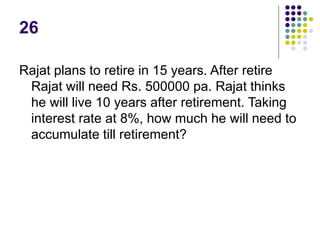

Rajat is considering various retirement planning and savings scenarios. He wants to know how much to save and invest annually over different time periods to achieve goals such as accumulating Rs. 5 million by retirement age 65, having funds to withdraw Rs. 1 million annually in retirement until age 90, and donating Rs. 200,000 every 5 years until age 75. A financial planner helps calculate the required annual contribution amounts for Rajat to meet his objectives given expected rates of return.