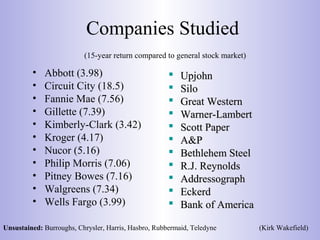

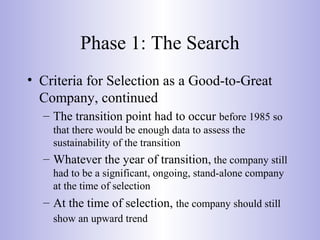

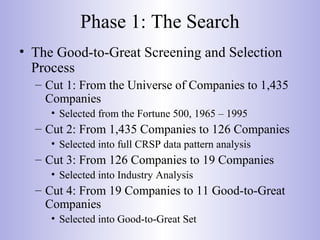

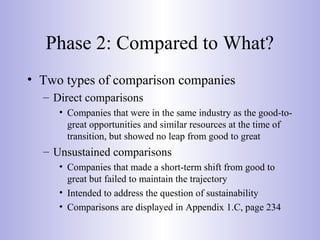

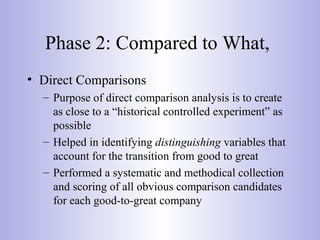

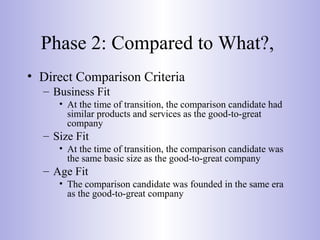

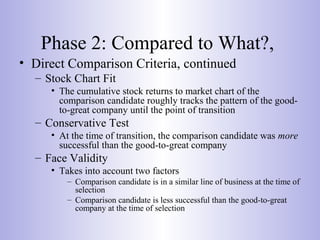

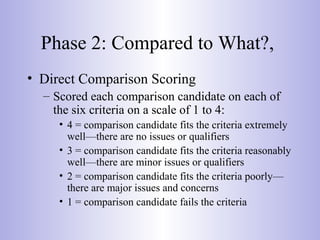

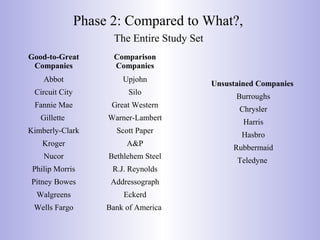

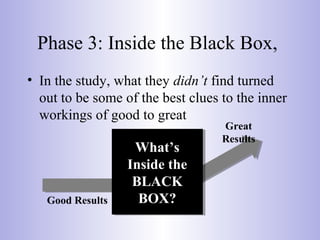

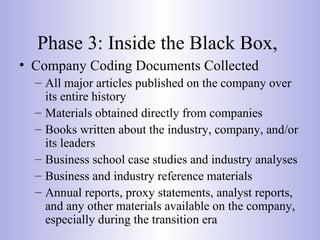

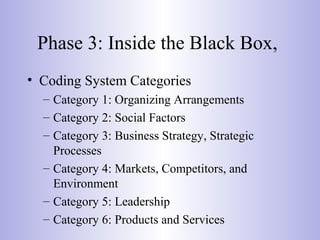

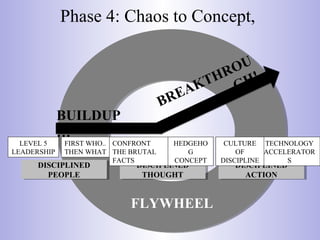

This document provides an overview of Jim Collins' book "Good to Great". It summarizes the research process, findings and conclusions. The research involved identifying companies that showed sustained great performance after a period of good performance. 11 companies were identified as "good-to-great". Their performance was compared to direct competitors and companies that saw only temporary improvements. Through extensive coding and analysis of these companies, insights were uncovered about what distinguishes companies that go from good to great. The key conclusion was that any organization can substantially improve and become great by applying the framework from this research.