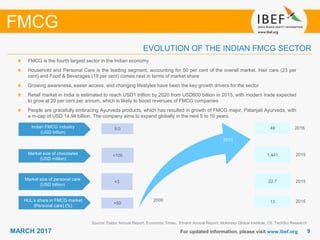

The document provides an overview of the FMCG sector in India, including market trends, growth drivers and opportunities. Some key points:

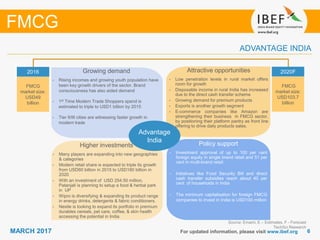

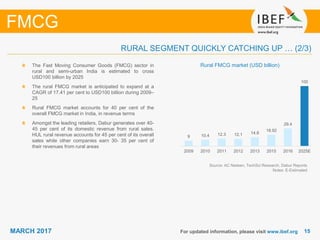

- The Indian FMCG market is expected to grow from USD49 billion in 2016 to USD103.7 billion by 2020, registering a CAGR of 20.6%.

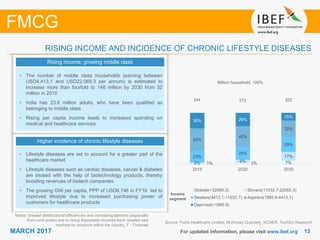

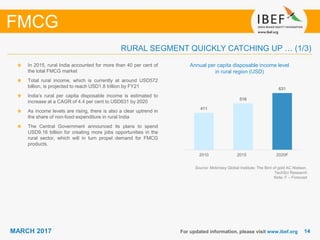

- Rural consumption and demand are major growth drivers as rural FMCG consumption is estimated to reach USD100 billion by 2025 from USD29.4 billion in 2016.

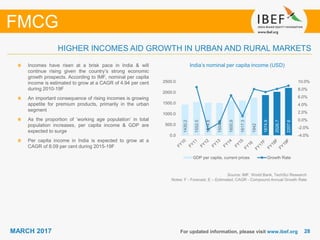

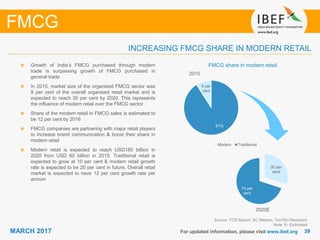

- Favorable demographics, rising incomes, and increasing modern trade are boosting the FMCG sector. Urban areas account for 60% of revenues currently.

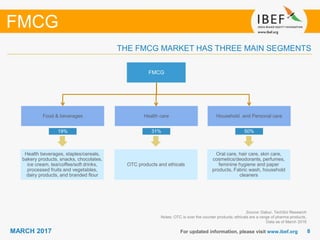

- Food and beverages and household/personal care make up