Embed presentation

Download as PDF, PPTX

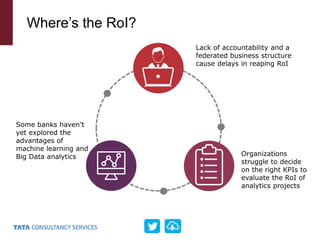

The document discusses how banking and financial services can use analytics to gain competitive advantages, such as generating new revenue streams and offering personalized products. It highlights the importance of managing and governing big data, addressing customer privacy concerns, and achieving return on investment (ROI) in analytics initiatives. The author emphasizes deploying self-service analytics tools and using APIs to integrate data into business processes.