Embed presentation

Downloaded 13 times

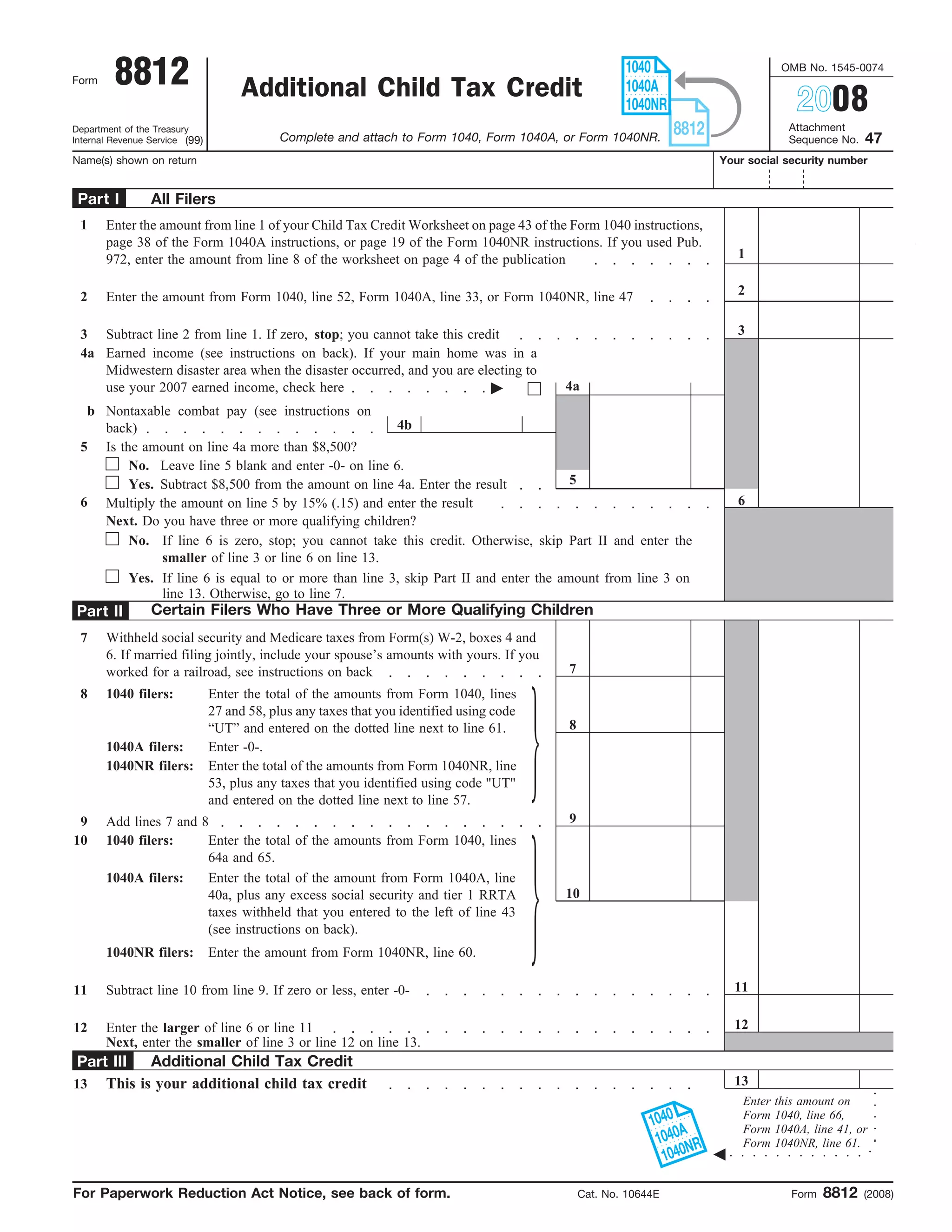

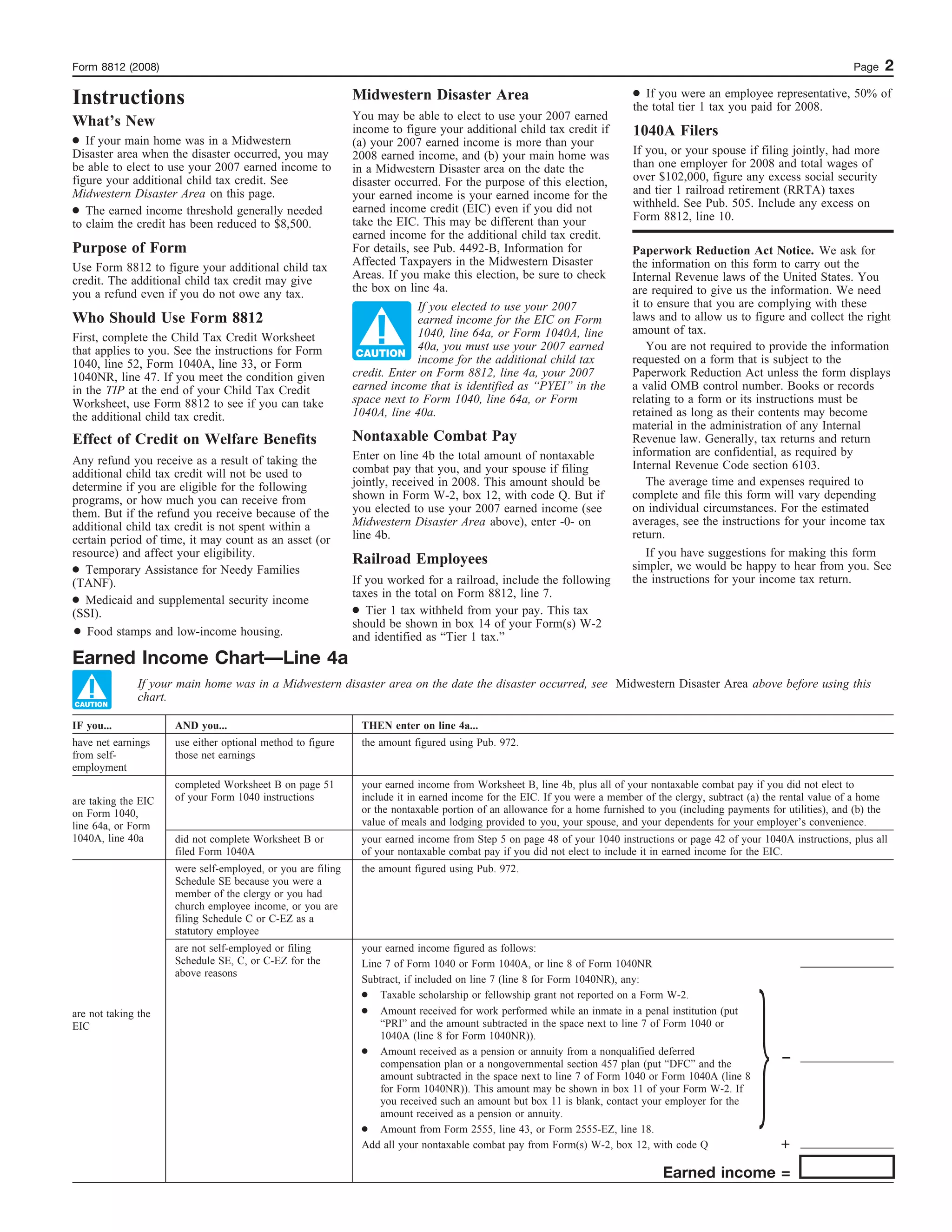

This document is an IRS Form 8812 for claiming an Additional Child Tax Credit for tax year 2008. It contains instructions for determining eligibility for the credit. Key details include: 1) The form is used to calculate an additional child tax credit amount and attach to Form 1040, 1040A, or 1040NR. 2) Part I contains instructions for determining the additional child tax credit amount based on amounts from the main tax form and the child tax credit worksheet. 3) Part II contains additional instructions for filers with 3 or more qualifying children to calculate the credit based on withheld taxes and tax liability. 4) The smaller of the amounts calculated in Parts I and II is entered on