Embed presentation

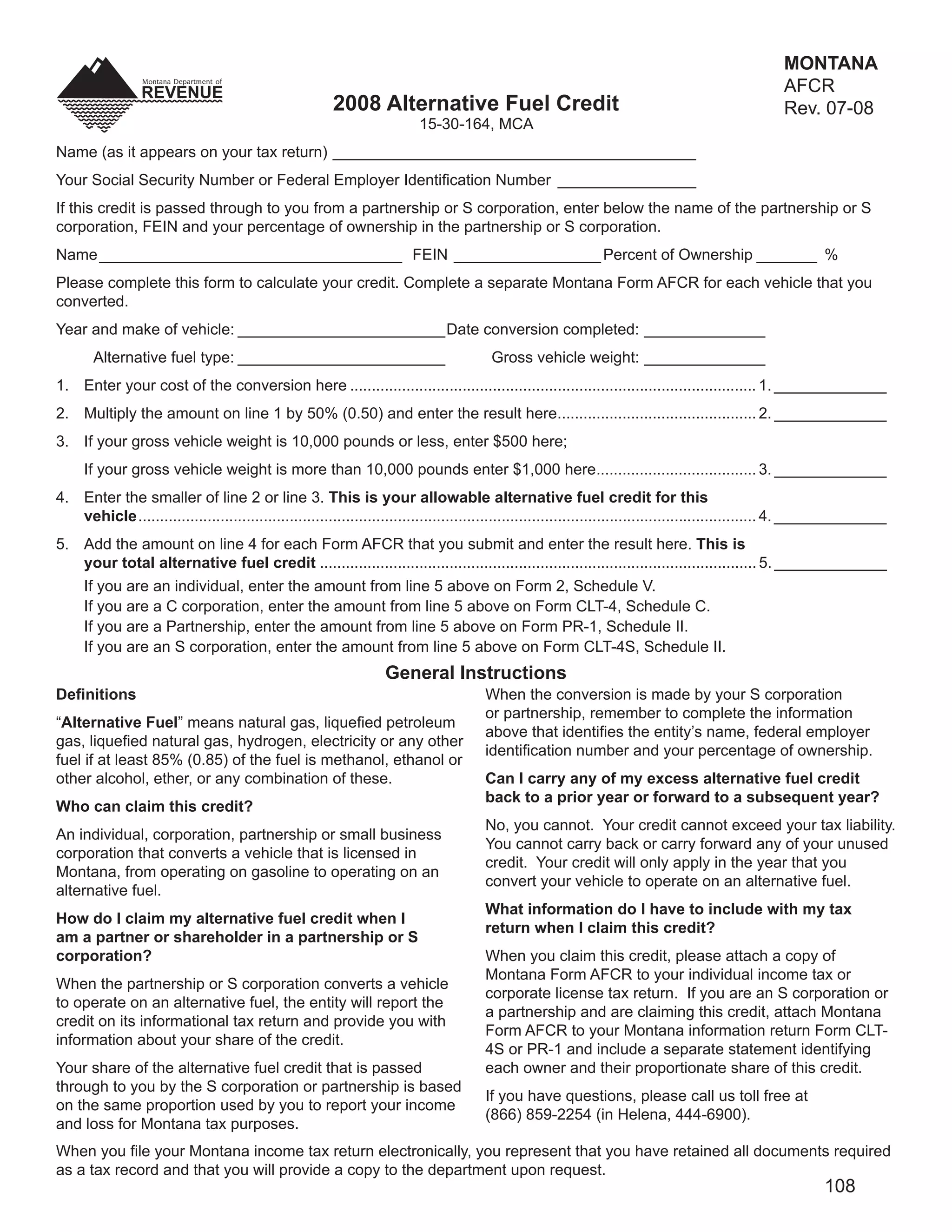

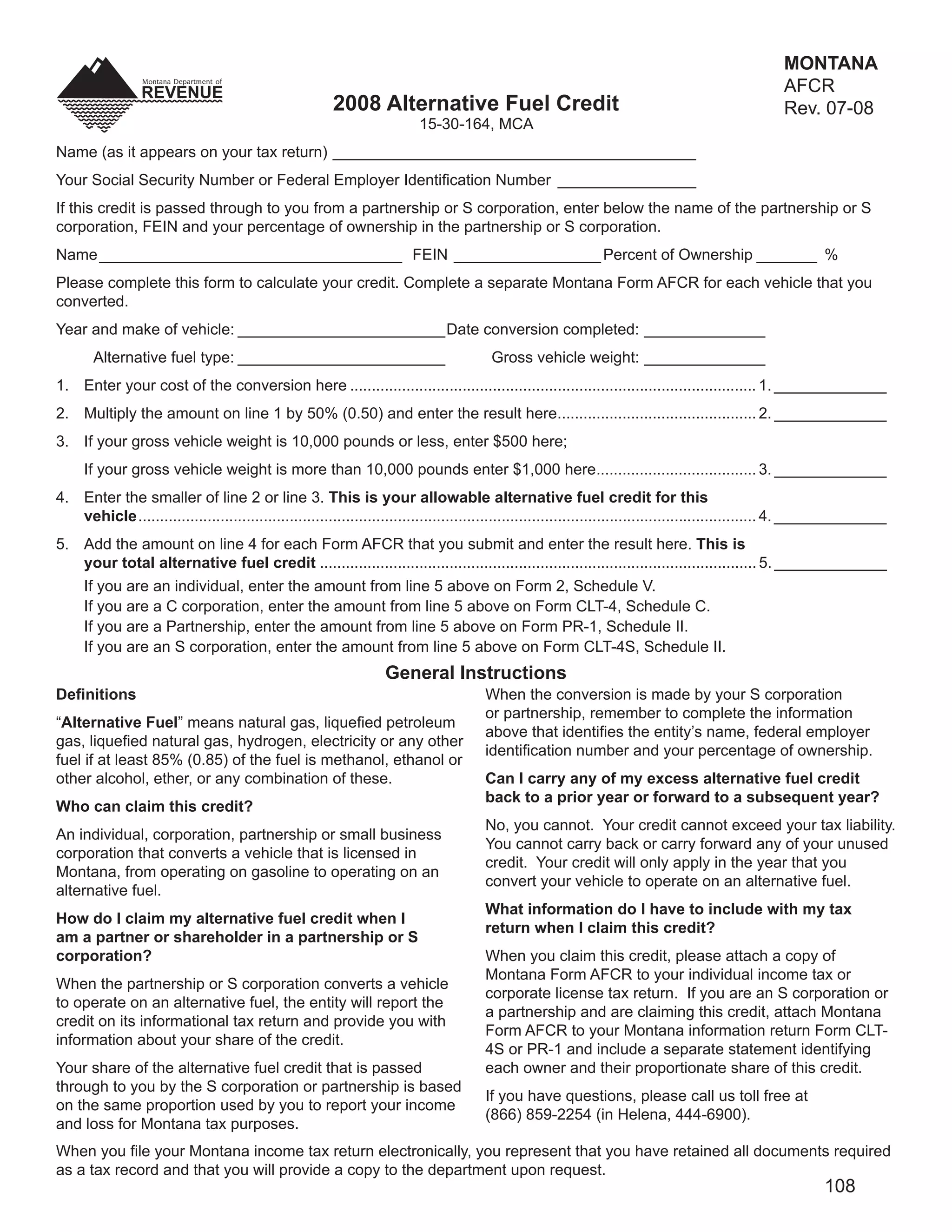

Download to read offline

This document provides instructions for claiming Montana's alternative fuel vehicle conversion tax credit. Key points: - The credit is 50% of conversion costs, up to $500 for vehicles under 10,000 lbs or $1,000 for heavier vehicles. - Individuals, corporations, partnerships or S corporations can claim the credit by submitting Form AFCR. - Partnerships and S corporations pass the credit to owners based on ownership percentage. Owners claim their share on their personal or business tax return. - The credit cannot be carried back or forward to other tax years and only applies to the year the vehicle was converted. Supporting documents must be attached to claim the credit.