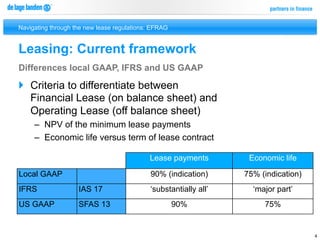

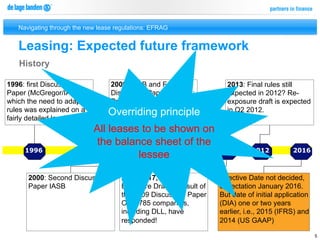

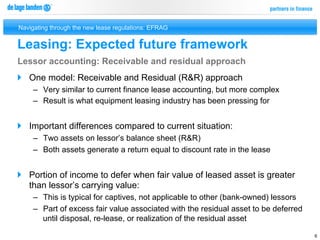

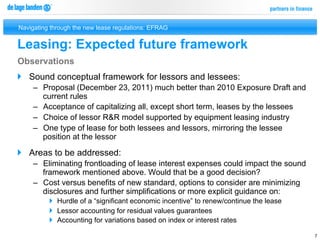

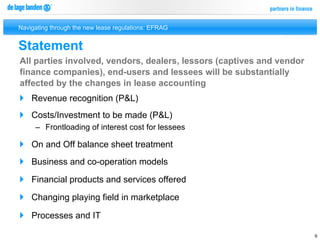

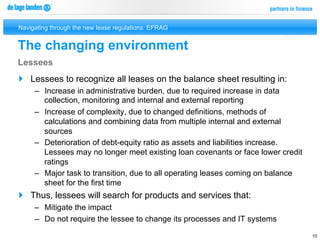

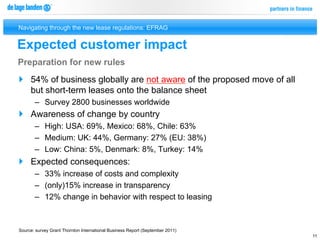

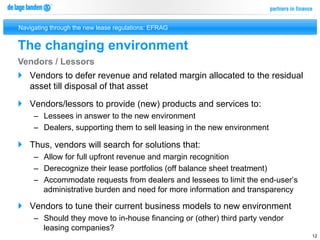

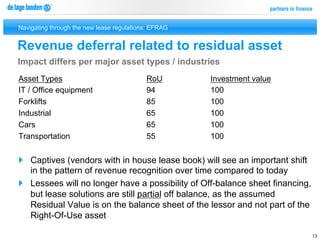

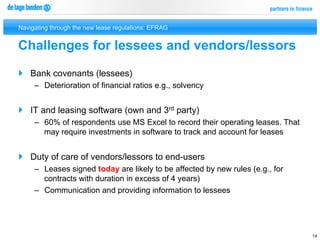

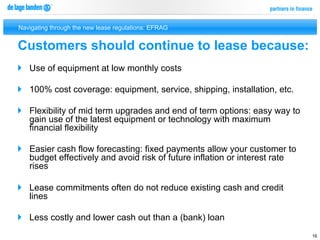

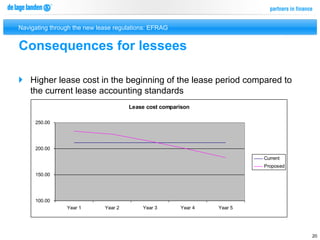

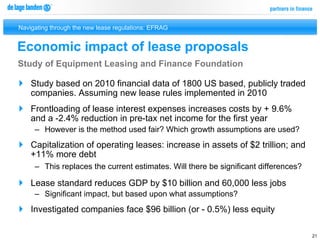

The document discusses the current and expected future framework for lease accounting under IFRS and US GAAP. It is expected that in 2013, final rules will be issued requiring all leases, except short-term leases, to be recognized on company balance sheets. This will substantially impact both lessees and lessors. Lessees will see increased administrative costs and complexity from the increased reporting requirements. Lessors will have to defer revenue recognition related to residual assets. Both lessees and lessors will need to prepare for the changes through investments in new processes, IT systems, and financial products and services.