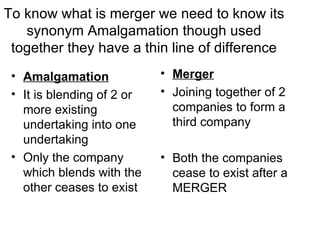

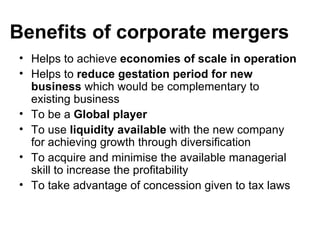

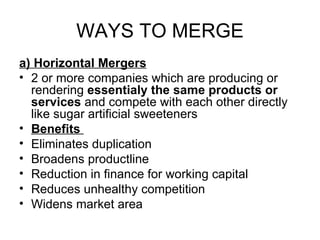

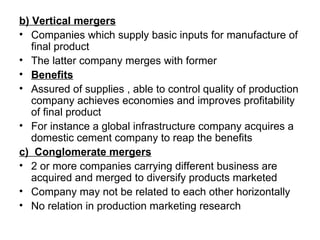

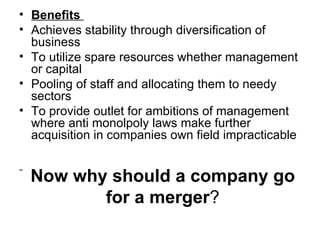

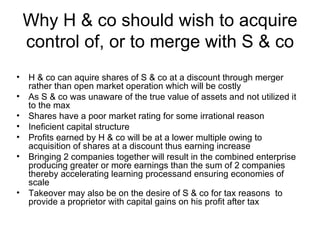

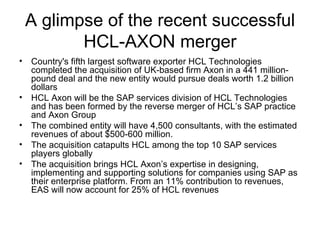

The document discusses the benefits of corporate mergers and acquisitions during an economic downturn. It states that cost cutting through economies of scale is needed, but companies must consider market and public sentiment. Mergers allow companies to expand while reducing costs. The types of mergers include horizontal between competitors, vertical between suppliers and customers, and conglomerate between unrelated industries. A recent example provided is HCL's acquisition of Axon, creating a large SAP services firm.