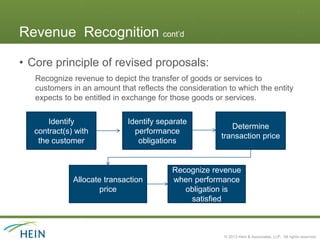

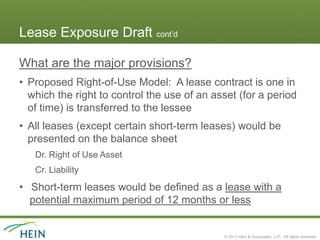

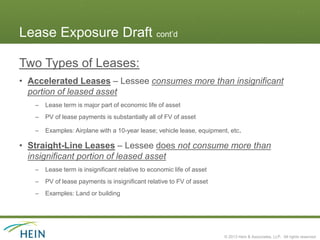

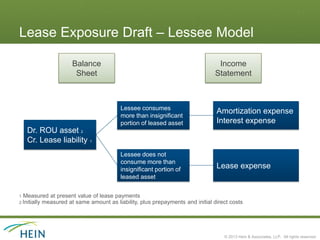

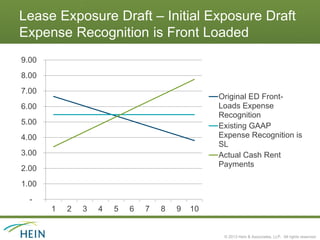

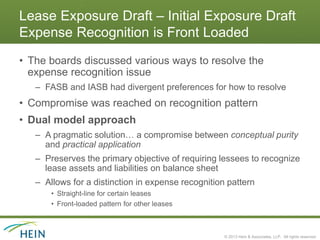

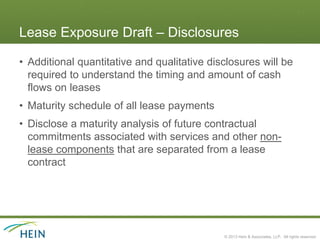

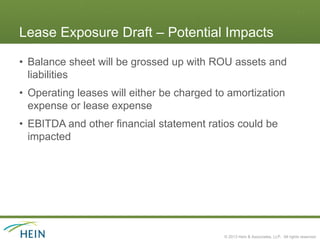

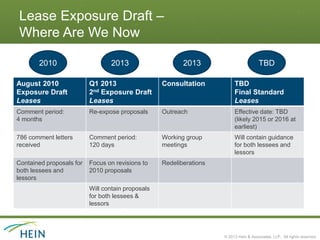

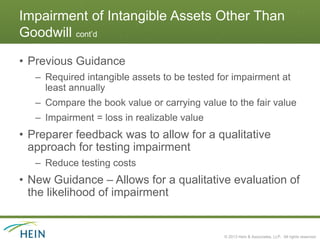

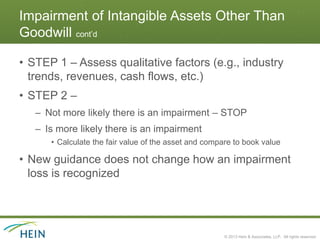

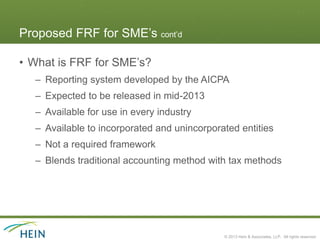

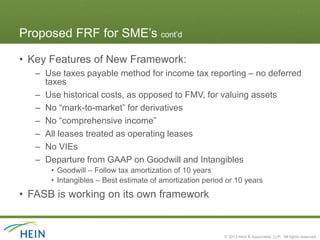

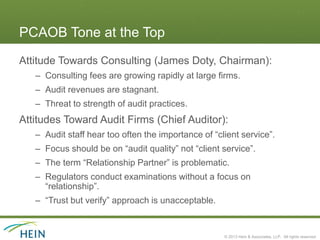

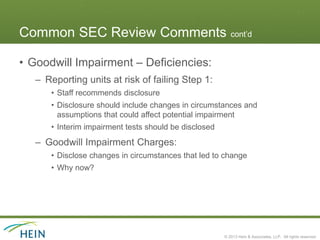

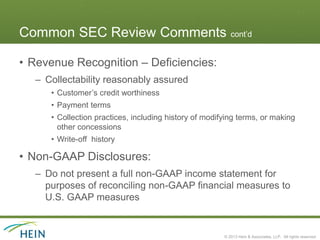

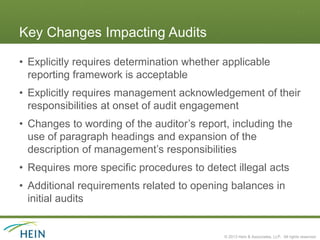

The document outlines recent developments in GAAP, focusing on FASB projects including revenue recognition, leases, and impairment of intangible assets. Key initiatives include a joint project with IASB to create a unified revenue standard and upcoming changes to lease accounting that will require all leases to be reported on balance sheets. Other topics discussed include a proposed financial reporting framework for SMEs, common SEC review comments, and evolving standards for auditing and quality control.