Embed presentation

Download to read offline

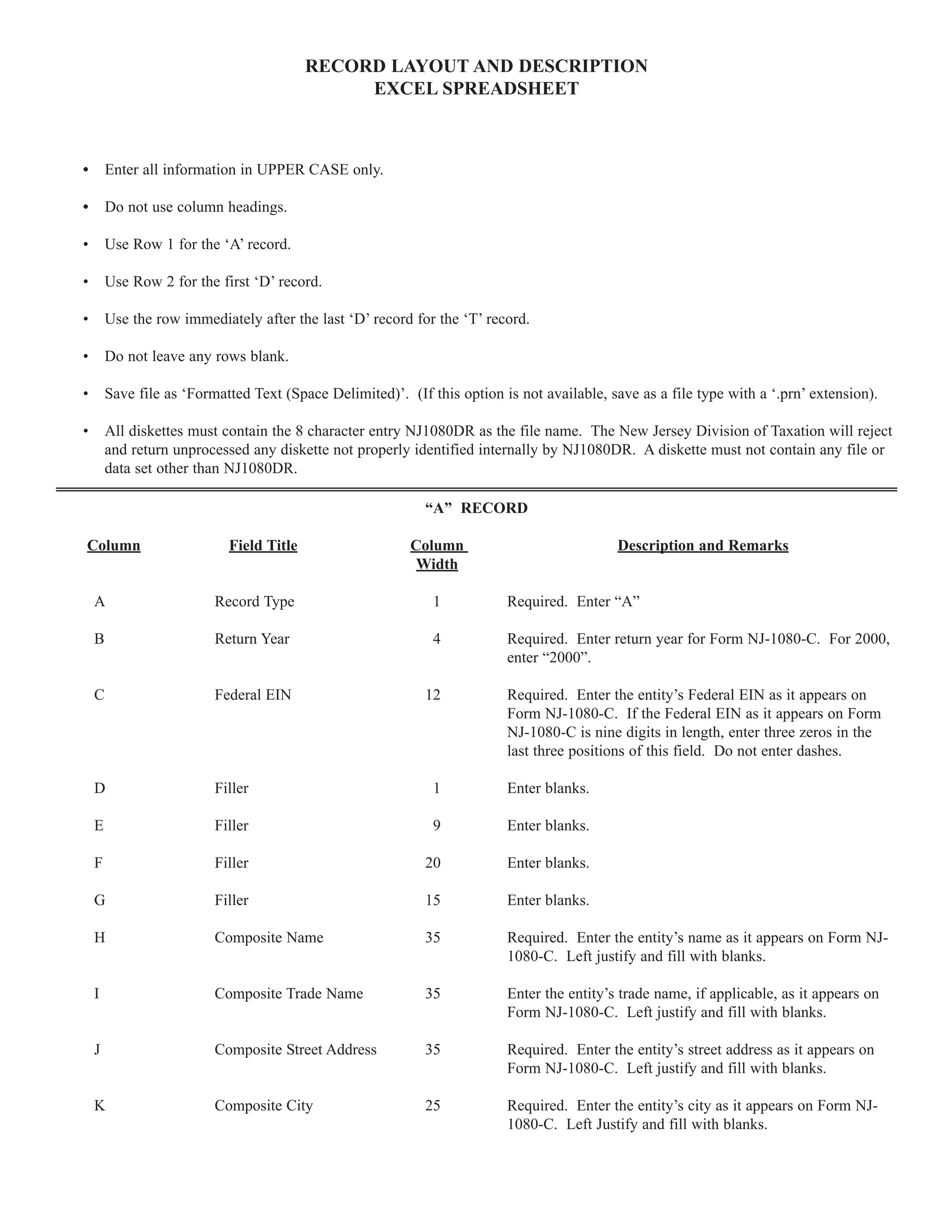

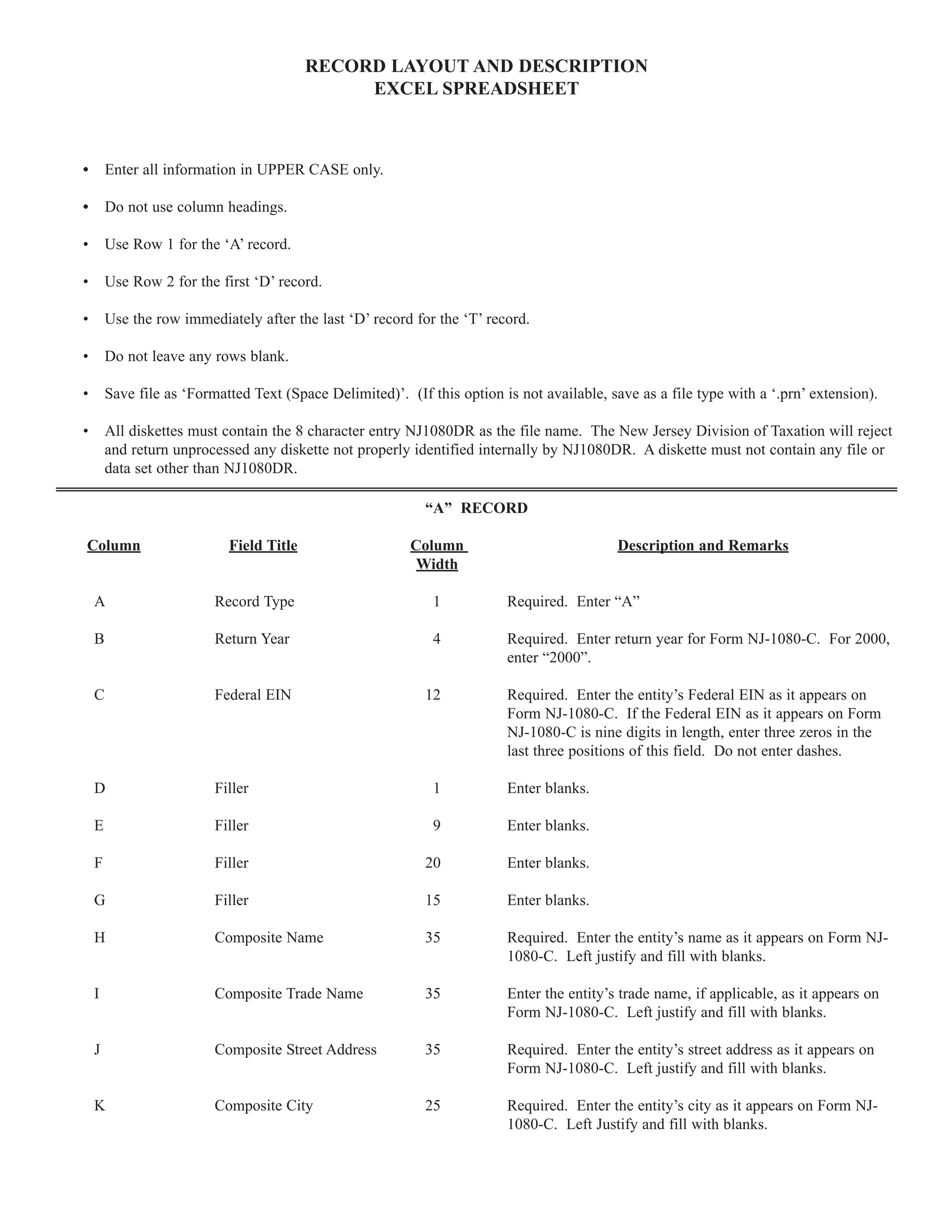

This document provides instructions for formatting an Excel spreadsheet to submit New Jersey tax form NJ-1080-C electronically. It describes the layout including required record types of "A," "D," and "T" records. Field names, descriptions, and formatting are defined for each record type to ensure proper submission of the tax filing. All information must be in uppercase and money amounts right justified with leading zeros for cents. The formatted file must be saved with the name NJ1080DR.