Embed presentation

Download to read offline

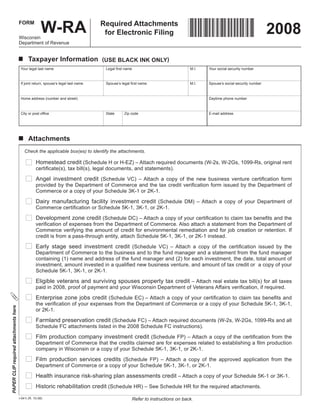

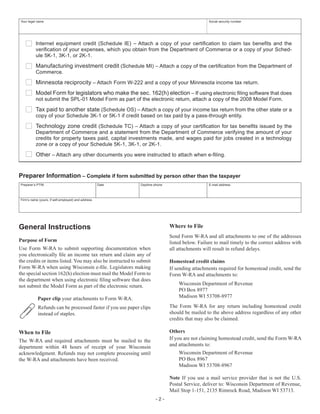

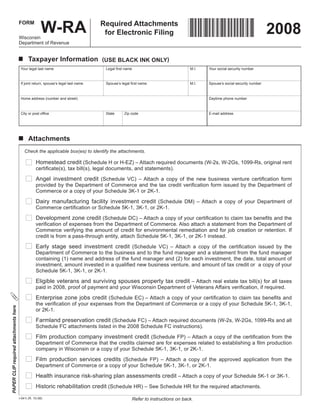

This document provides instructions for taxpayers filing their Wisconsin tax return electronically. It lists various tax credits and items that may require attachments to substantiate the claims. The taxpayer must submit these attachments on Form W-RA within 48 hours of receiving an electronic filing acknowledgment from Wisconsin. The instructions specify where to mail the Form W-RA based on whether the taxpayer is claiming the homestead credit or other credits. Failure to submit the required attachments in a timely manner could delay any tax refund.