- General Electric is a large conglomerate consisting of eight subsidiaries across various industries. Larry Culp, the first outsider to lead GE, is currently the CEO.

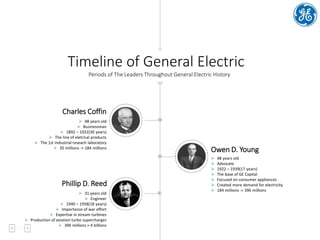

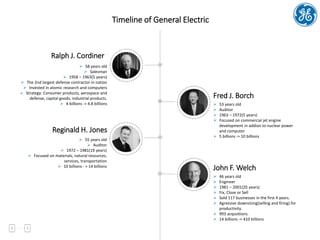

- GE has had several leaders throughout its history who have helped shape the company. John F. Welch significantly grew GE during his 20-year tenure through acquisitions and aggressive downsizing.

- After the financial crisis, then-CEO Jeffrey Immelt focused on divesting non-core businesses and acquiring industrial companies to return GE to its industrial roots.