Corporate Presentation for December 2010.

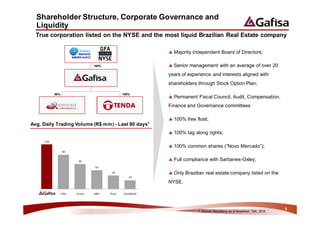

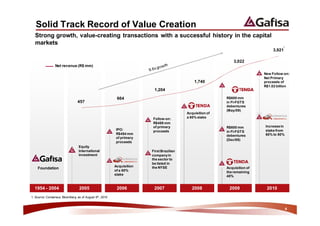

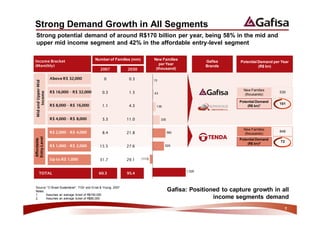

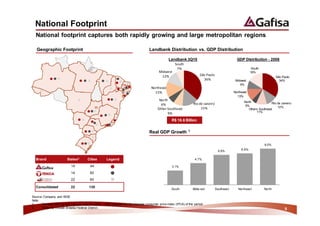

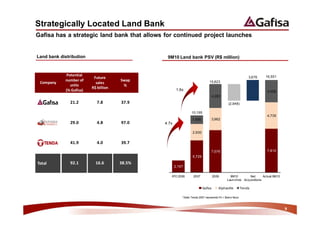

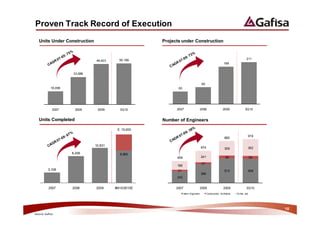

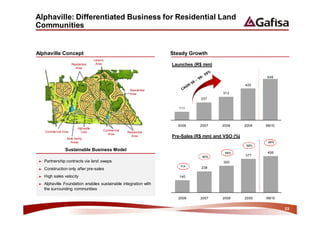

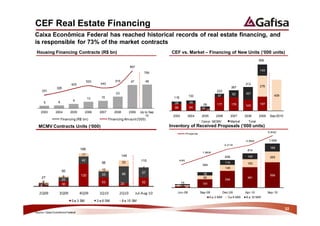

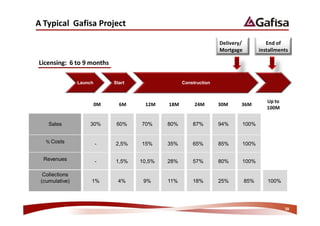

1. The presentation provides an overview of Gafisa's competitive advantages including its diversified product offerings across all income segments, national footprint capturing major markets, strategically located landbank, strong brand recognition, and proven track record of execution.

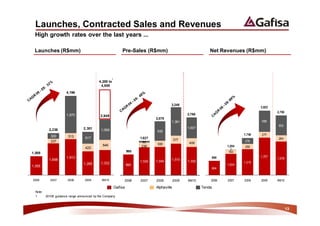

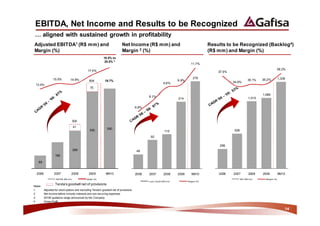

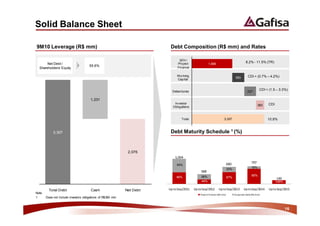

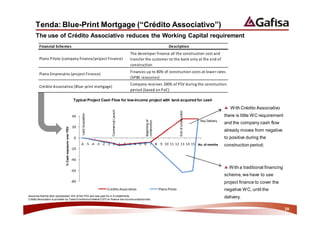

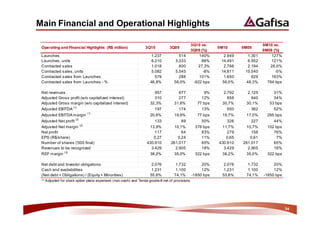

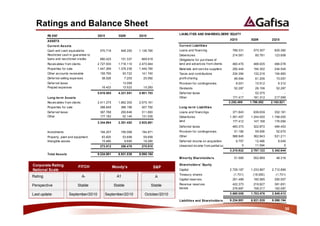

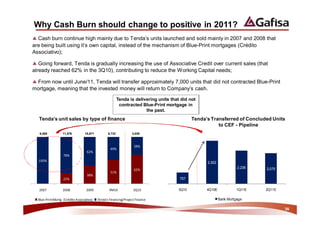

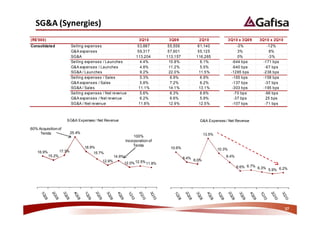

2. Financial highlights discussed include sustained growth in launches, contracted sales, revenues, EBITDA, and net income in recent years aligned with profitability increases. The company also has a solid balance sheet and favorable debt maturity profile.

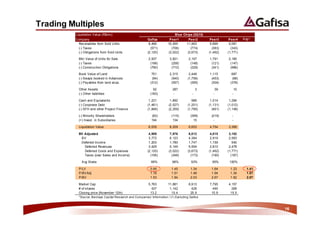

3. Trading multiples indicate Gafisa trades at a discount to peers based on its liquidation value after accounting for receivables, taxes, and obligations from sold units.