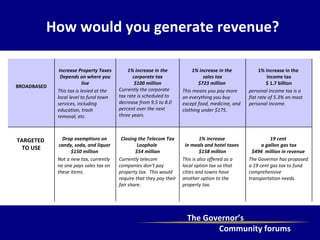

The document discusses several options for generating state revenue, including:

1) Closing the telecom tax loophole which could generate $54 million by requiring telecom companies to pay property taxes.

2) Increasing the corporate tax rate by 1% which could generate $100 million instead of allowing the scheduled decrease.

3) Increasing the gas tax by 19 cents per gallon which the Governor has proposed and could generate $494 million for transportation needs.

4) Increasing meals and hotel taxes by 1% which could generate $158 million and give cities/towns another tax option besides property taxes.