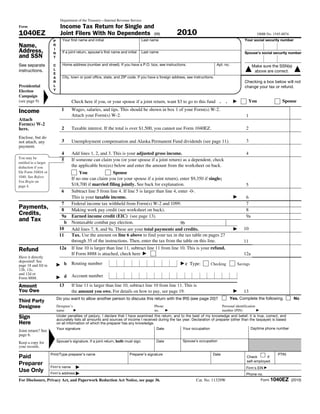

Nikita Daryanani is filing a single tax return for 2010 reporting $40,000 in wages. The standard deduction of $9,350 is subtracted from adjusted gross income of $40,000, resulting in taxable income of $30,650. Using the tax table, the tax due is $4,175. No payments, credits or refund are reported. The full amount owed of $4,175 is shown on line 13.