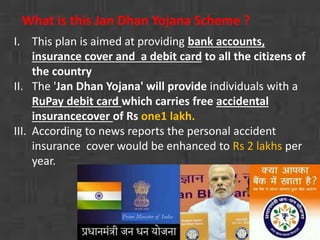

Prime Minister Narendra Modi launched the Pradhan Mantri Jan Dhan Yojana (PMJDY) scheme on August 28, 2014. The scheme aims to provide bank accounts, debit cards, accident and life insurance to all Indian citizens who do not have bank accounts. On the first day of the launch, the goal was to open 1 crore (10 million) bank accounts. The scheme targets opening over 15 crore (150 million) bank accounts and bringing over 7.5 crore (75 million) unbanked families into the banking system. Key benefits of opening a bank account under PMJDY include RuPay debit cards, Rs. 1 lakh accident insurance and Rs. 30,000 life