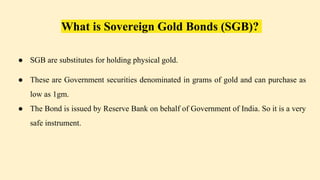

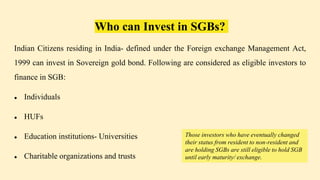

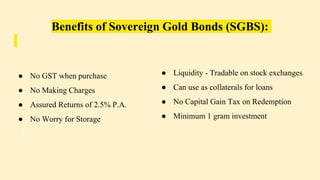

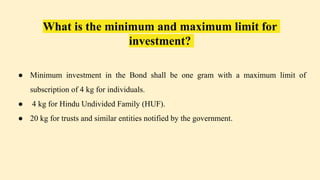

Sovereign Gold Bonds (SGB) are government securities available for purchase in grams of gold, offering a safe alternative to physical gold ownership for Indian residents. Investors can buy a minimum of 1 gram and up to 4 kg, with benefits including no GST, assured interest of 2.5% per annum, and no capital gains tax upon redemption. The bonds can be purchased through various authorized agencies and traded on stock exchanges, with maturity resulting in the market value of gold and periodic interest for the investor.