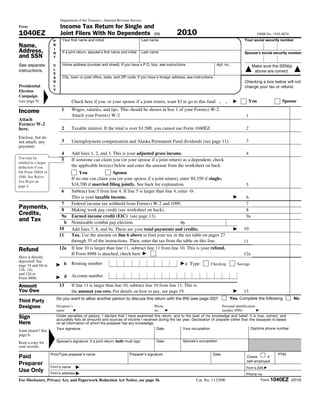

1. The document is a 2010 Form 1040EZ, which is a simplified tax return for single and married filing jointly taxpayers with no dependents. It provides instructions for reporting wages, interest, unemployment compensation, and tax payments.

2. The taxpayer, Jocelyn Wong, is filing as a single individual and reports $40,000 in wages on Line 1. With the standard deduction of $9,350, the taxable income is $30,650.

3. Using the tax table, the tax due is $4,183. Since no payments were made, the full amount owed is entered on Line 13.