Embed presentation

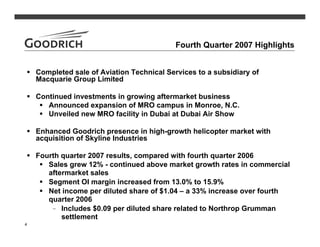

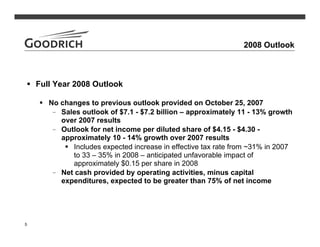

Download as PDF, PPTX

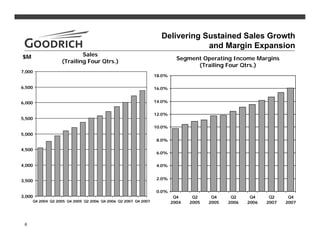

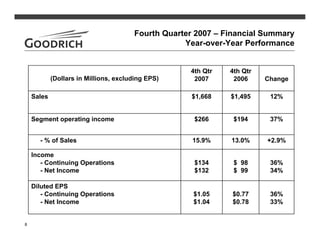

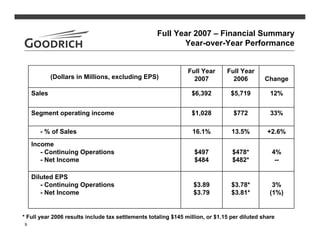

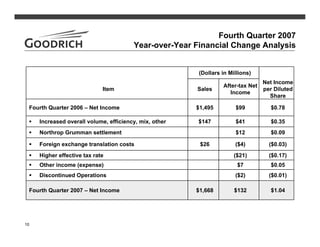

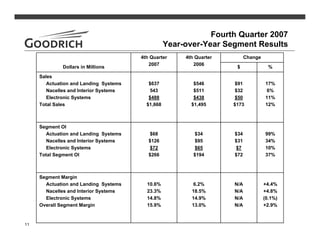

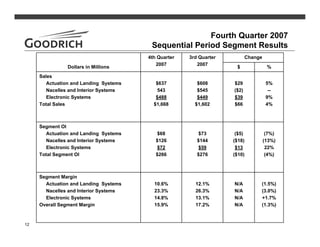

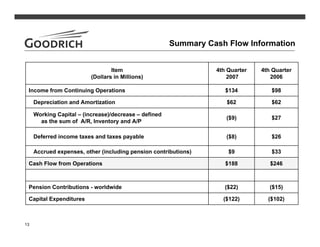

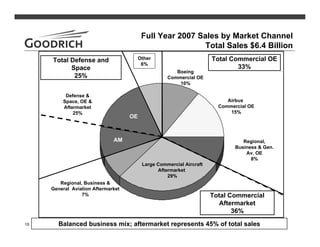

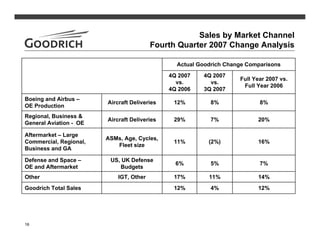

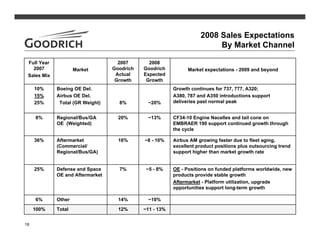

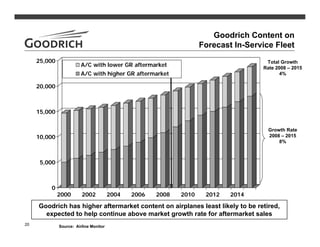

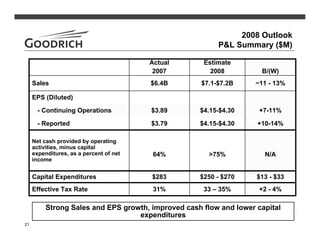

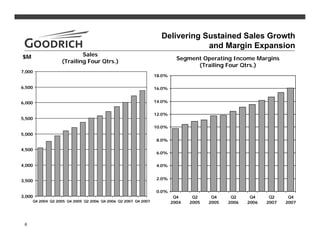

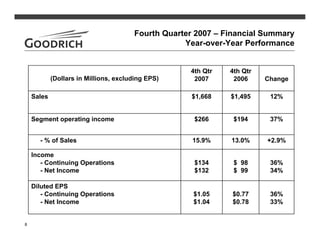

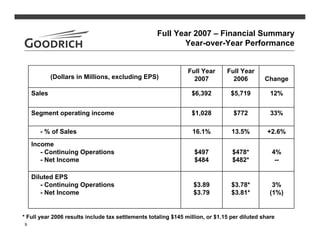

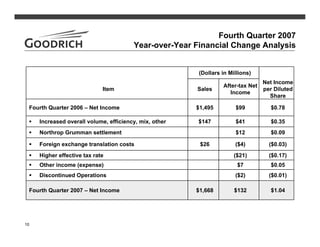

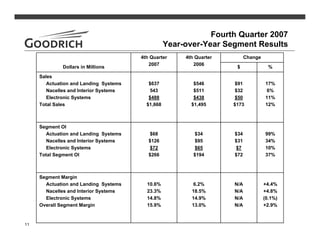

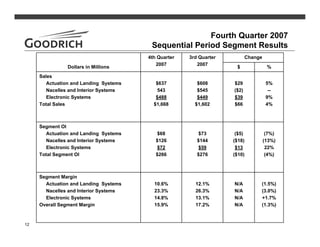

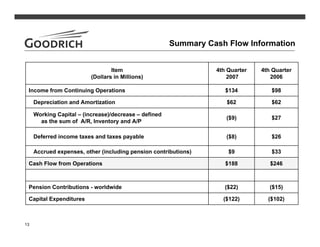

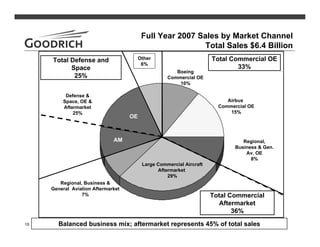

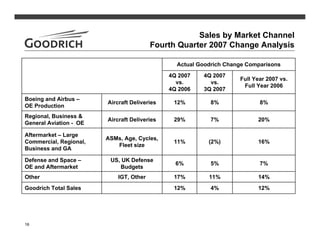

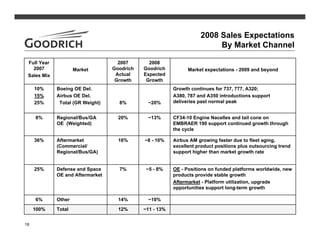

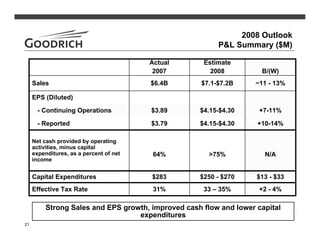

Goodrich Corporation reported fourth quarter 2007 results with the following highlights: - Sales grew 12% to $1.668 billion compared to fourth quarter 2006, driven by strong commercial aftermarket sales. - Segment operating income margin increased from 13.0% to 15.9% over the same period. - Net income per diluted share increased 33% to $1.04, including $0.09 per share related to a settlement. - For full year 2008, Goodrich expects sales growth of 11-13% to $7.1-7.2 billion and net income per diluted share growth of 10-14% to $4.15-$4.30, reflecting expected increases in commercial aircraft deliver