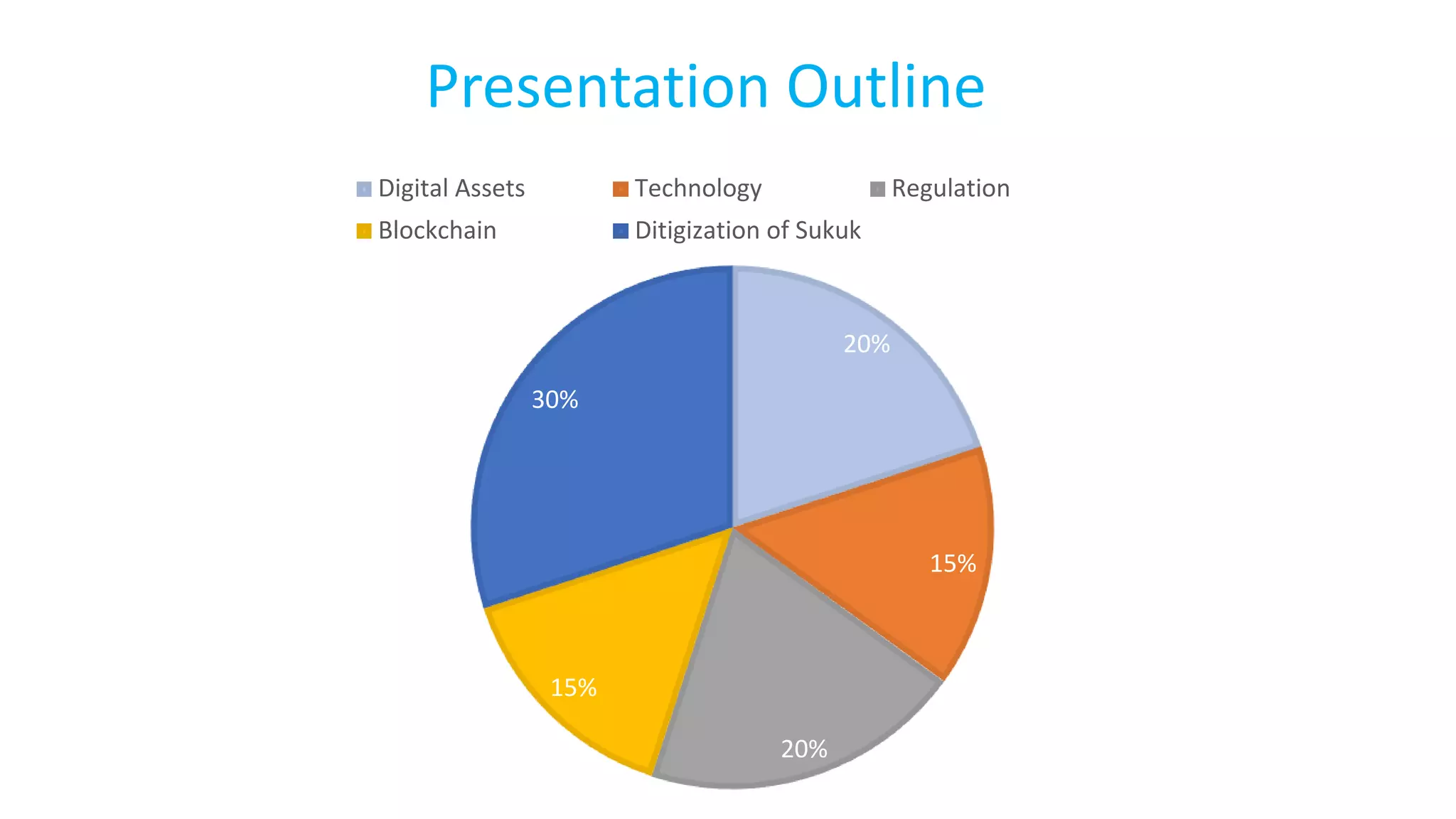

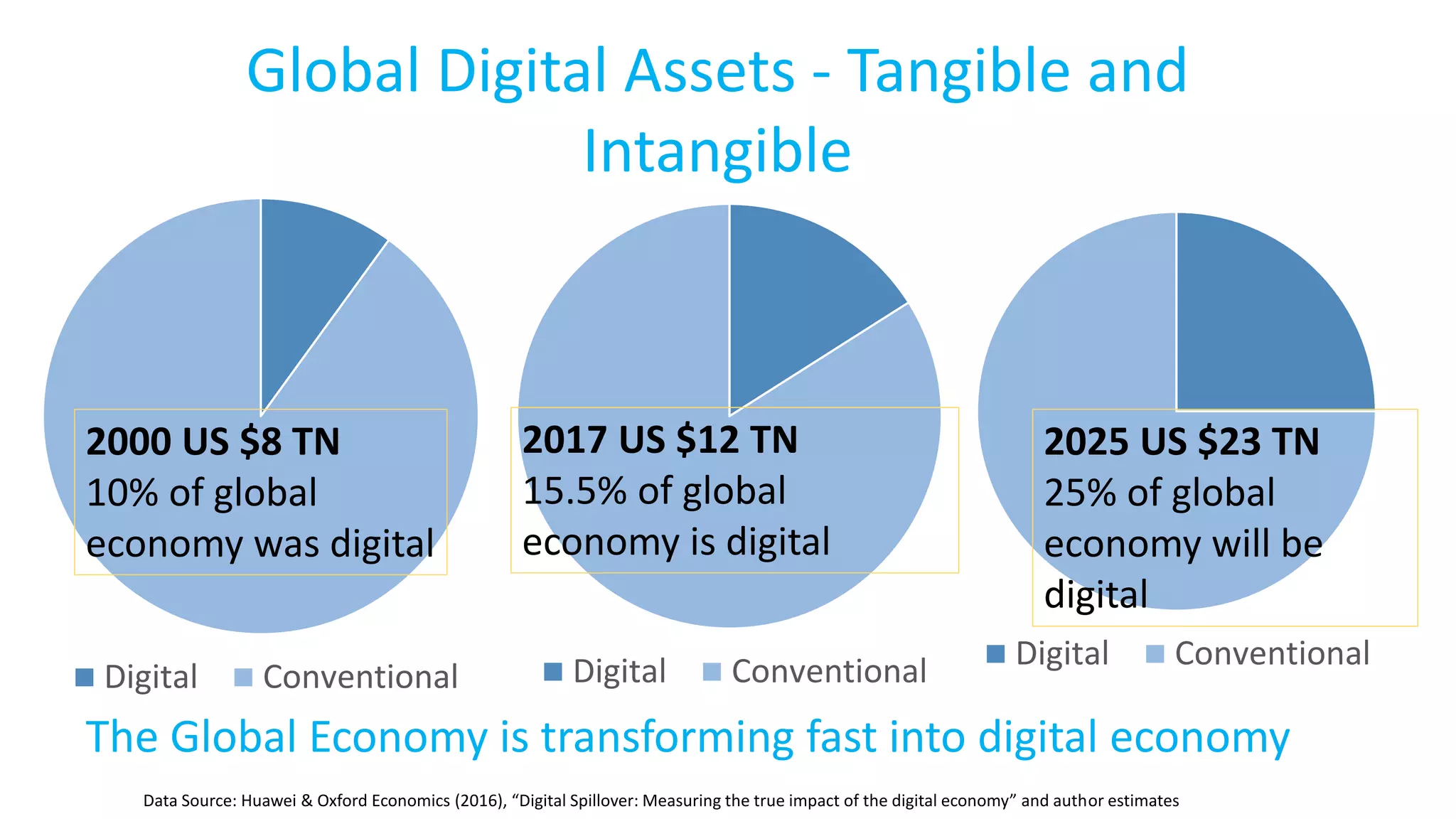

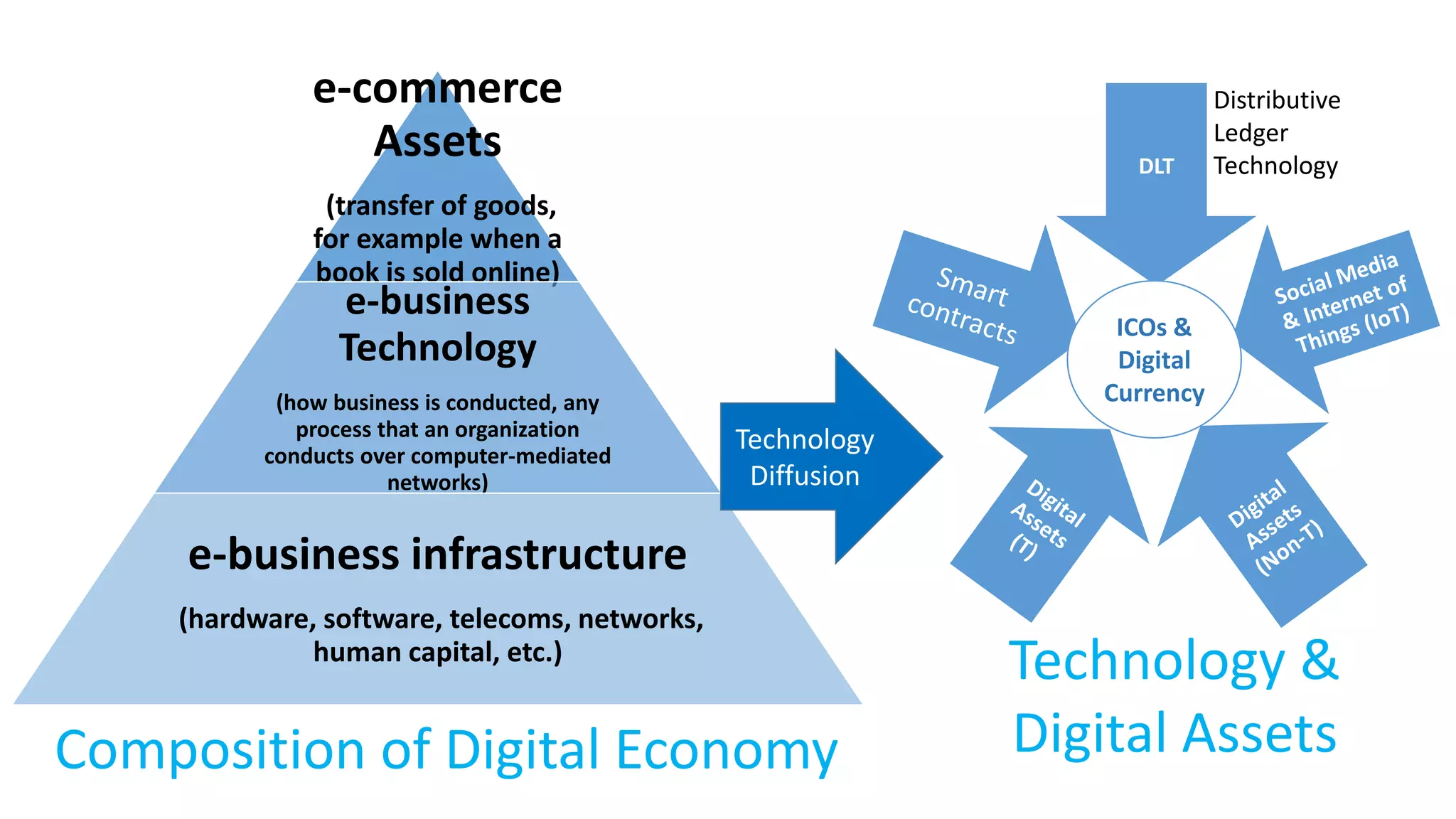

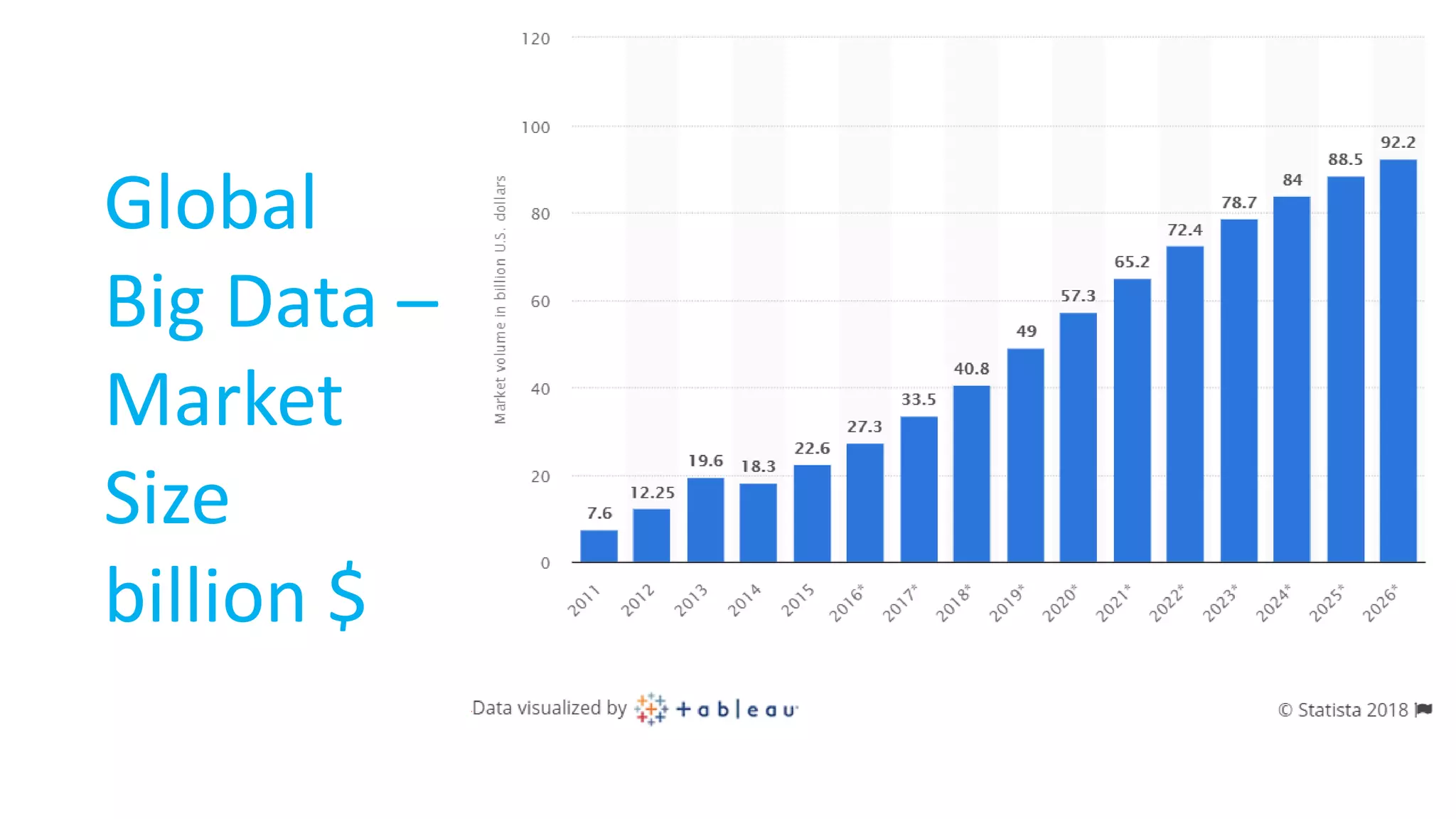

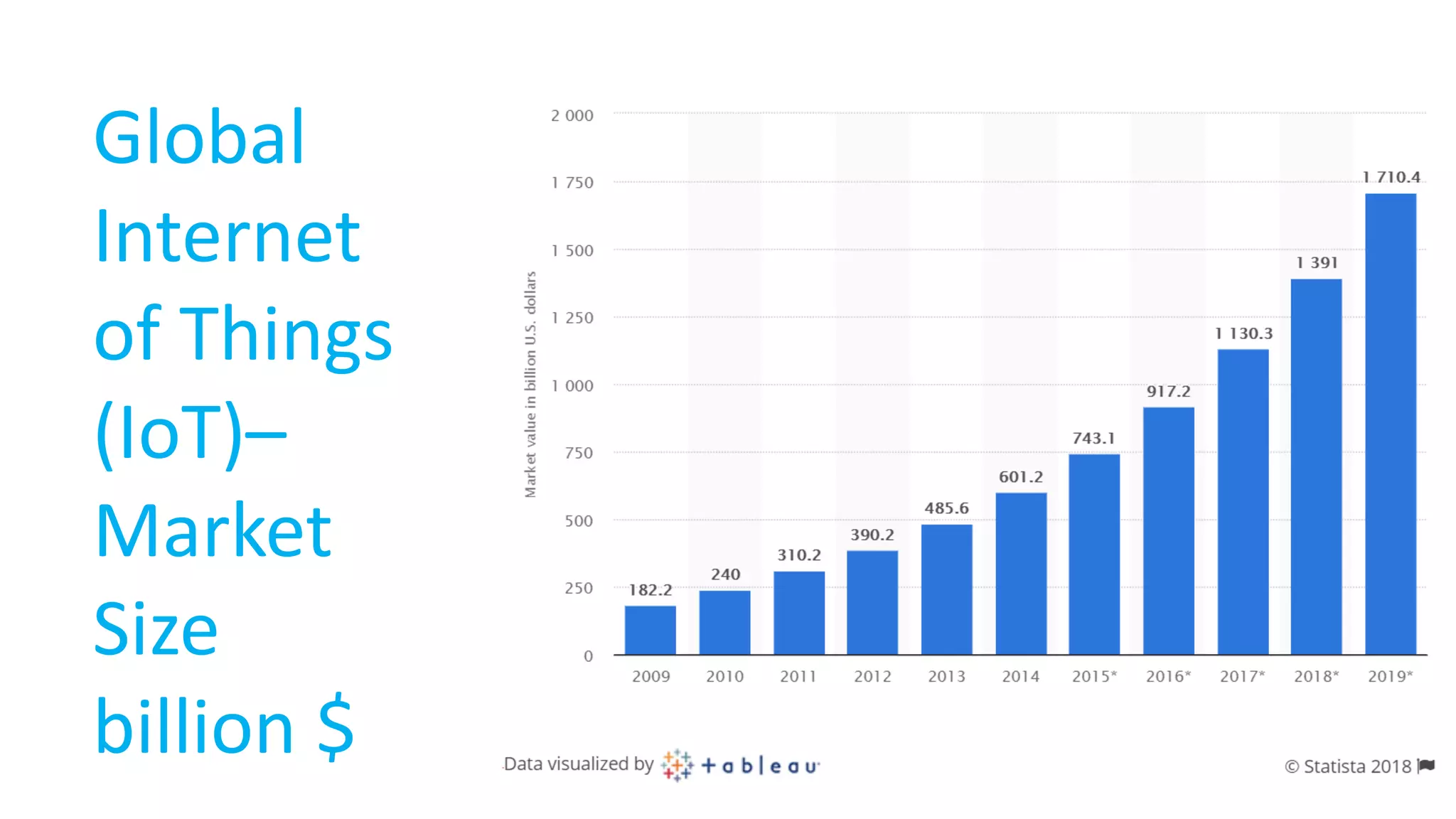

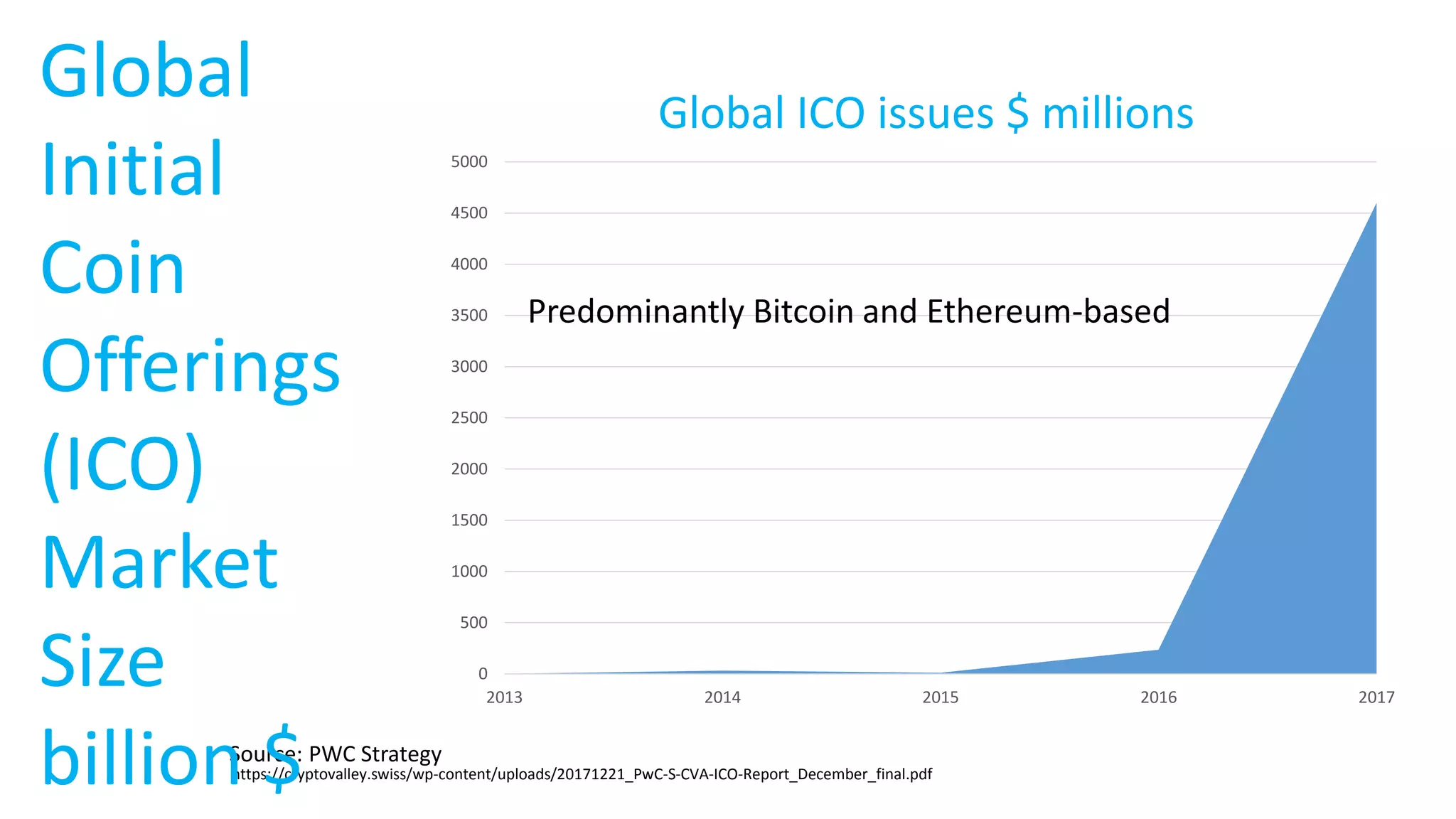

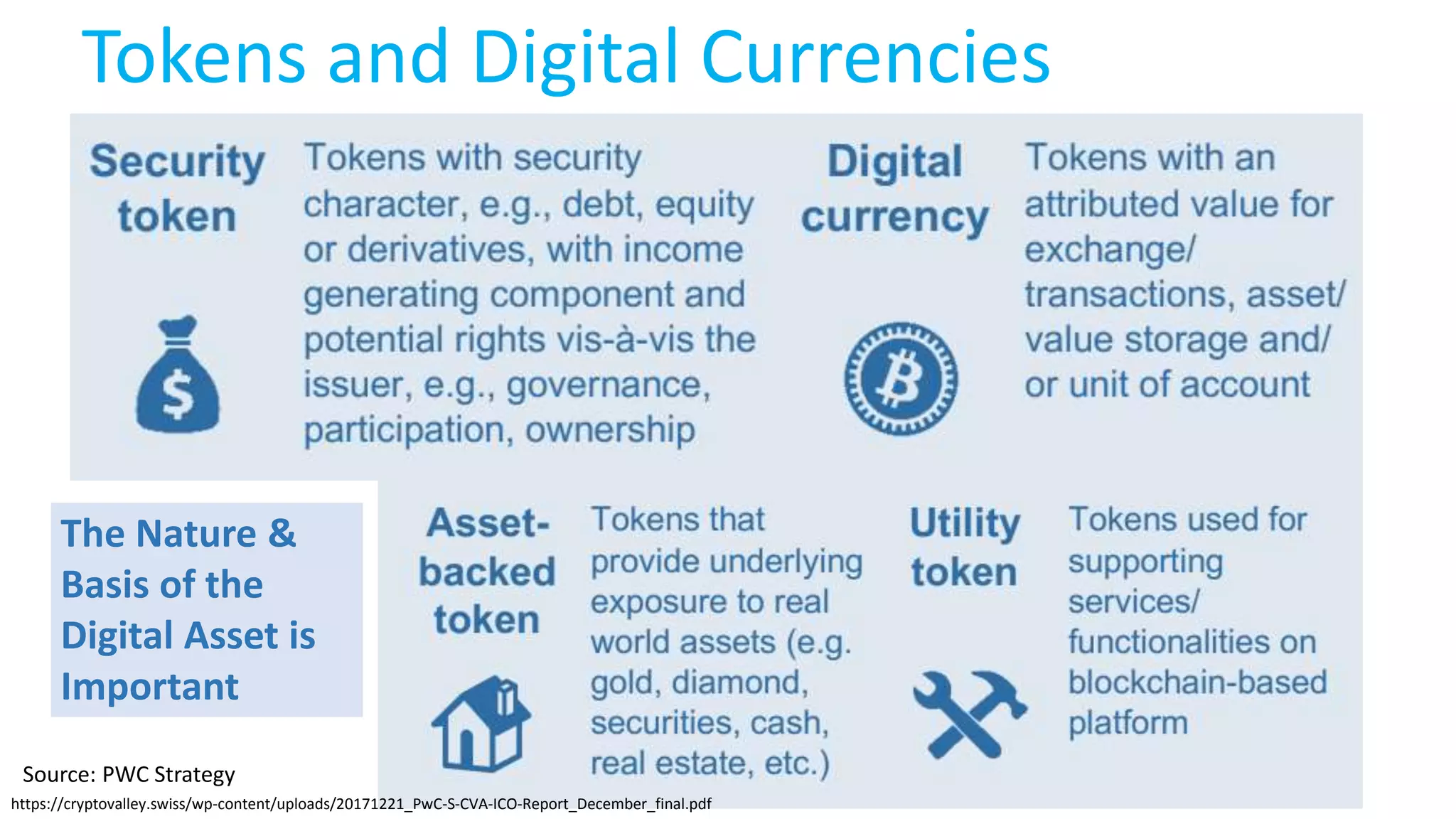

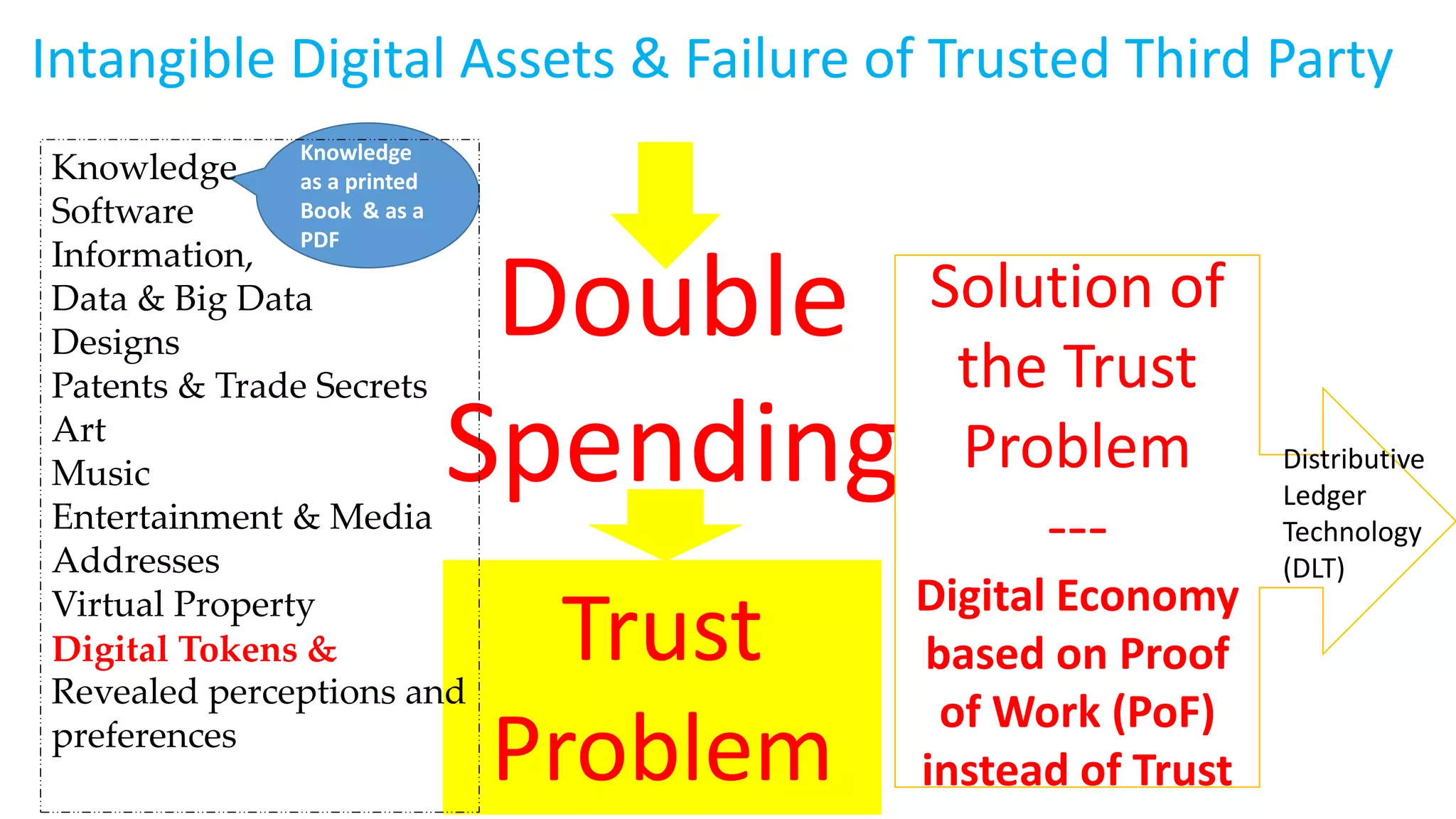

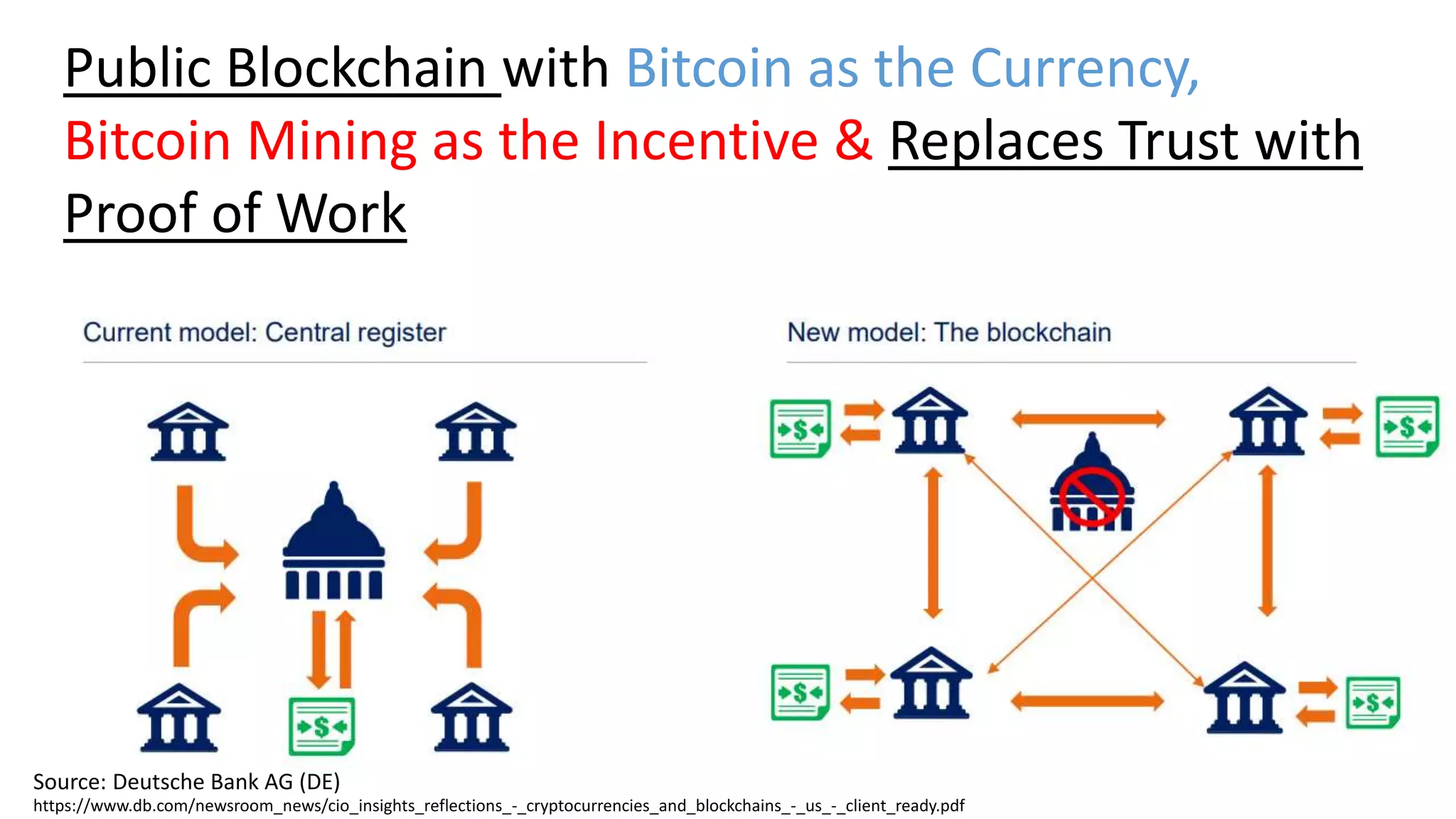

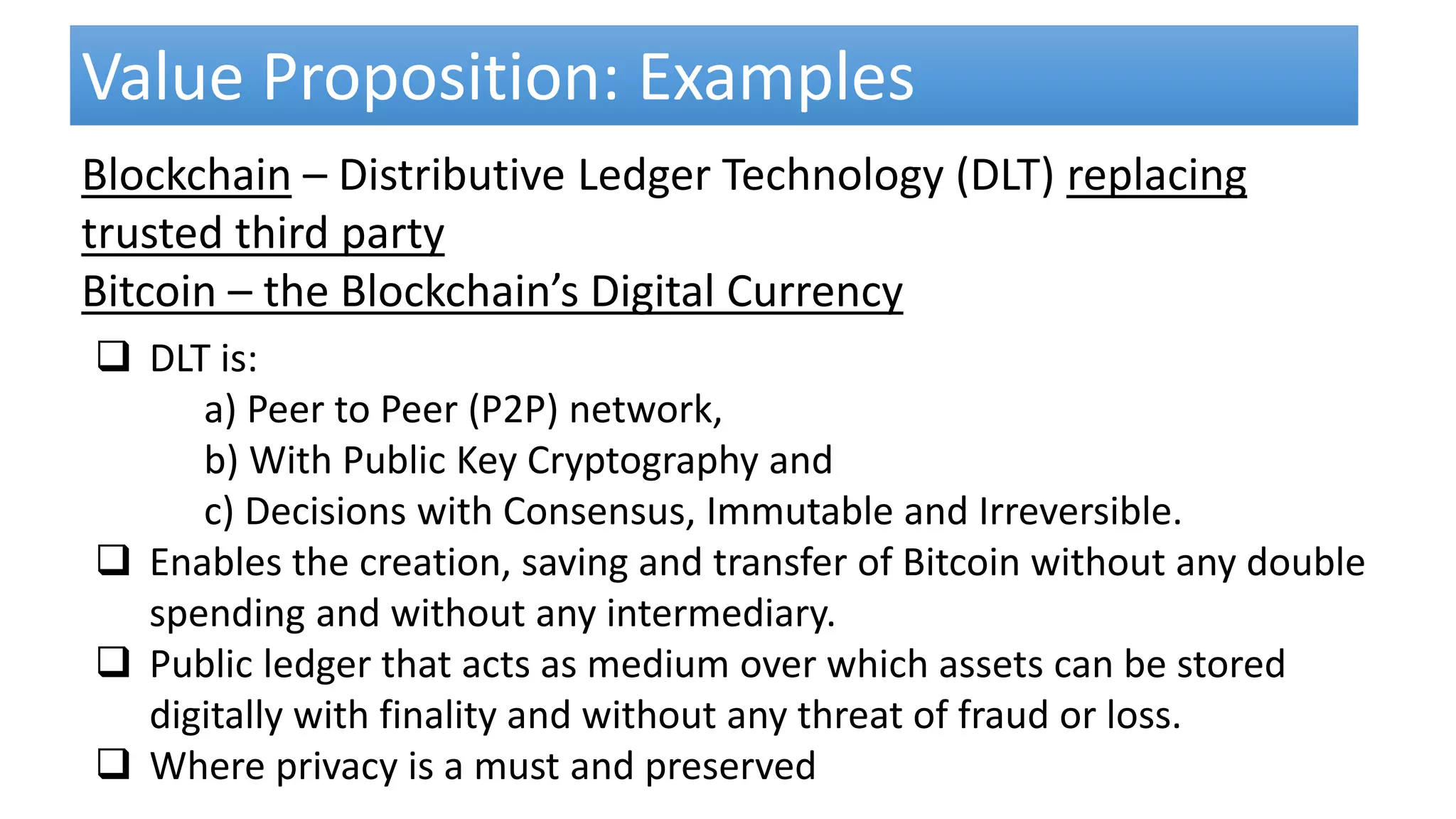

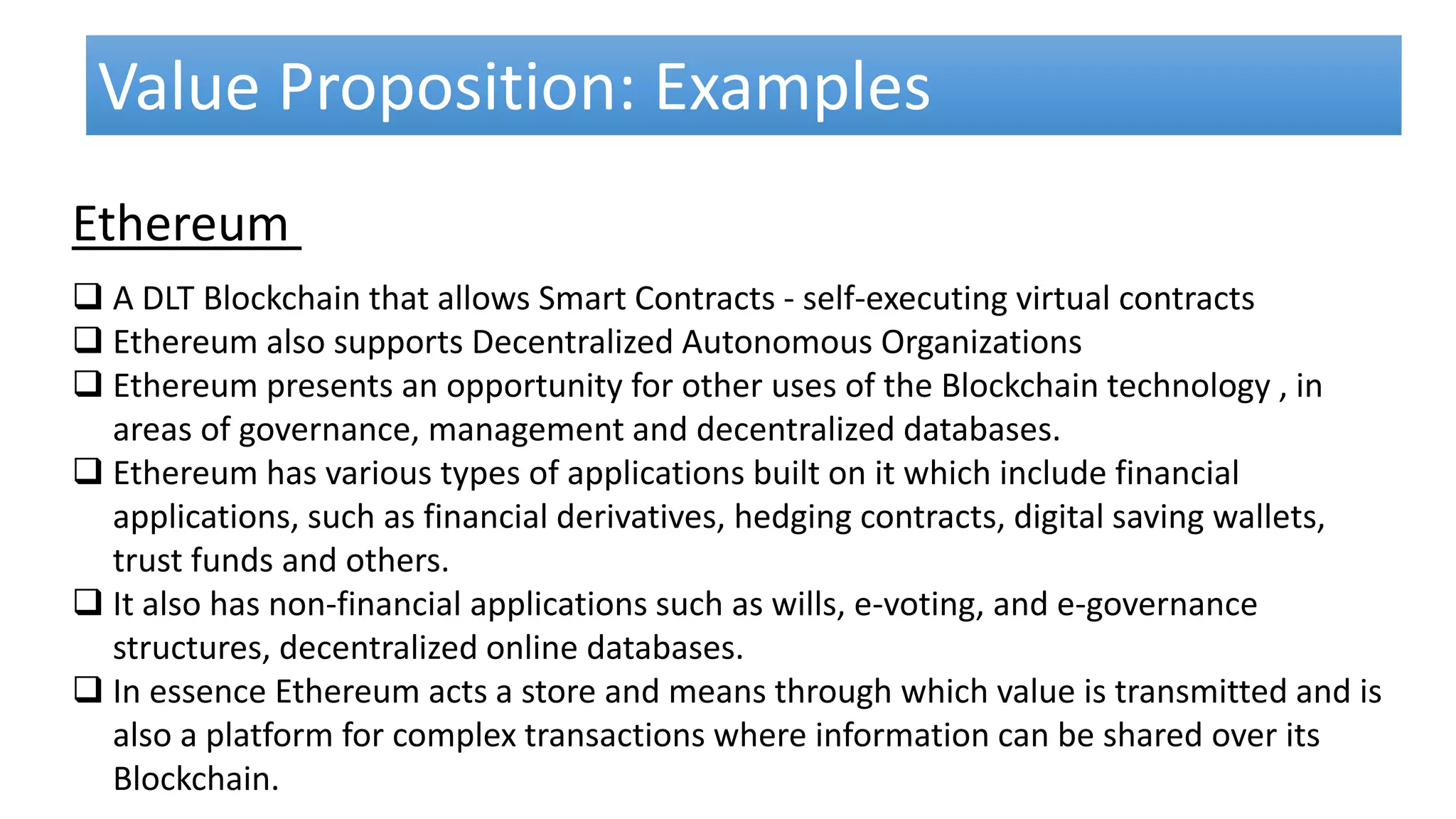

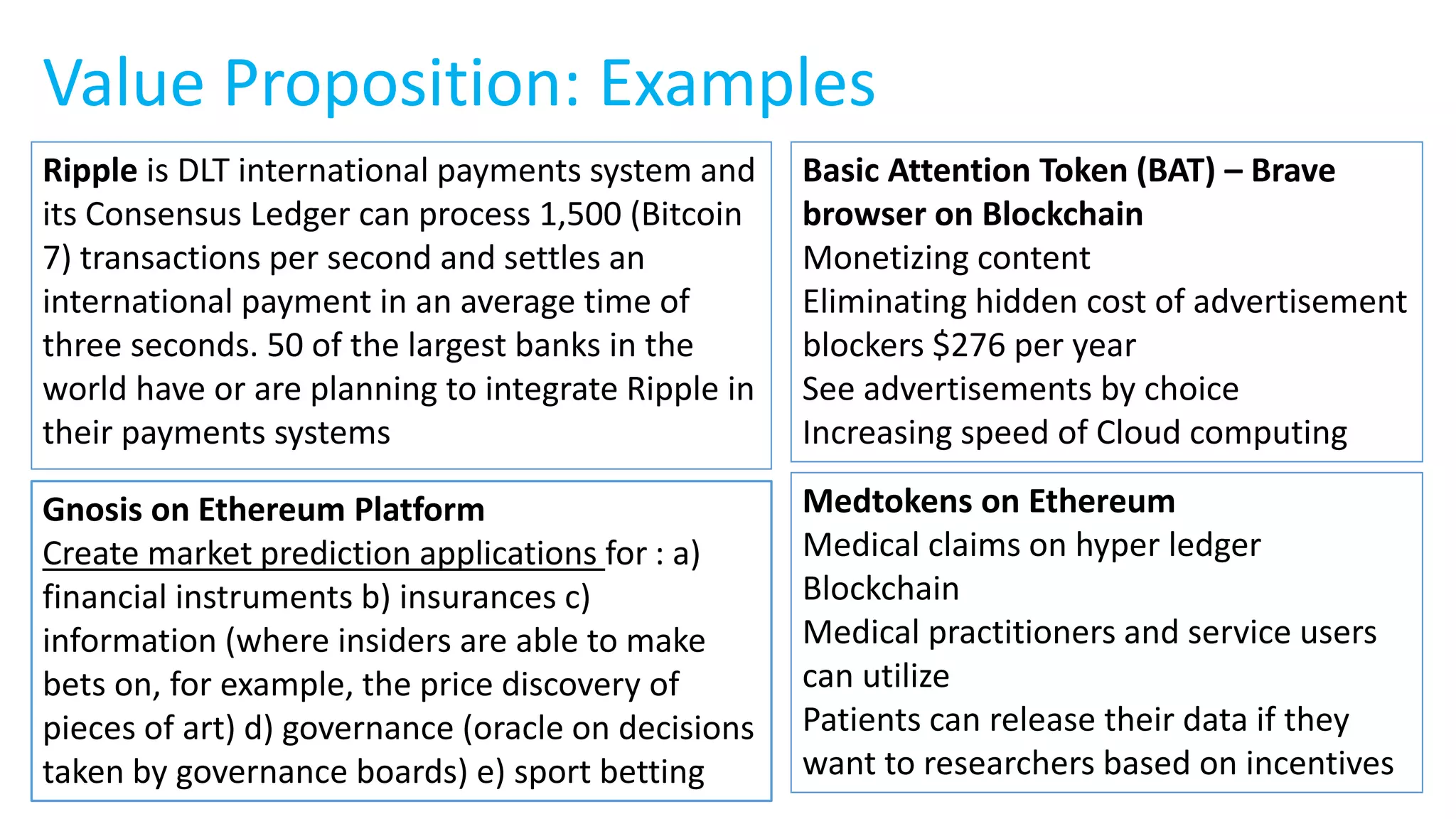

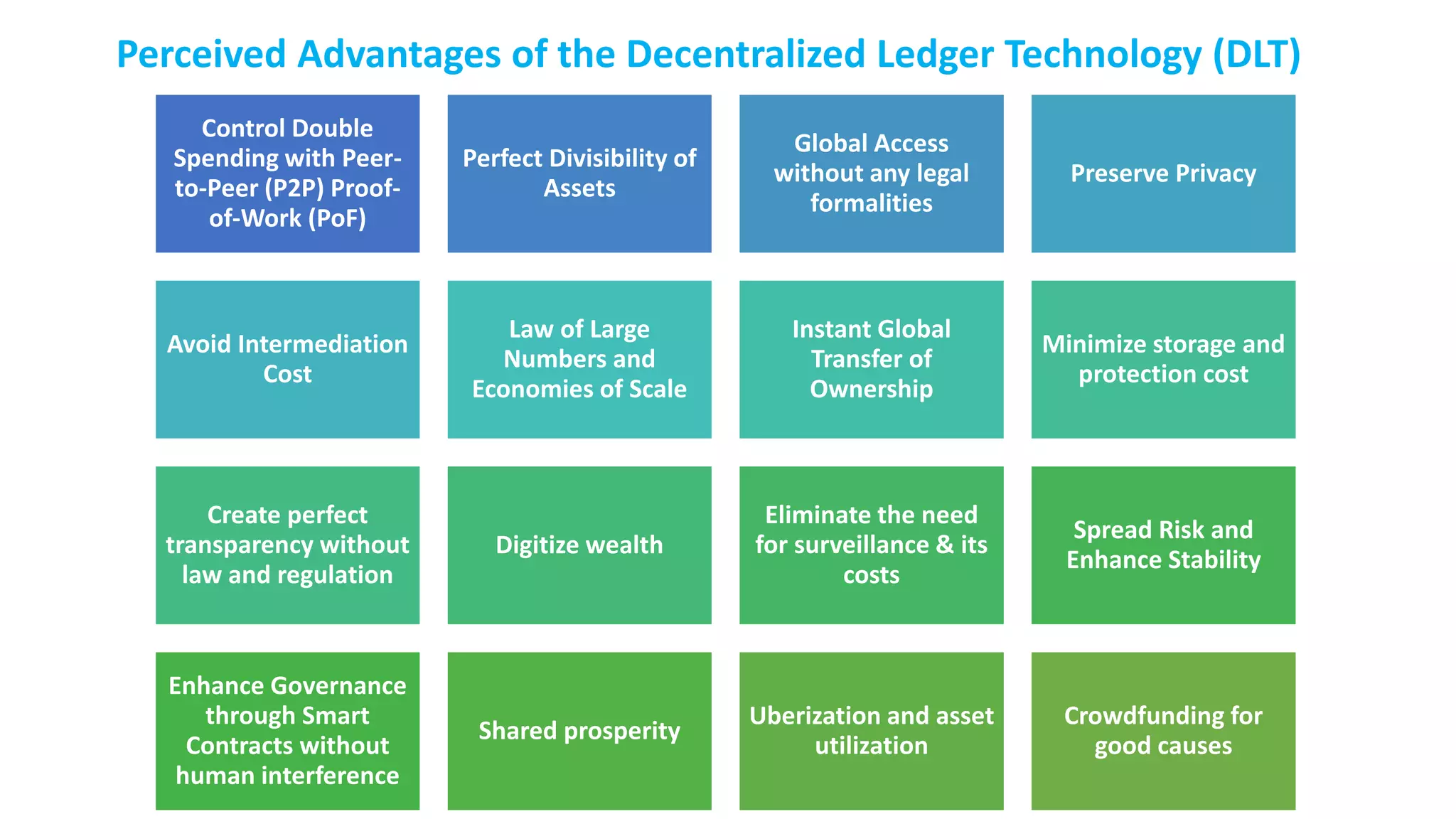

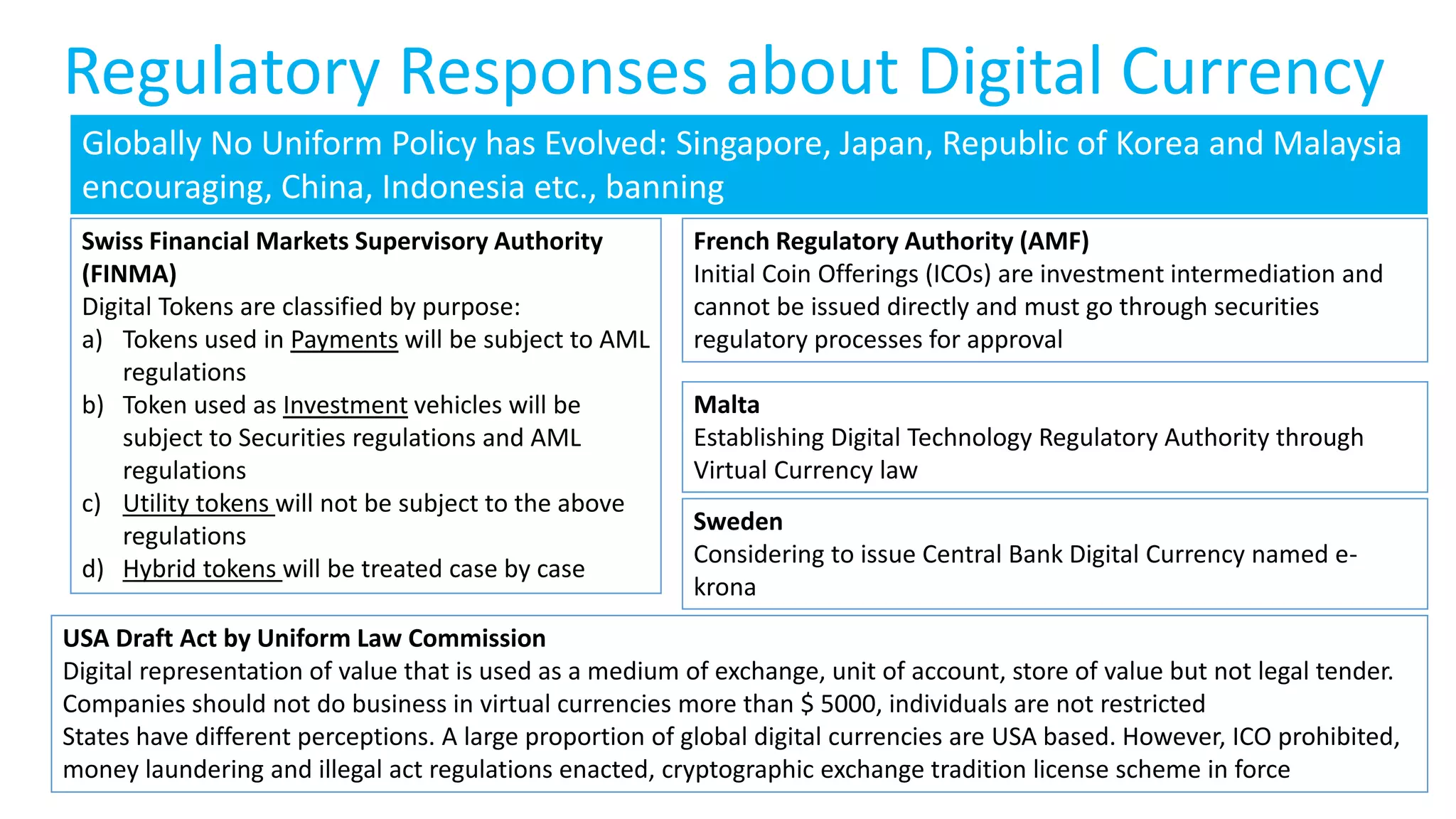

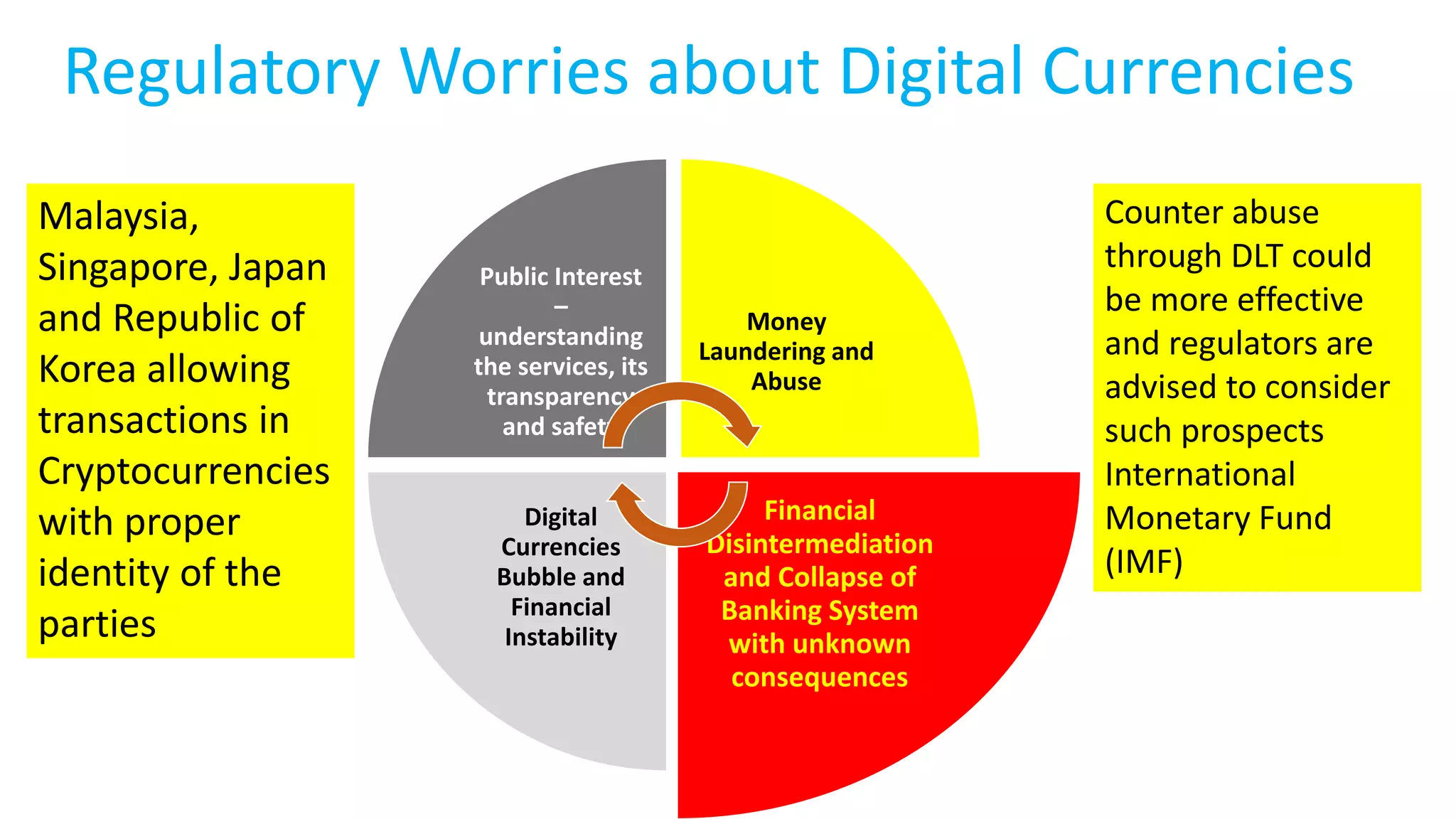

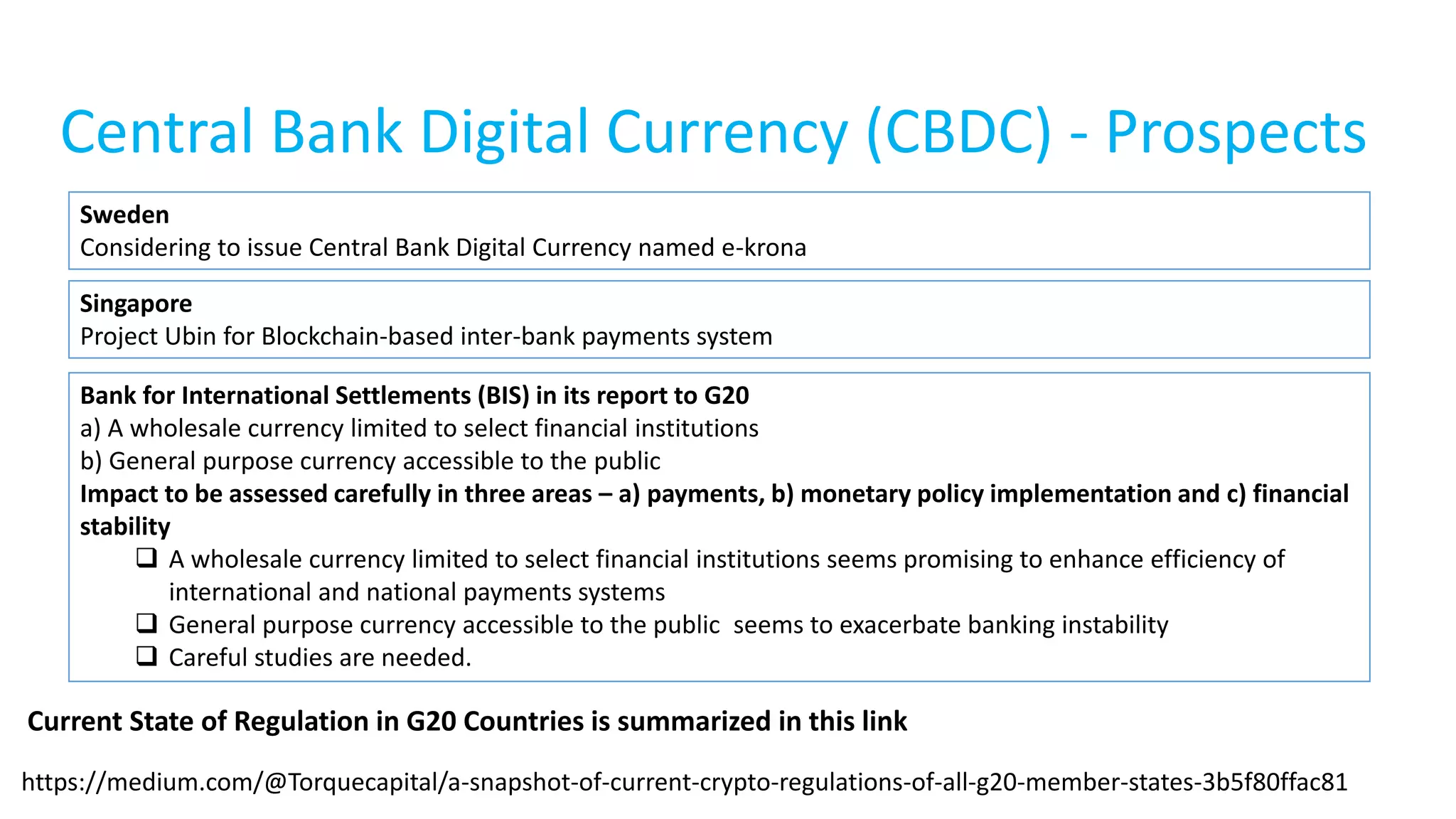

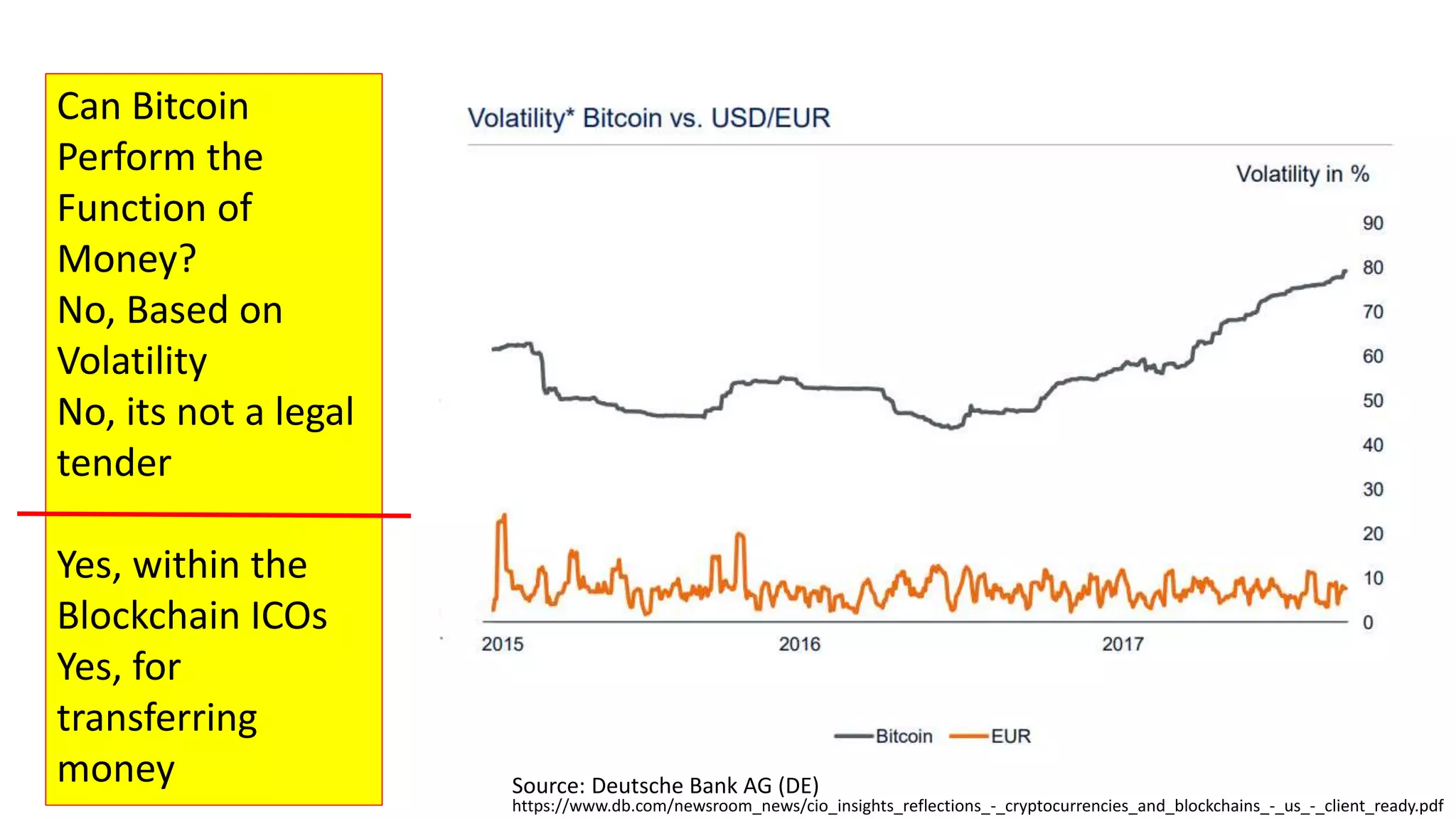

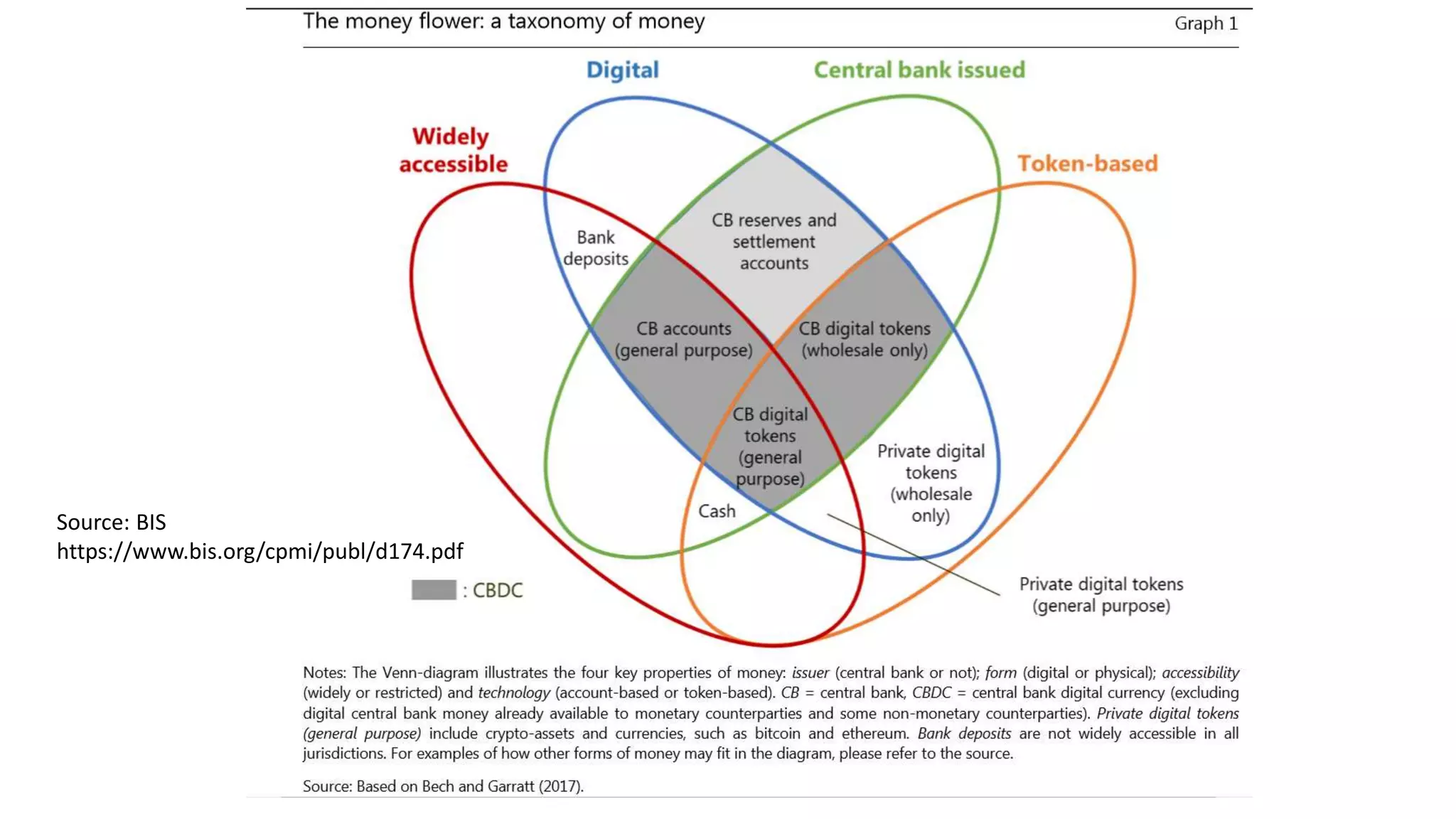

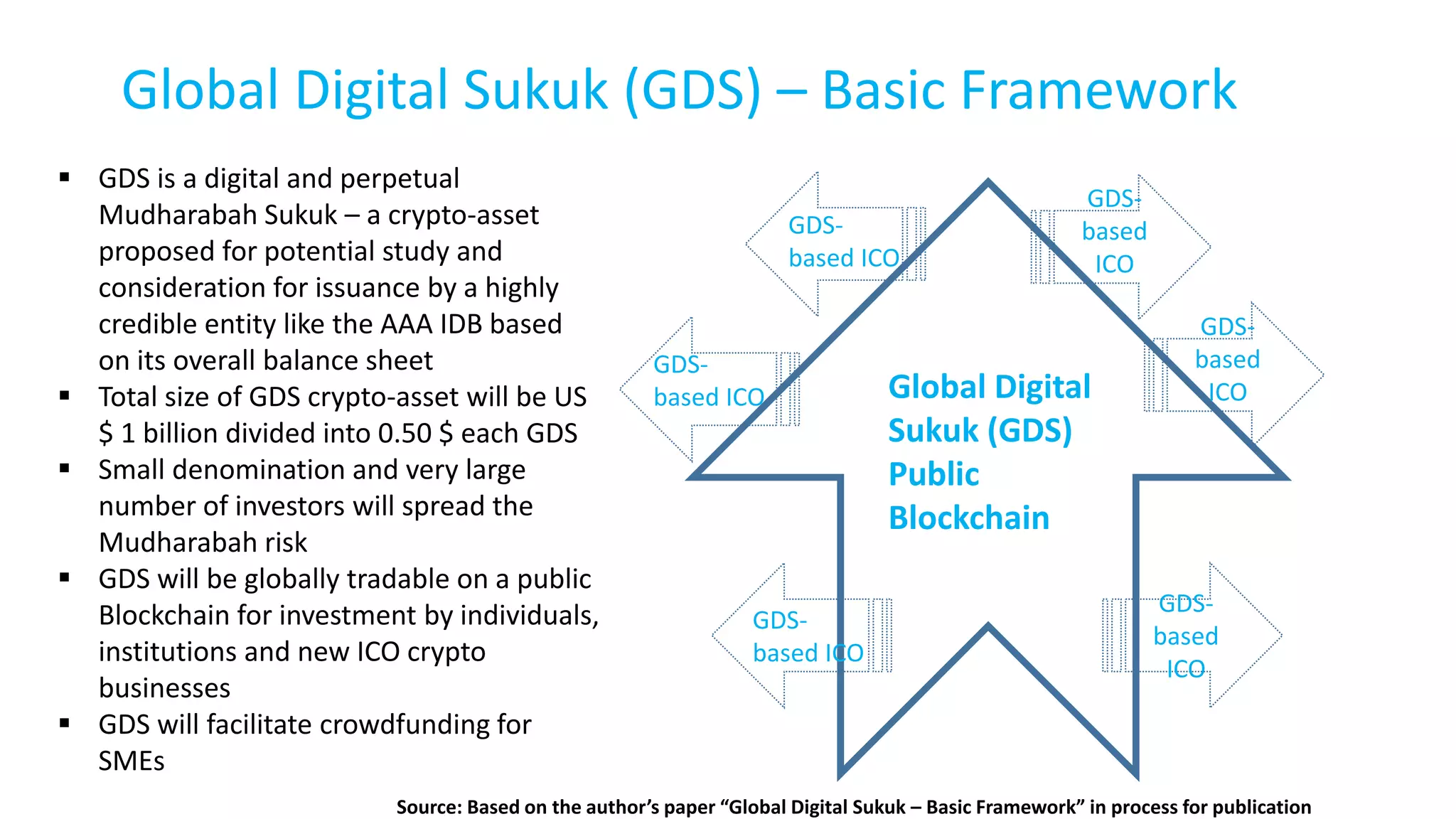

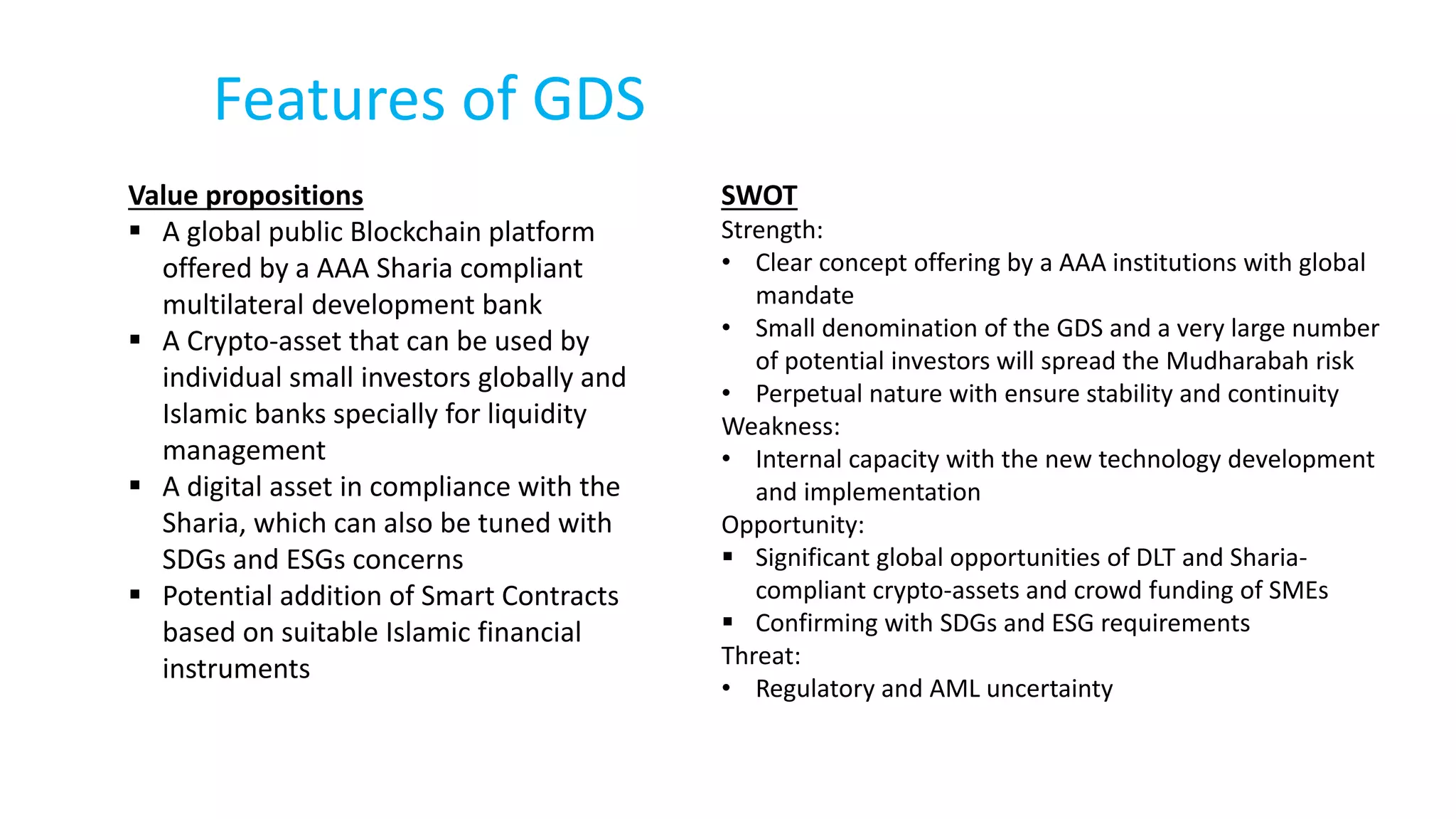

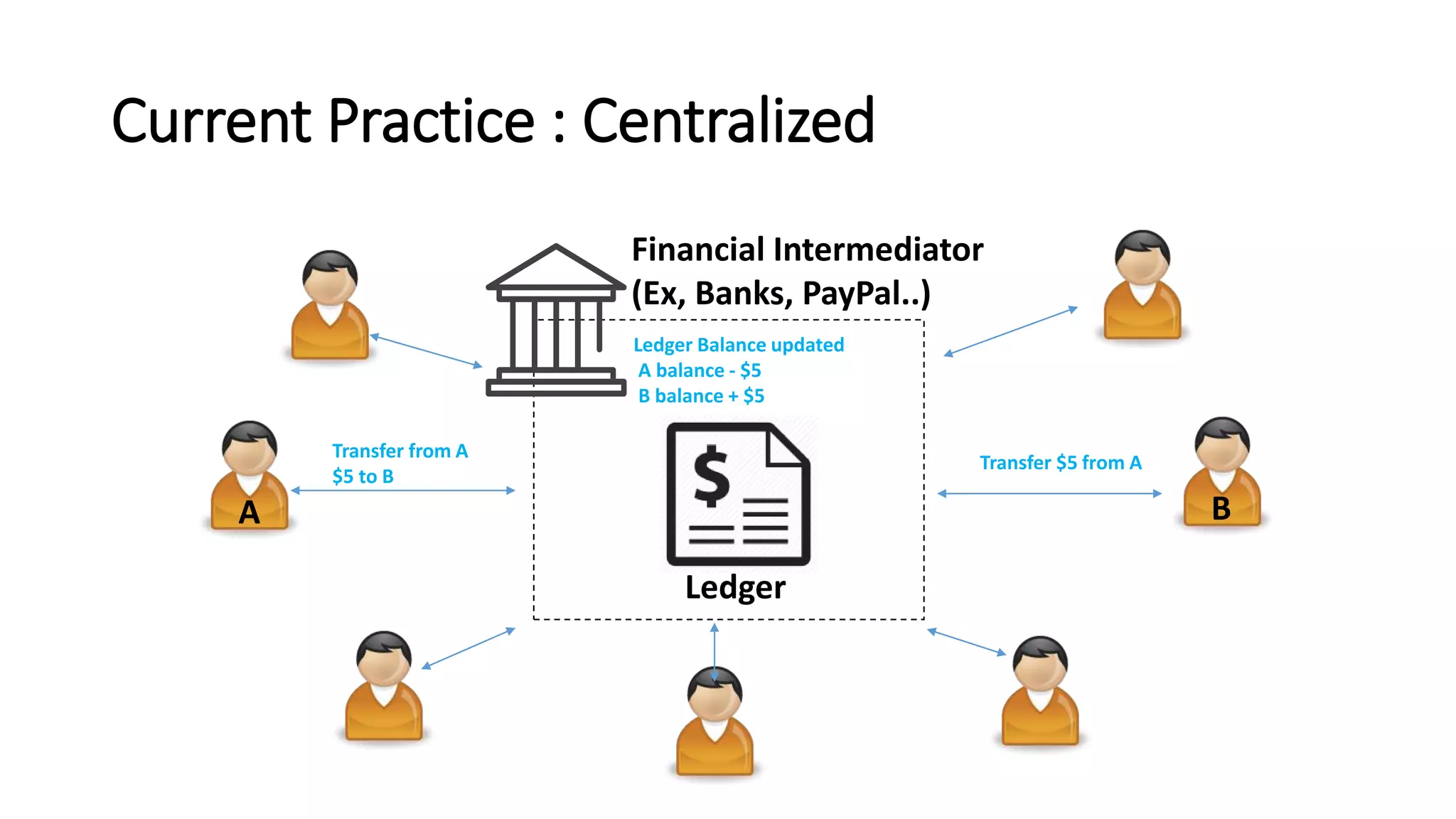

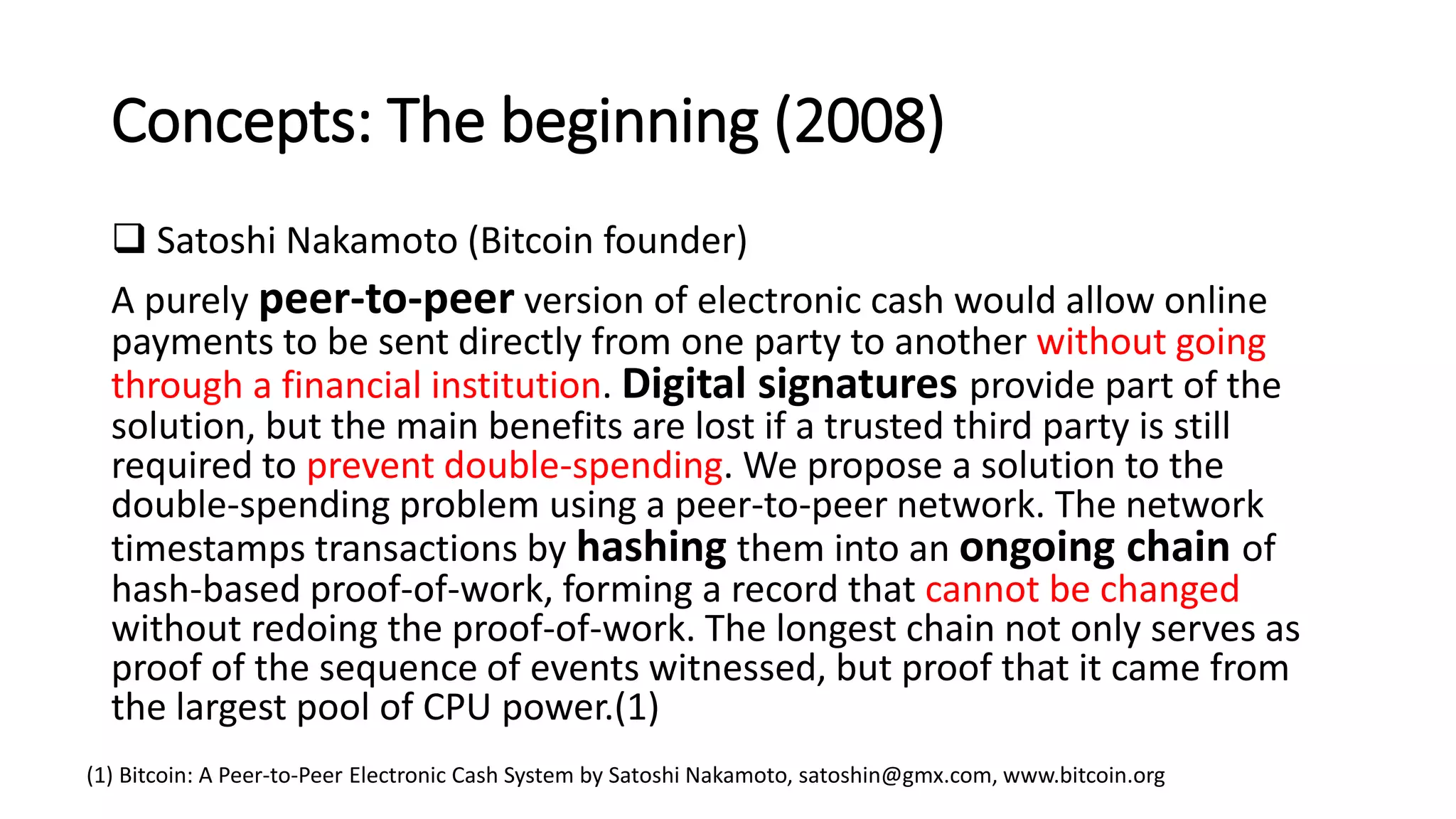

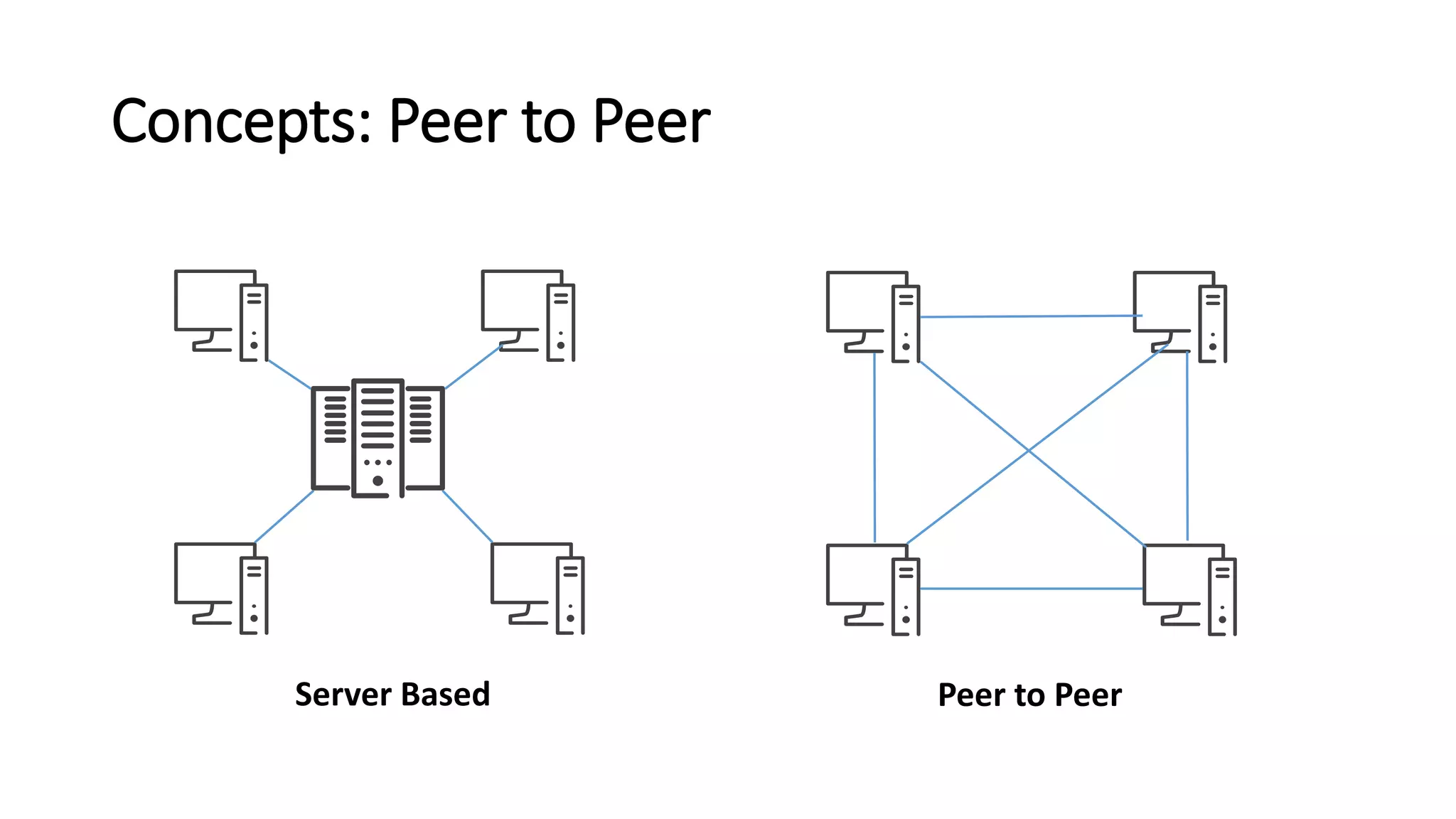

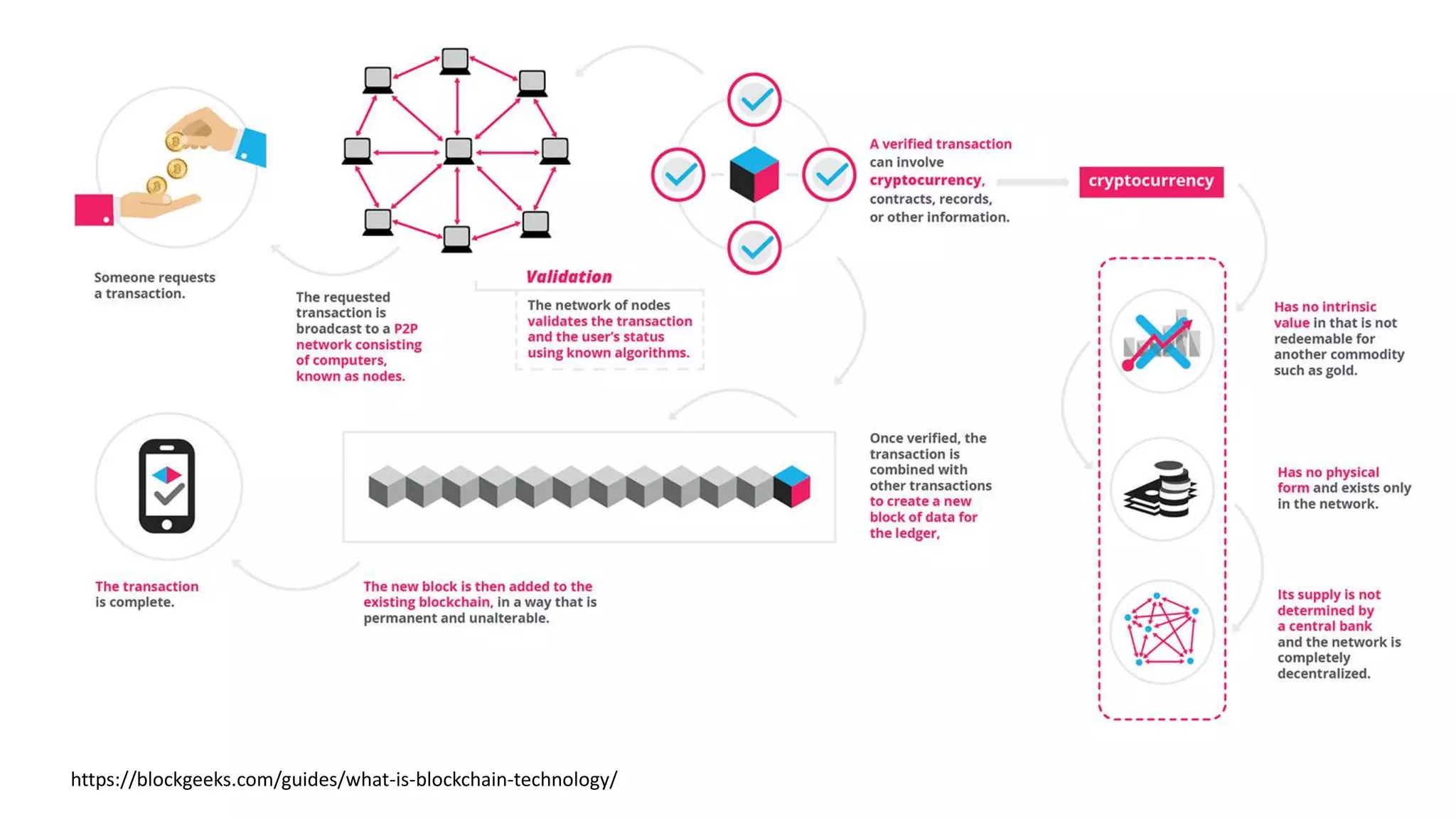

The document discusses the concept of digitizing sukuk using blockchain technology and cryptocurrencies, outlining some of the perceived advantages such as avoiding intermediaries, instant global transfer of ownership, and enhancing governance through smart contracts, and also addresses some of the regulatory challenges currently facing digital currencies. It proposes a framework for a global digital sukuk that could be issued on a public blockchain by a multilateral development bank to facilitate crowdfunding and investments that comply with Islamic finance principles.