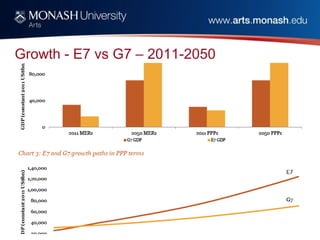

2) Indonesia is on track to become the 11th largest economy by 2020, joining the emerging economies of Brazil, Russia, India, China, Turkey and Mexico (E7).

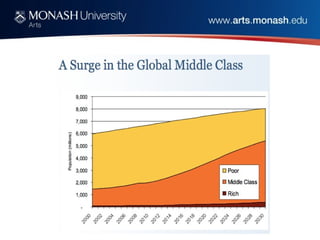

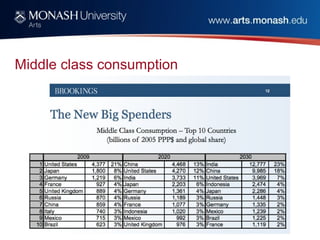

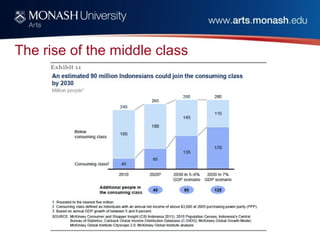

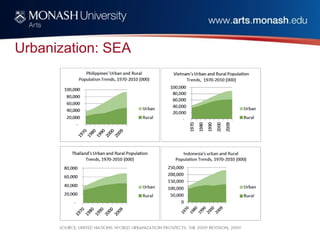

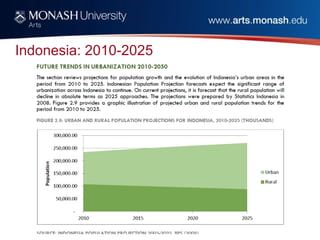

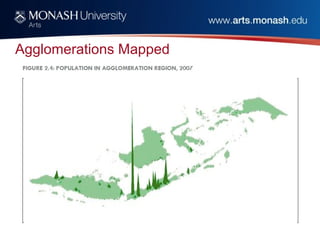

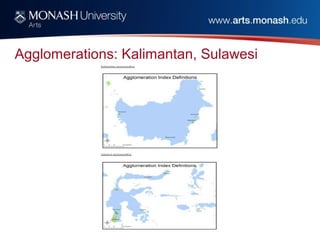

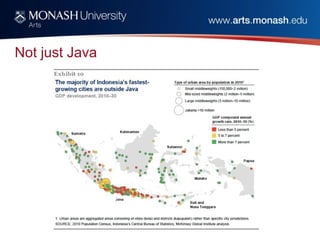

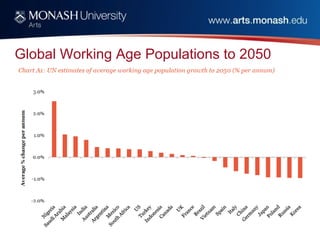

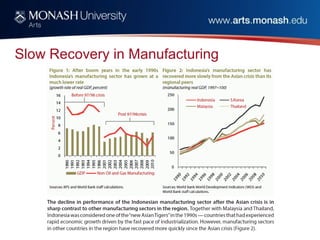

3) Rapid urbanization, growth of the middle class, and younger workforce present opportunities for economic growth but also challenges around infrastructure, education, and developing manufacturing outside of Java.