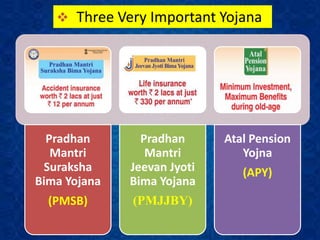

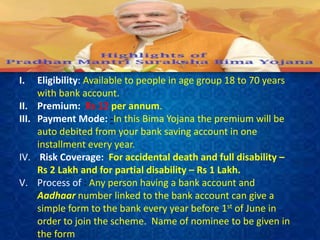

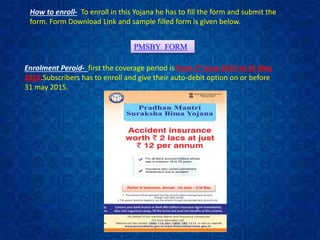

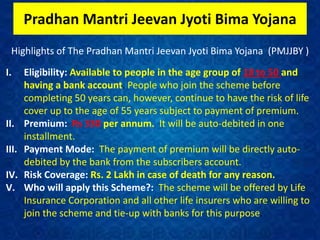

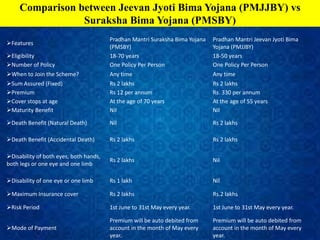

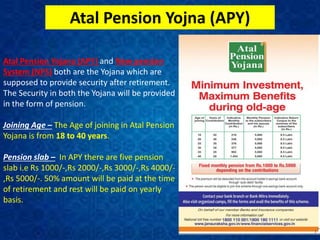

The document outlines three important government schemes: Pradhan Mantri Suraksha Bima Yojana (PMSBY) which provides accidental death and disability coverage for Rs. 12 per year; Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) which provides a Rs. 2 lakh life insurance policy for Rs. 330 per year; and Atal Pension Yojana (APY) which offers subscribers pension amounts ranging from Rs. 1,000-5,000 per month upon retirement in exchange for monthly contributions.