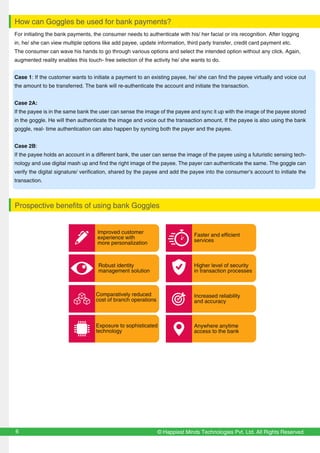

The document discusses the potential future of using wearable technology like smart glasses or "goggles" for banking. It envisions a future where customers can access banking services and make payments through goggles using biometric authentication like facial or iris recognition, without needing to touch or click anything. The goggles would allow virtual conferencing with bank representatives, viewing accounts and initiating transactions just by voice or hand gestures. This "touch-free banking" through goggles could provide benefits like improved customer experience, higher security, and access to banking services anywhere at any time. While the technologies are still developing, wearables may play an important role in redefining the retail banking experience in the future.