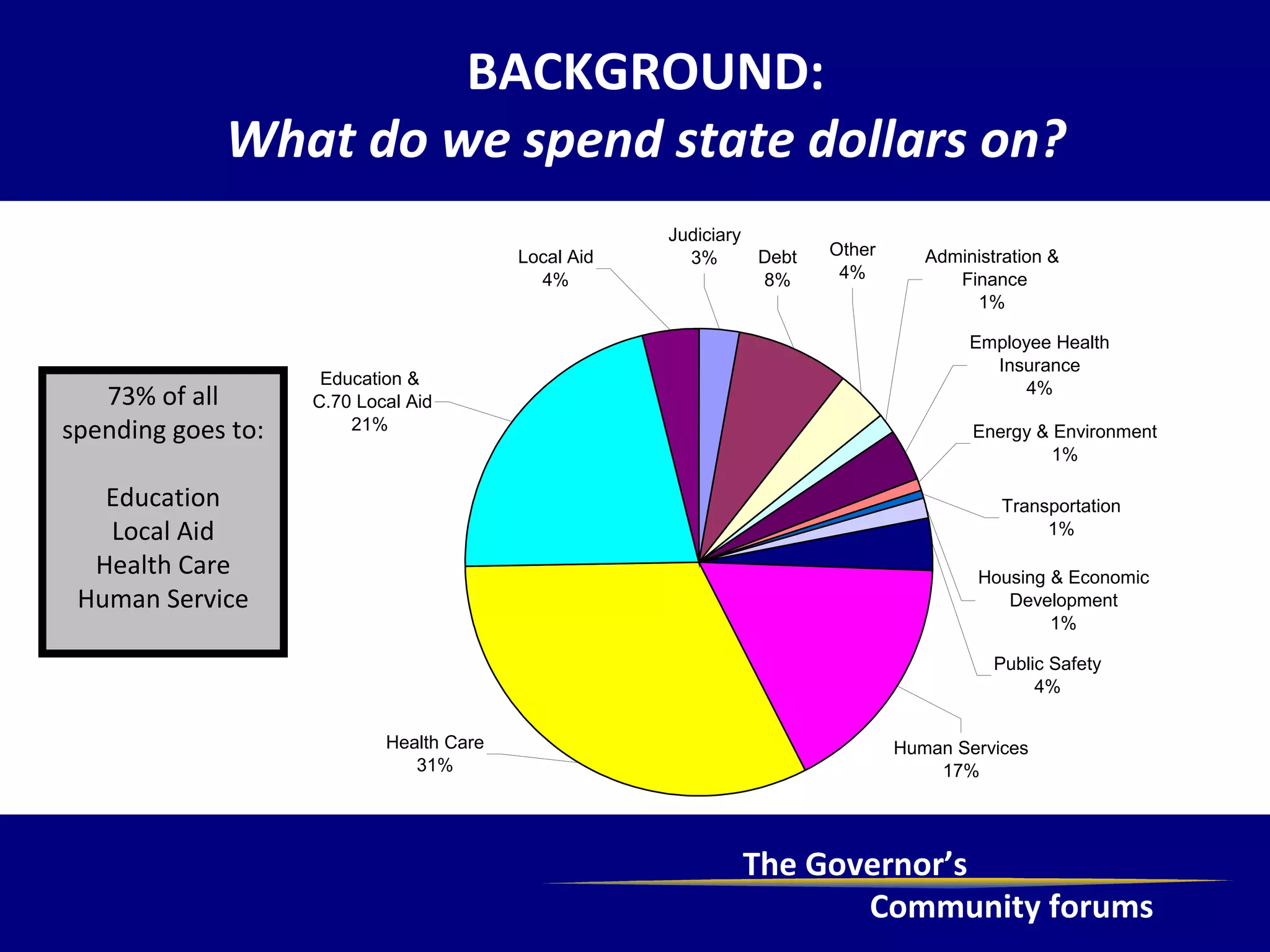

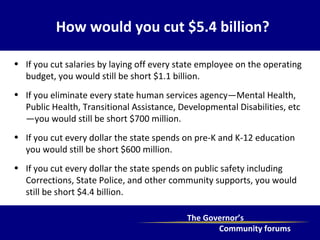

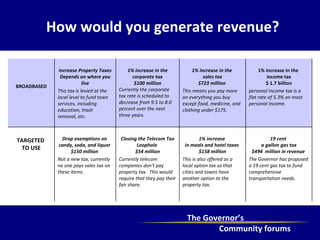

The document discusses Massachusetts state budget shortfalls and potential options to close a $5.4 billion gap. It notes that 73% of state spending goes to education, local aid, healthcare, and human services. Even eliminating all state human services agencies or education spending would not close the full gap. Potential revenue generators discussed include closing tax loopholes, increasing various taxes by 1% including the corporate tax, gas tax, meals and hotel taxes, and income and sales taxes. Raising property taxes is also mentioned but impacts would depend on location.