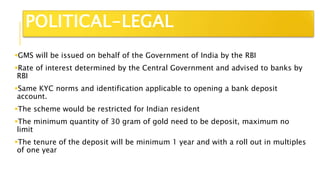

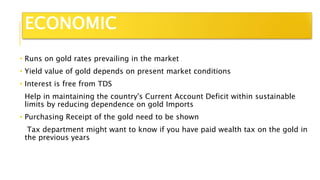

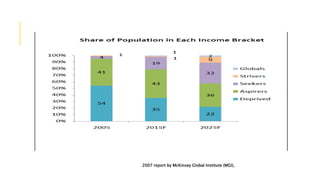

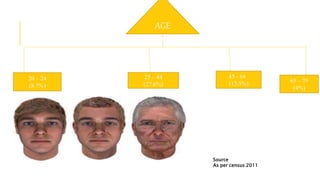

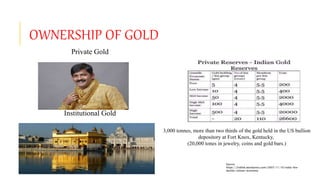

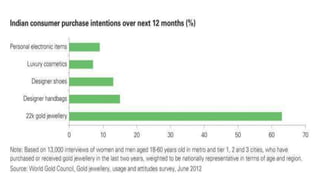

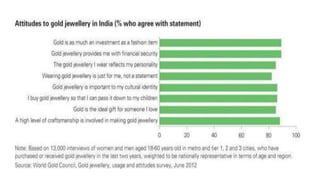

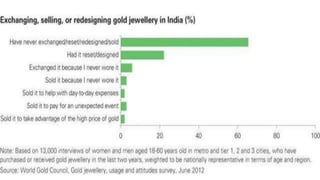

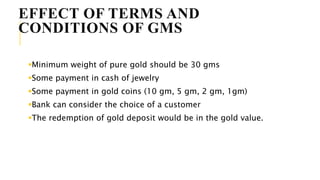

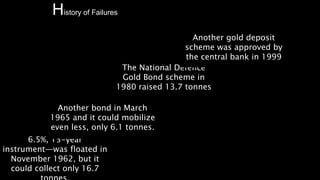

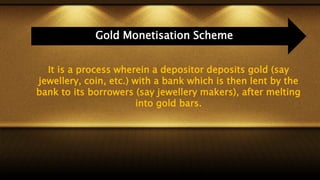

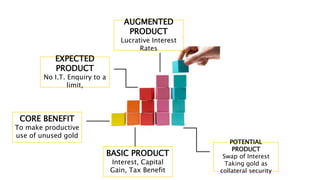

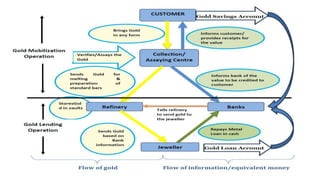

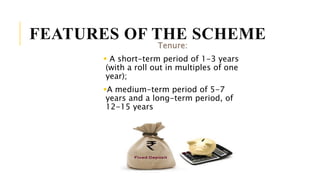

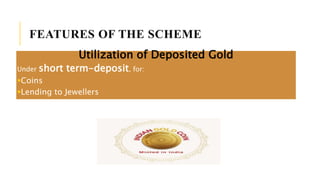

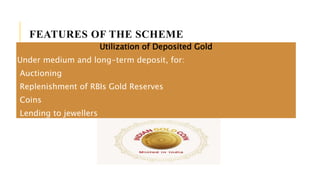

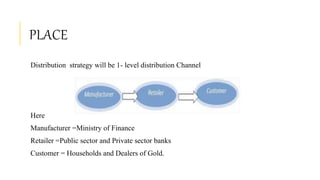

The document details a gold monetization scheme aimed at utilizing India's substantial gold reserves to boost the gems and jewelry sector and reduce reliance on gold imports, impacting the country's trade deficit. It outlines various aspects of the scheme, including market conditions, economic implications, target consumer segments, consumer behavior, and operational features, such as interest rates and deposit tenures. The scheme's success relies on changing consumer attitudes towards gold and making gold deposits attractive, despite a historical culture of gold ownership in India.