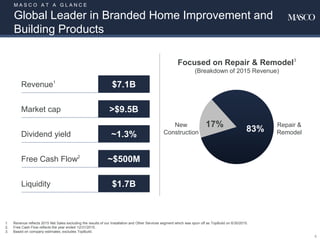

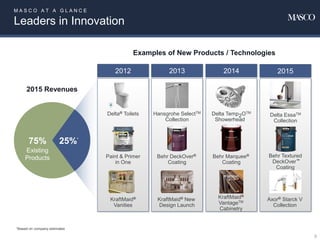

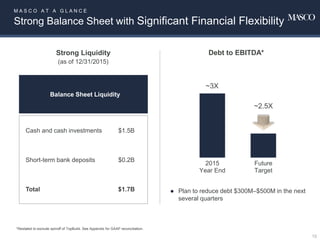

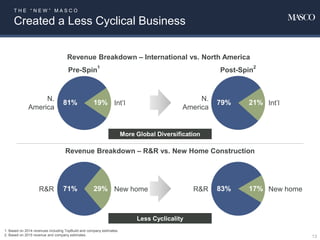

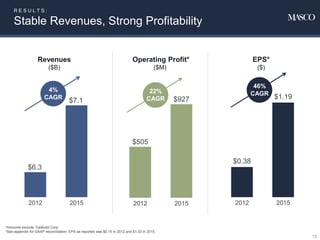

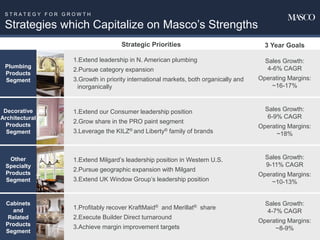

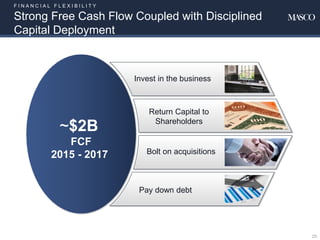

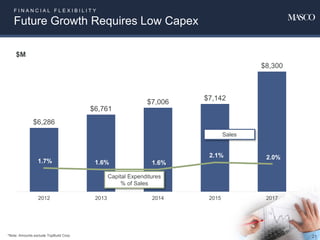

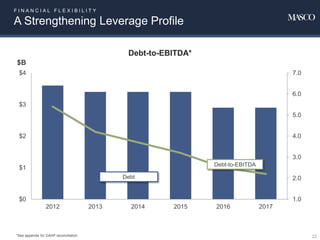

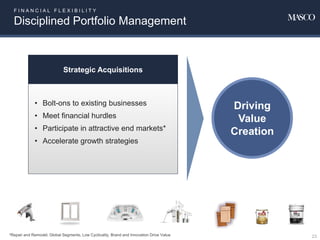

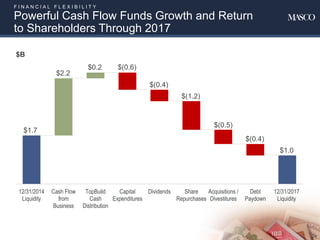

Raymond James held its 37th Annual Institutional Investors Conference on March 7, 2016. John Sznewajs, Chief Financial Officer of Masco Corporation, presented at the conference. Masco is a global leader in home improvement and building products with strong brands and industry-leading positions. Sznewajs discussed Masco's transformation initiatives, operational excellence focus, growth strategies capitalizing on its strengths, and financial flexibility to fund growth and return capital to shareholders through 2017.