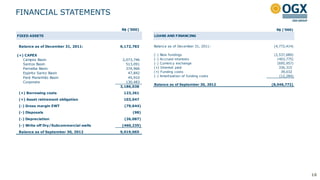

OGX reported financial results for the first nine months of 2012. Key highlights include:

- Revenues of R$150.7 million from the sale of ~800,000 barrels of oil in Q3 2012.

- EBITDA loss of R$305.1 million for the year-to-date and R$51.6 million in Q3.

- Net loss of R$887.1 million for the year-to-date and R$343.6 million in Q3.

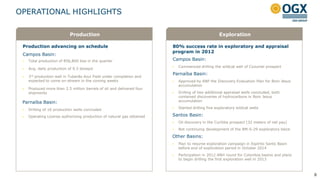

- Production averaged 9.3 kboepd in Q3 from the Campos Basin fields, with a third well coming online soon.

- Exploration success rate was 80% in 2012, with

![2013 OUTLOOK

Prospect Block

Total Estimated

Recoverable Volume Working Interest

OGX Estimated

Recoverable Volume Spud date

Exploratory wells to be drilled

(PMean) (PMean)

Cozumel BM-C-37 209-270 mmboe 70% 146-189 mmboe 4Q12 • Santos Basin: 1 well until the concession for exploration ends in

Tulum BM-C-37 194-280 mmboe 70% 136-196 mmboe 4Q12

Cancun BM-C-37 184-294 mmboe 70% 129-206 mmboe 1Q13 March 2013

Viedma BM-C-38 245-313 mmboe 70% 172-219 mmboe 1Q13

Cotopaxi BM-C-38 30-40 mmboe 70% 21-28 mmboe 1Q13 • Parnaíba Basin: 10 wells

Total - 861-1,196 mm boe 70% 603-837 mm boe -

TOTAL PRODUCTION • Espírito Santo Basin: 3 wells, together with Perenco, the operator

[XXX] of the blocks

Cancun

CAPEX

Tulum 2013 Capex Breakdown

2012 annual estimate:

Exploration 2013 Annual

$1.2 billion 20% estimate:

Cozumel

US$1.2 billion

Viedma

Development

80%

Drilled Wells

Cotopaxi 2012/2013 planned wells

11](https://image.slidesharecdn.com/ogx3qearningspresentation-121109075227-phpapp02/85/OGX-3Q-Earnings-Presentation-11-320.jpg)