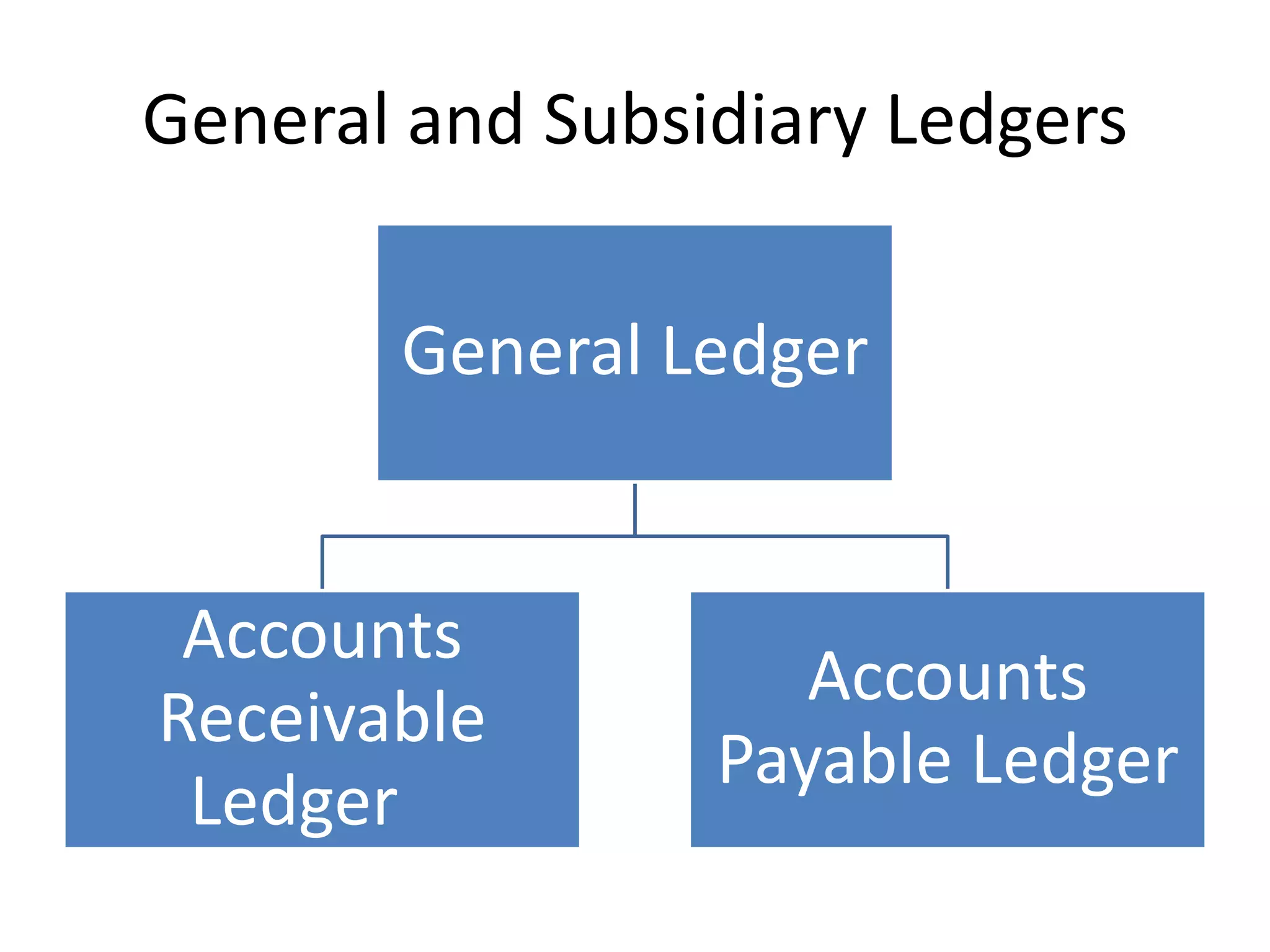

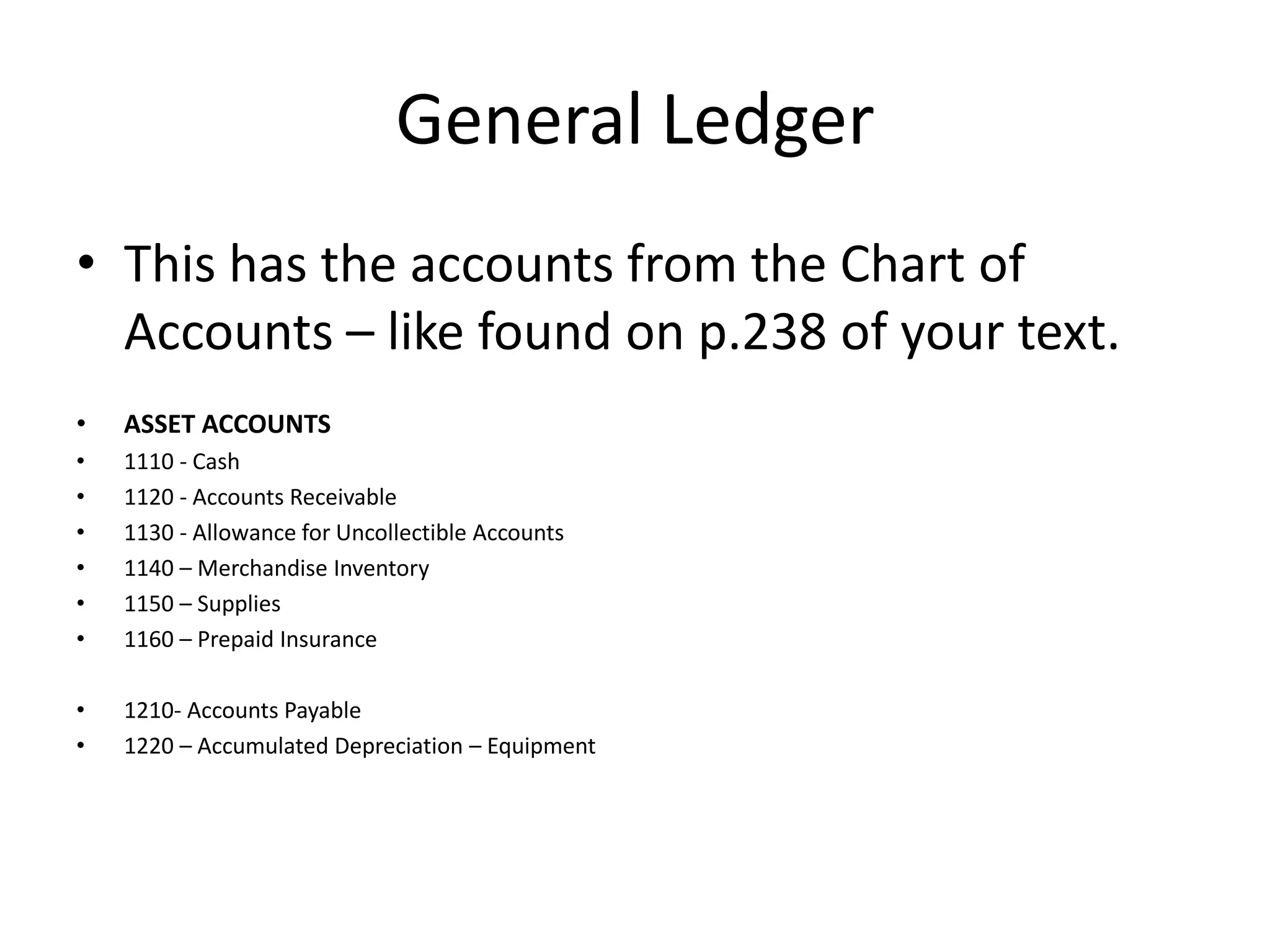

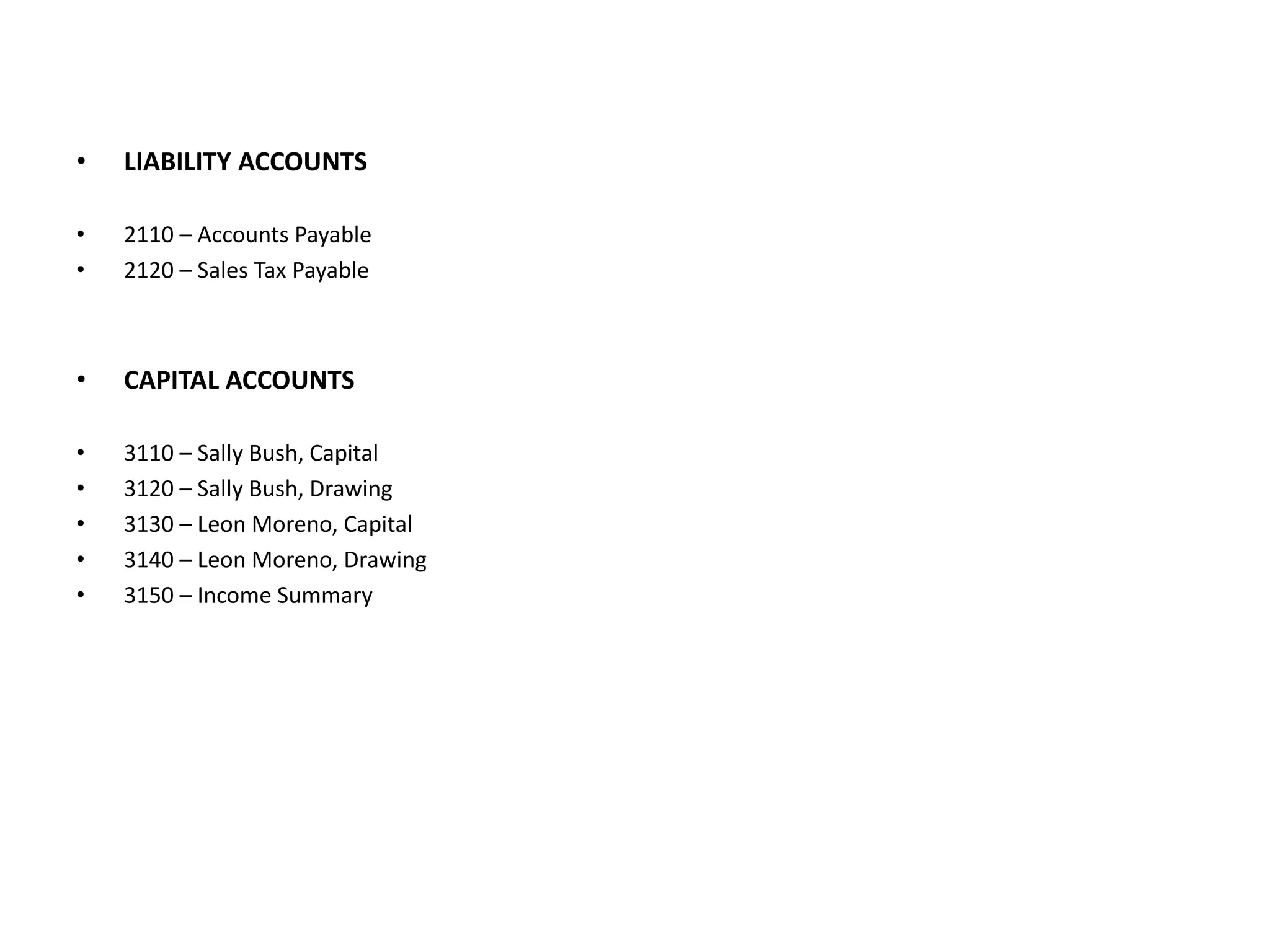

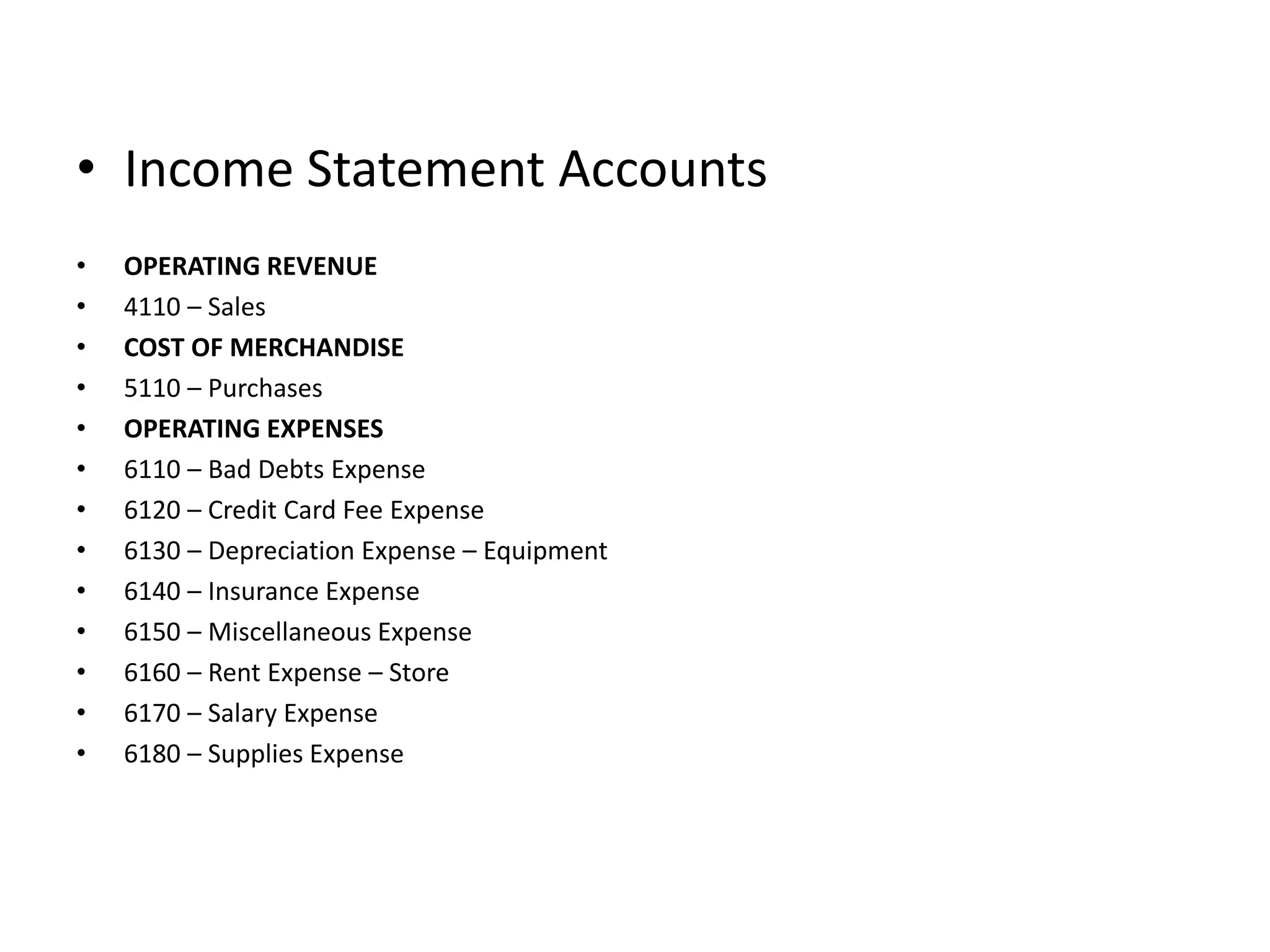

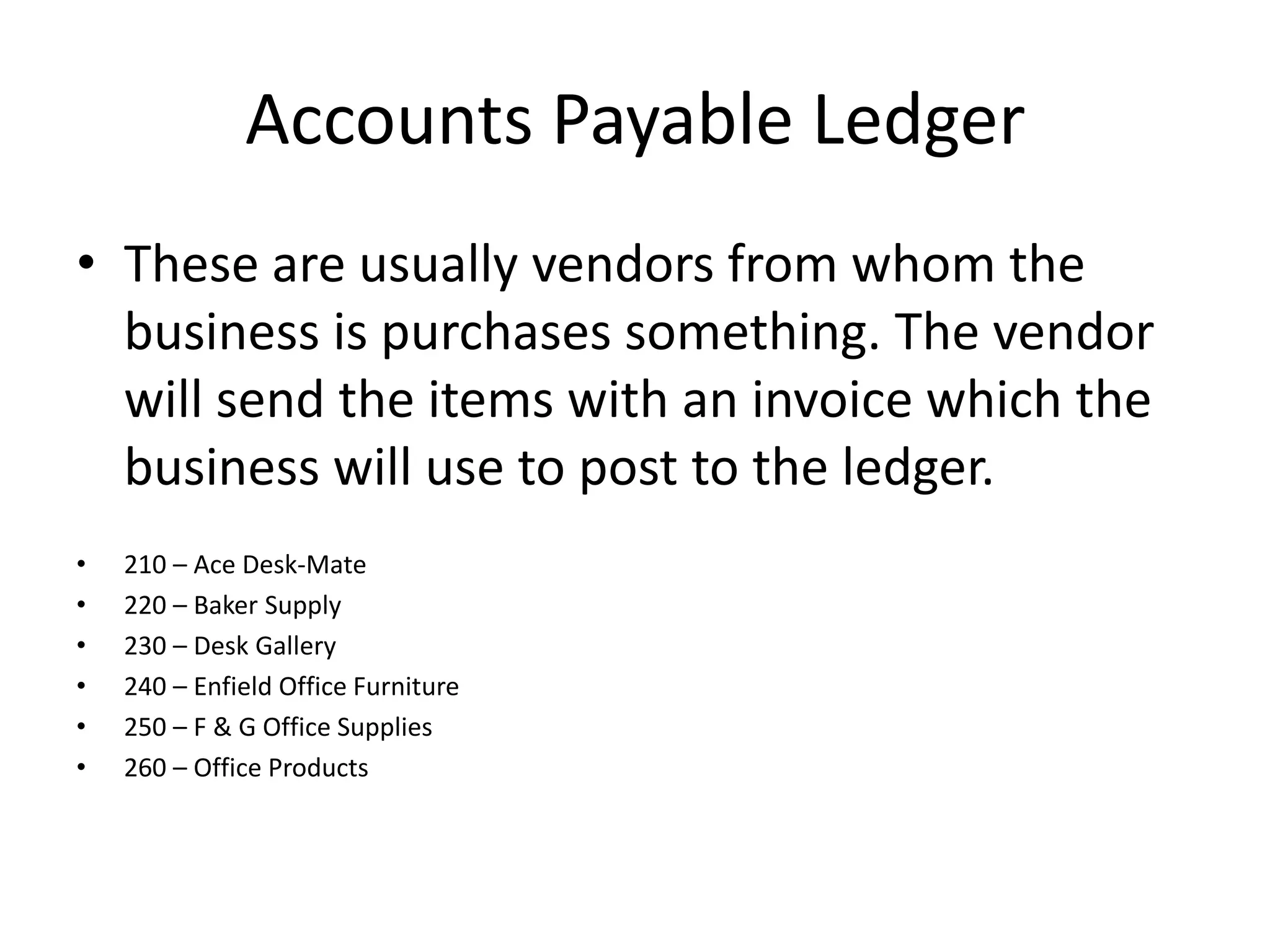

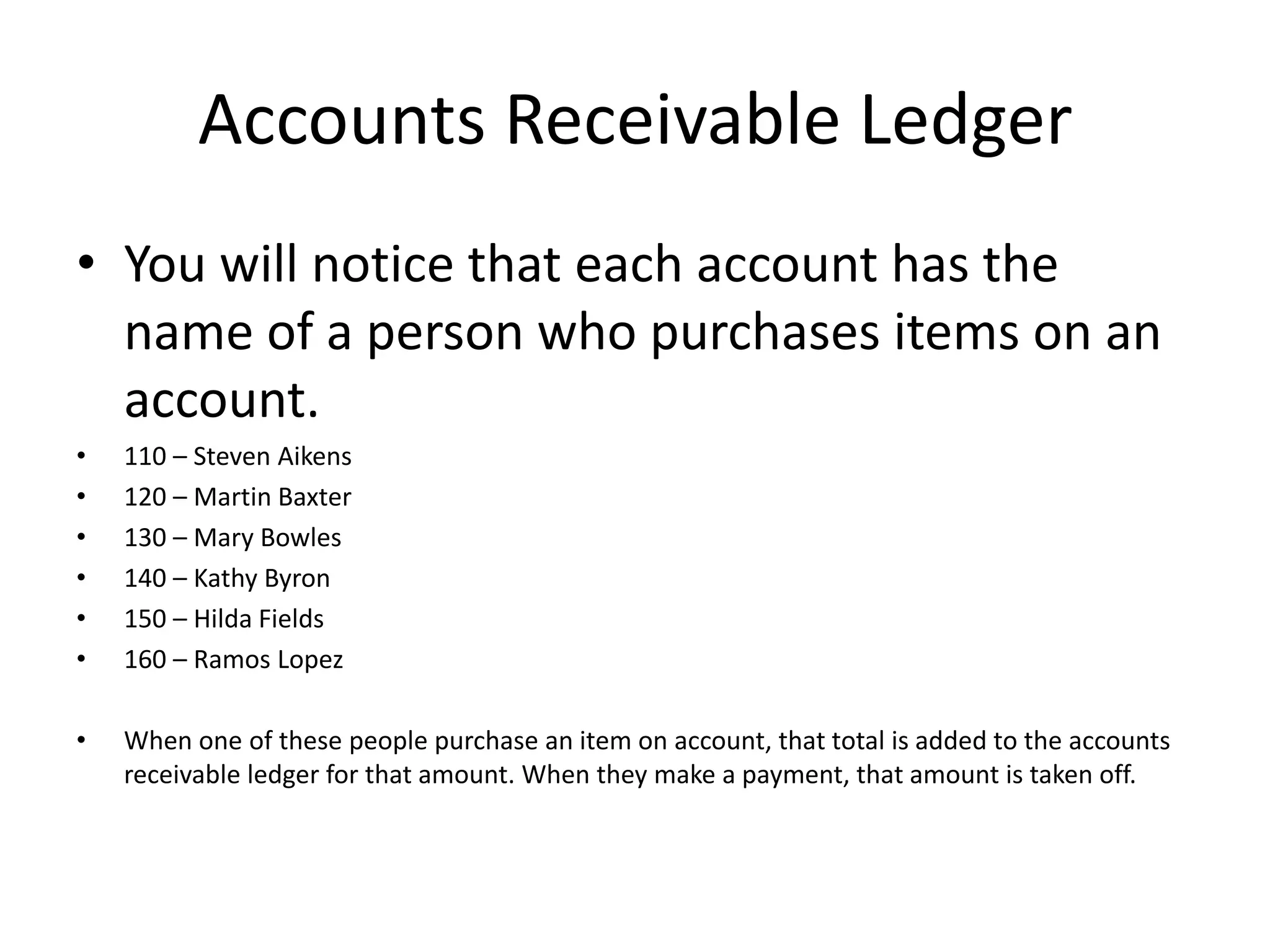

This document summarizes the general and subsidiary ledgers for a business. The general ledger contains asset, liability, and capital accounts. The income statement accounts track operating revenue, cost of merchandise, and operating expenses. The accounts payable ledger lists vendors the business purchases from. The accounts receivable ledger contains customer accounts that purchase items on credit.