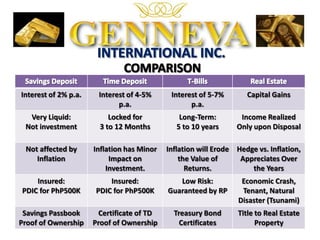

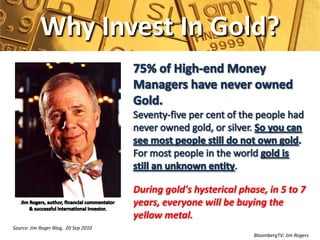

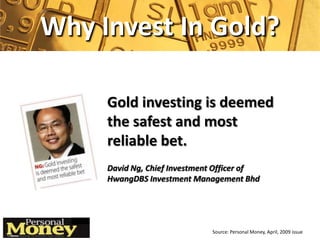

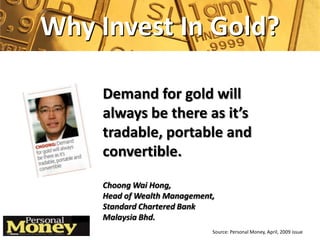

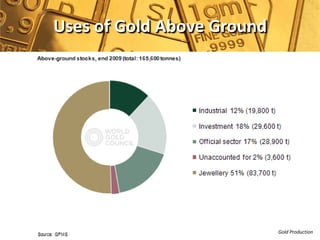

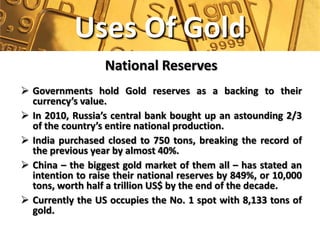

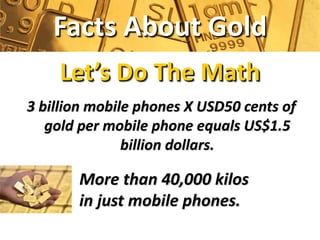

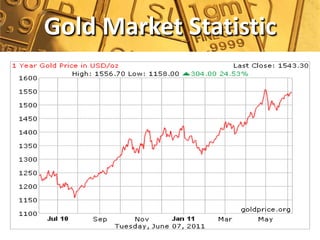

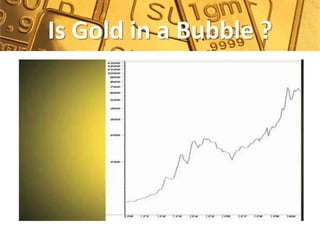

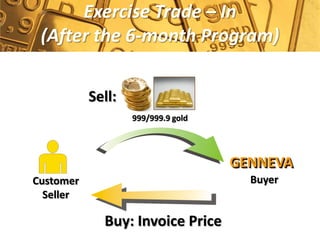

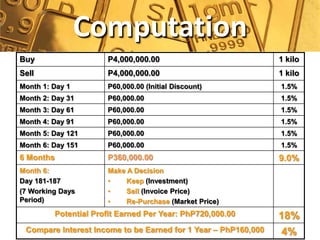

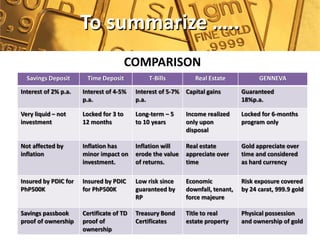

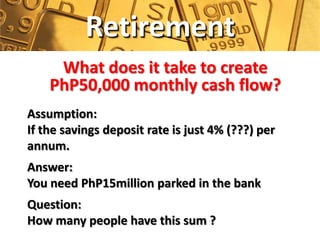

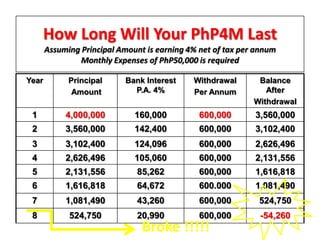

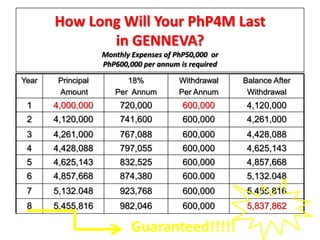

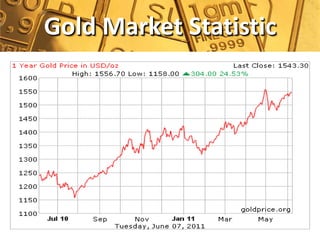

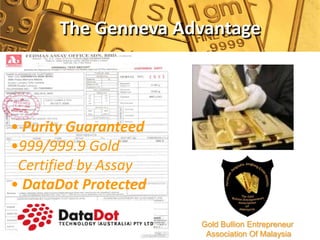

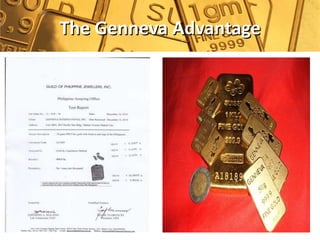

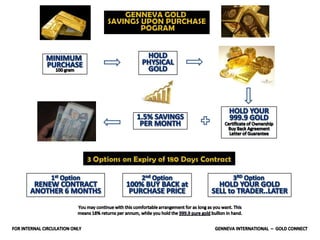

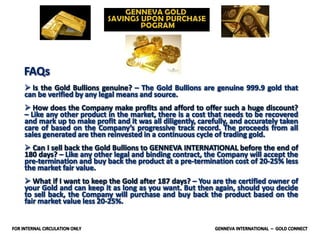

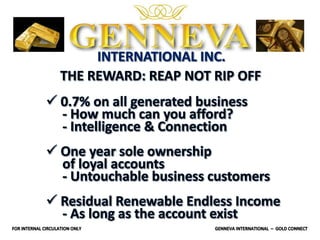

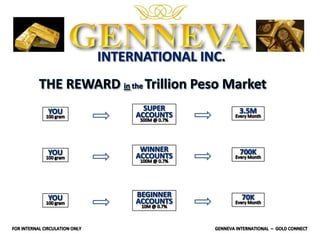

The document discusses various investment options, particularly focusing on gold as a safe and reliable investment due to its liquidity and potential for appreciation. It highlights the rising demand for gold from countries like Russia, India, and China, along with the challenges in gold mining and production. Additionally, it presents a comparison of Genneva's gold investment program versus traditional investment avenues, emphasizing the benefits of higher returns and guaranteed gold purity.