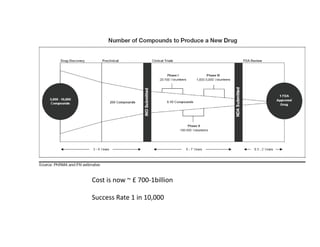

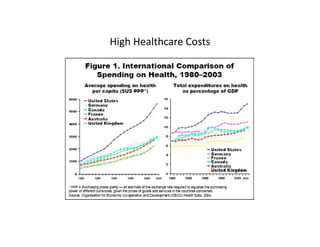

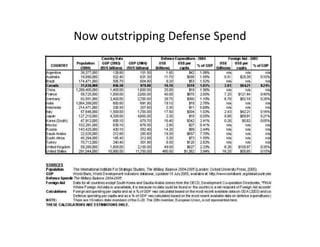

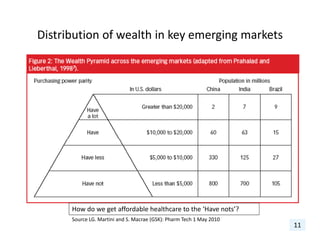

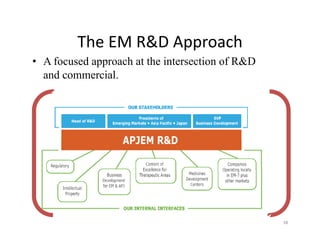

The pharmaceutical industry faces significant challenges, including high R&D costs and low success rates for new drug approvals, which require innovative strategies to engage emerging markets. Companies like GlaxoSmithKline are adapting by acquiring local products and committing to affordable healthcare measures in low-income countries. The future of drug development is expected to involve more cross-border collaboration and a focus on creating tailored solutions for diverse healthcare challenges.