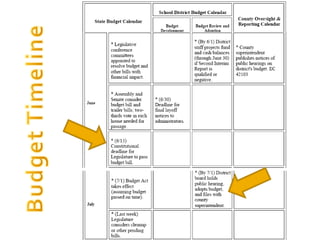

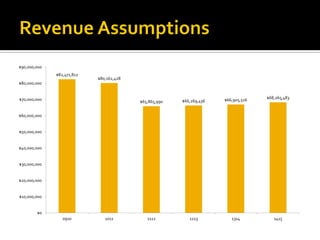

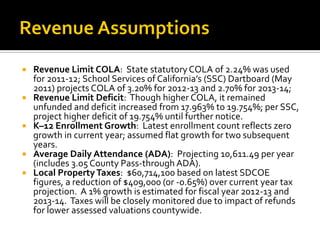

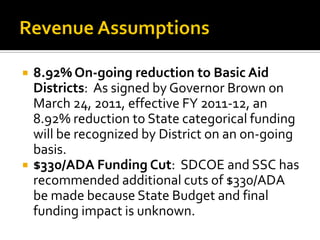

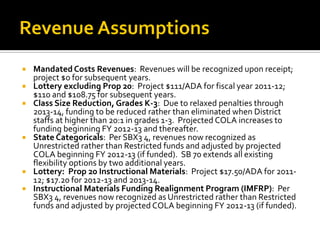

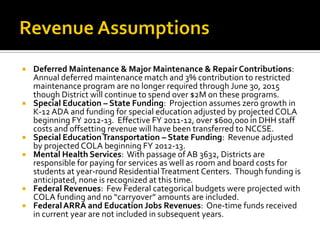

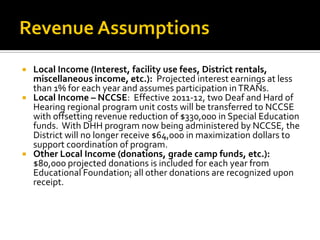

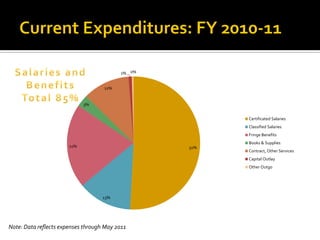

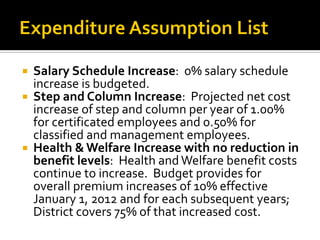

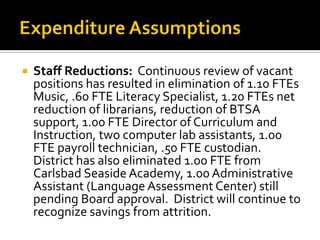

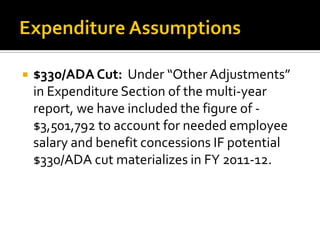

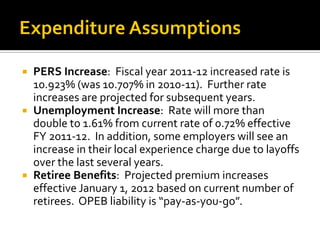

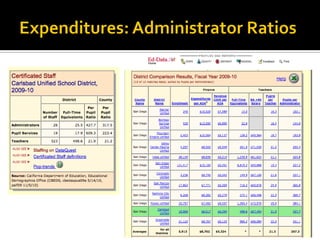

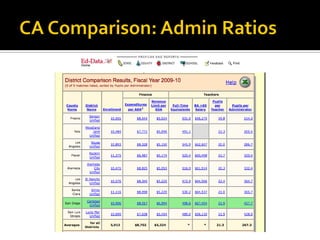

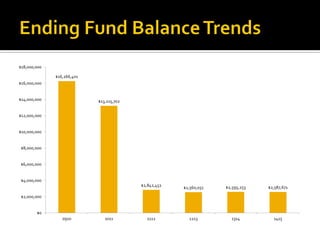

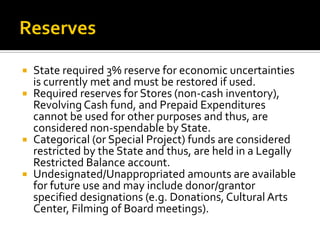

The document provides fiscal assumptions and projections for a school district's budget from 2011-12 through 2013-14. It includes assumptions about revenues, expenditures, staffing levels, and other factors. Charts show historical and projected revenues and expenditures. The district is facing reductions in state funding and increasing costs, and has made staffing and program reductions in response. Approval of the assumptions would allow completing multi-year budget projections.