Embed presentation

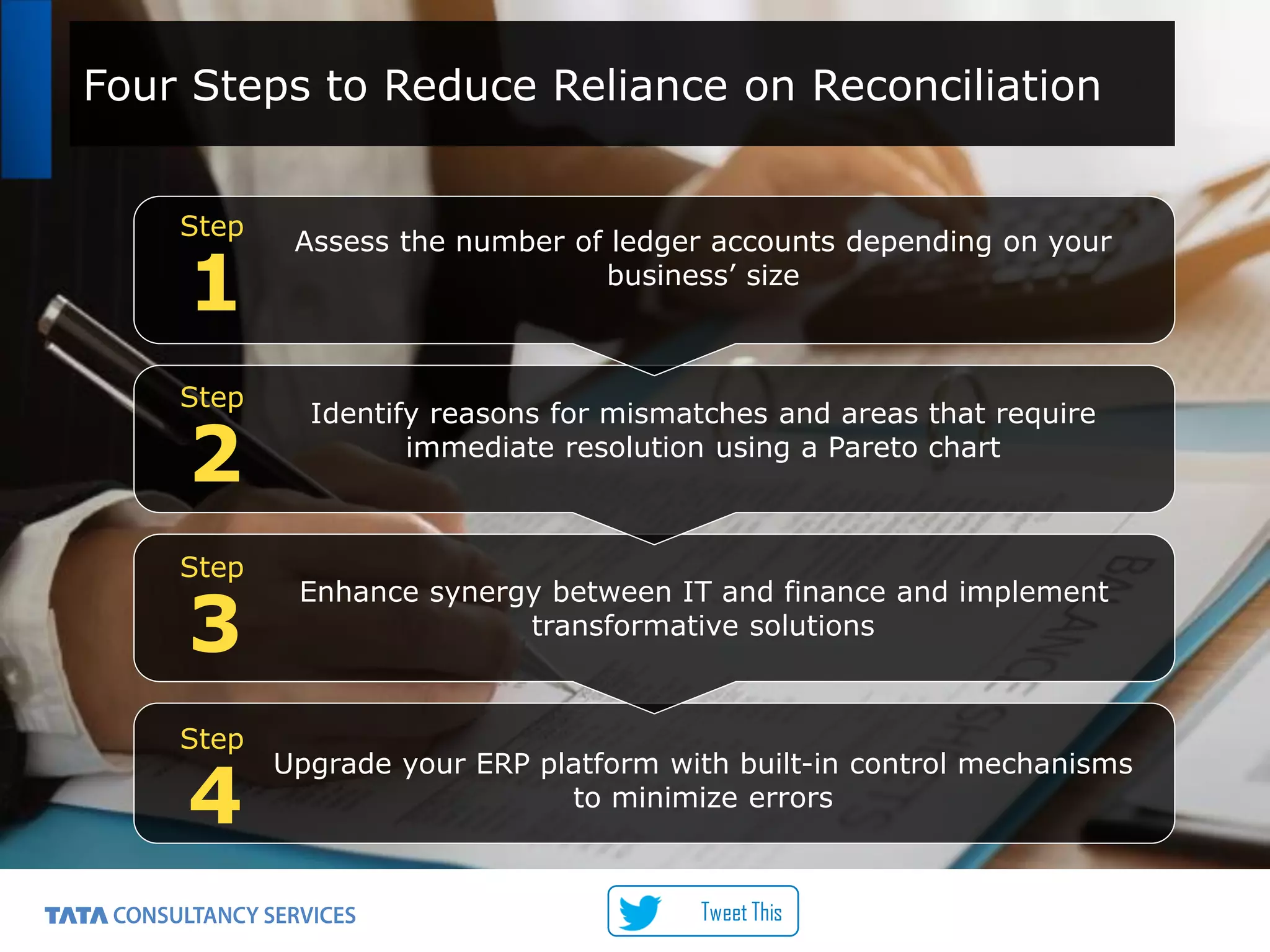

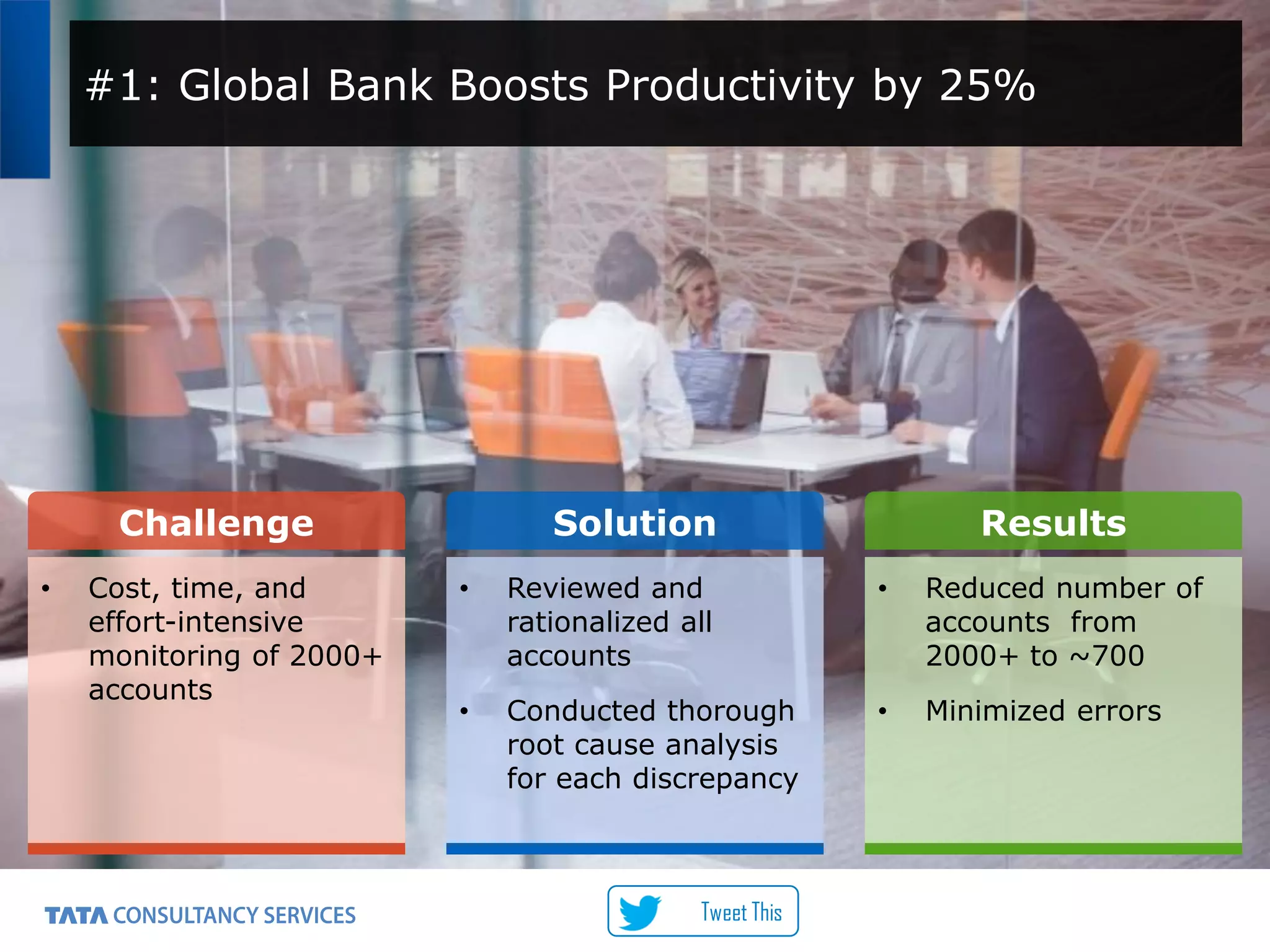

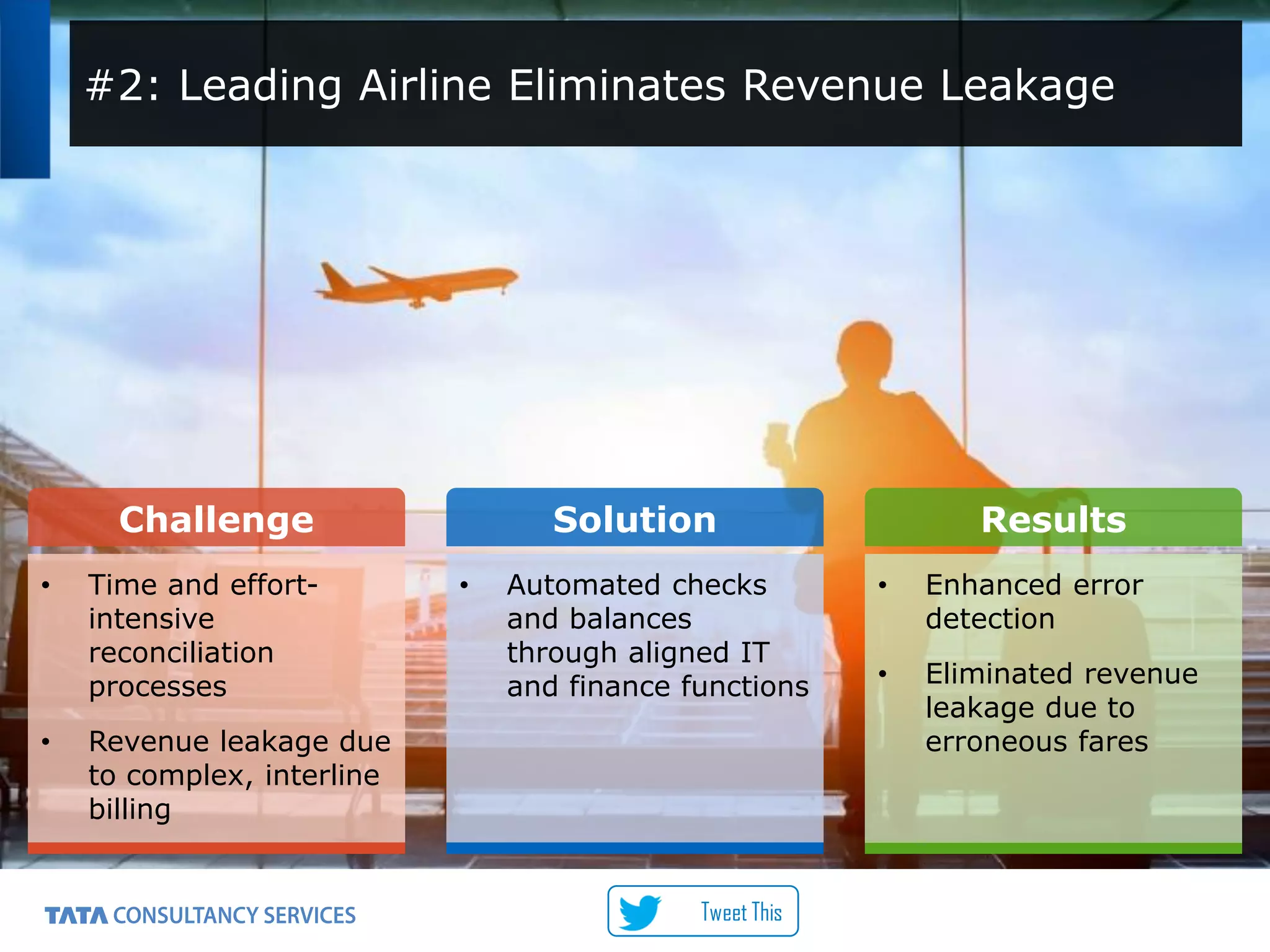

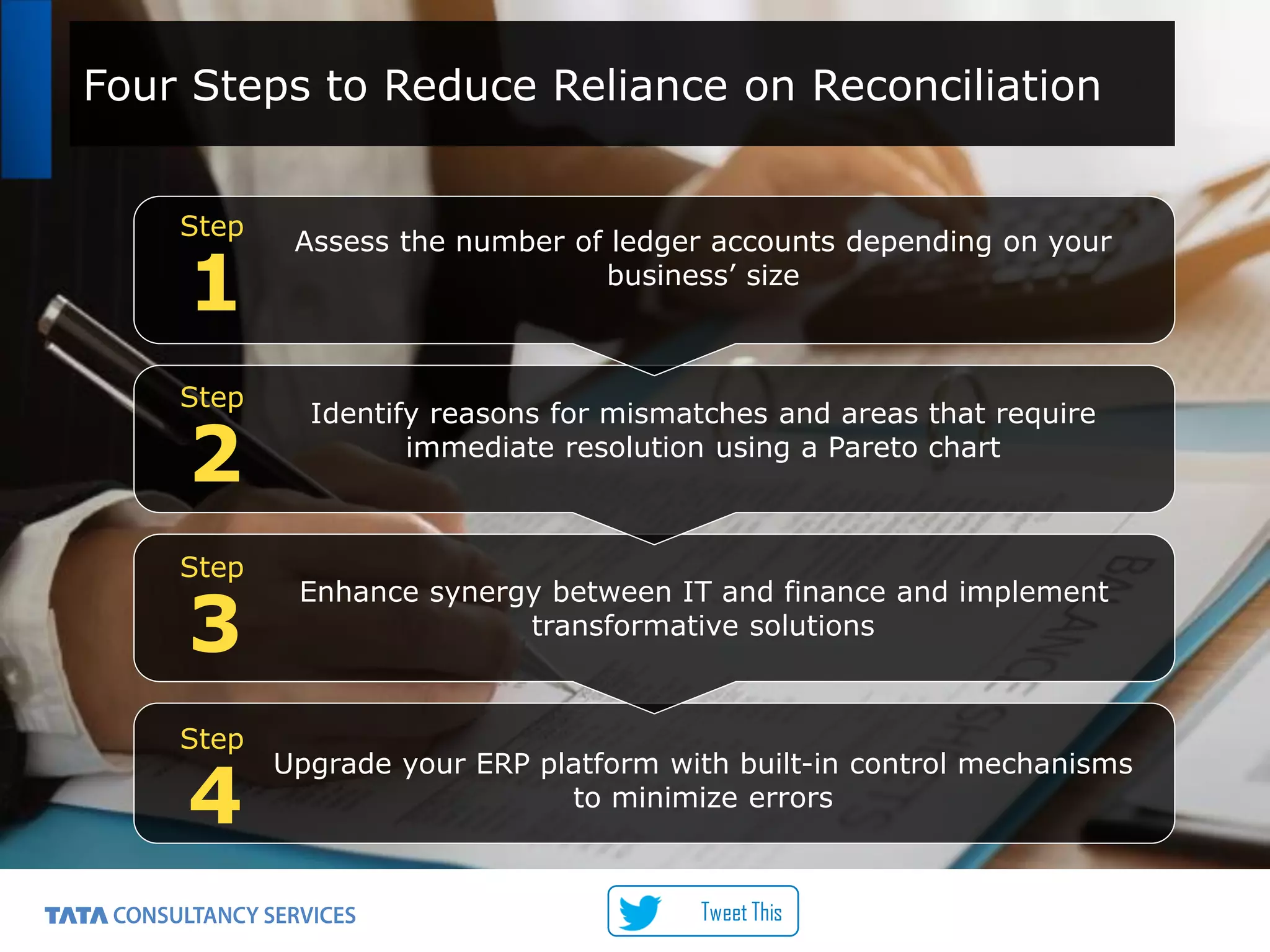

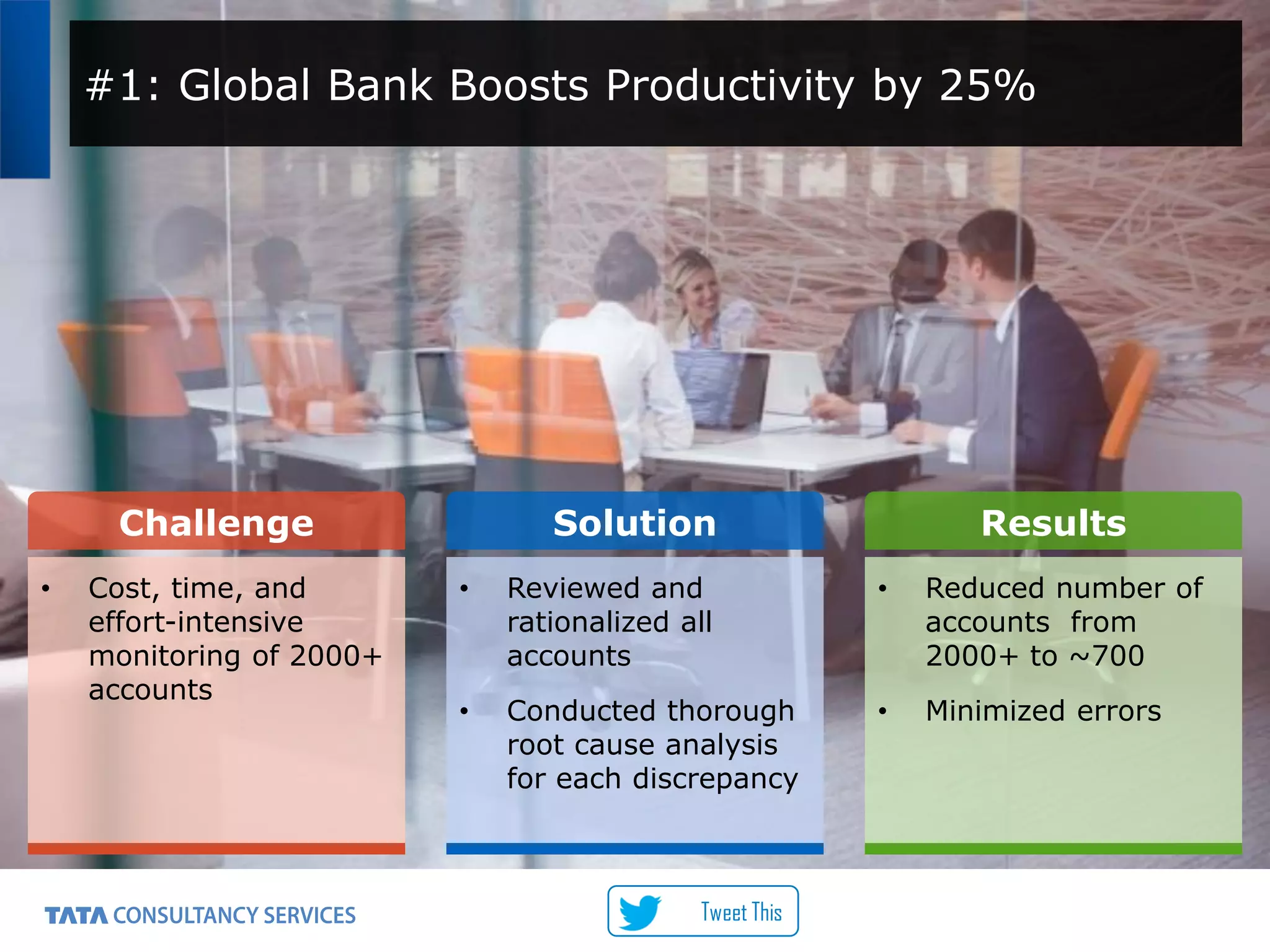

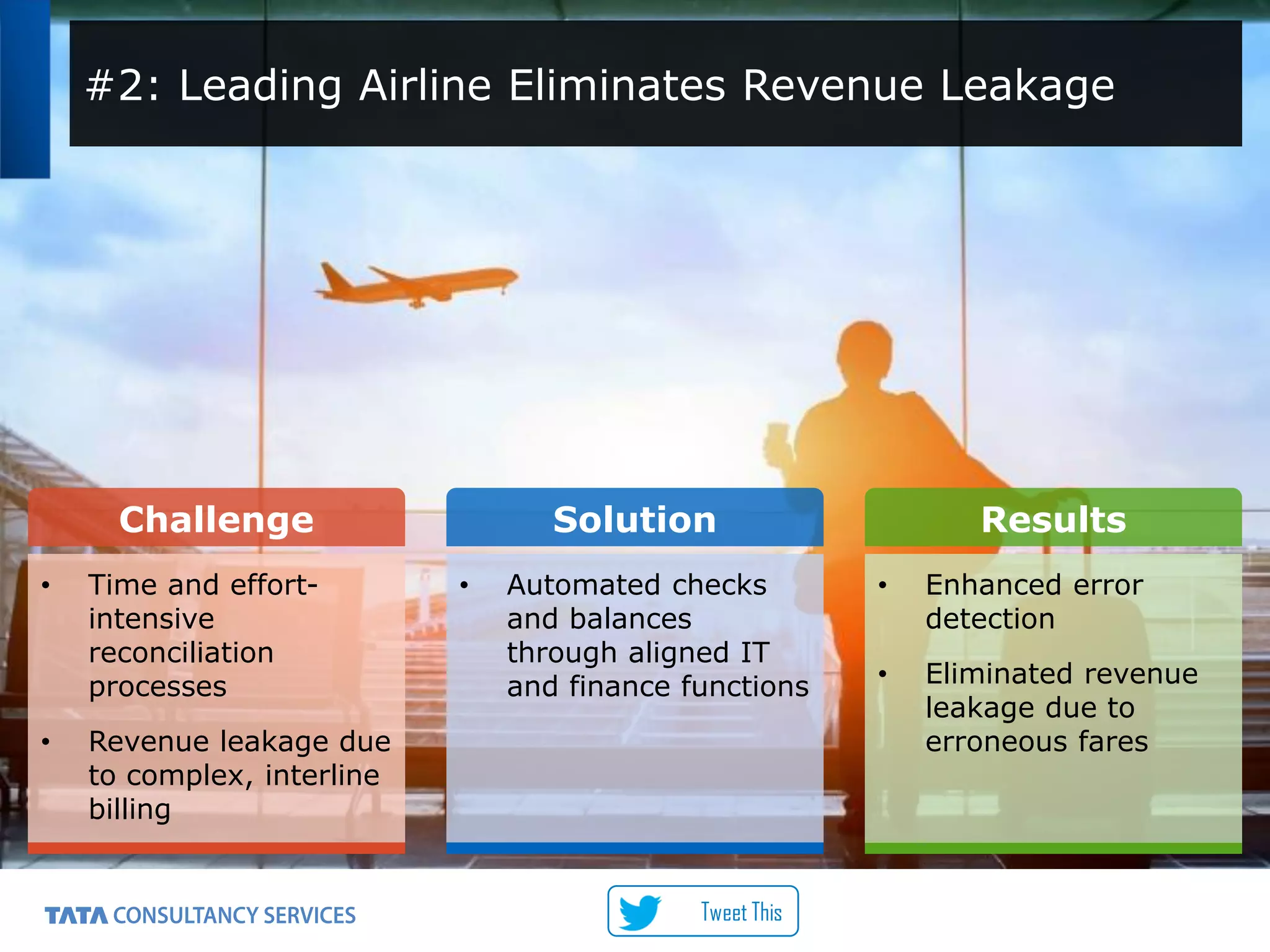

This document discusses the limitations of manual reconciliation processes and provides steps to reduce reliance on reconciliation in the digital age. It recommends upgrading ERP platforms, enhancing synergy between IT and finance, identifying reasons for mismatches, and assessing the number of ledger accounts depending on business size. It also discusses how industry leaders like a global bank and airline have boosted productivity by 25% and eliminated revenue leakage by automating reconciliation processes.