The document discusses mobile adoption trends based on analytics from Flurry. It summarizes that:

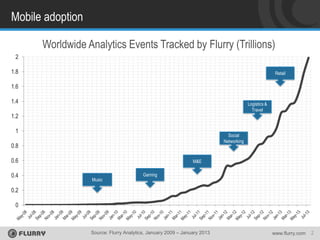

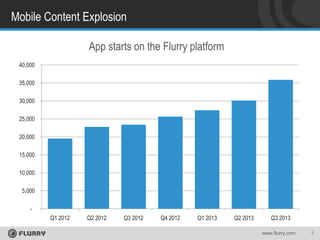

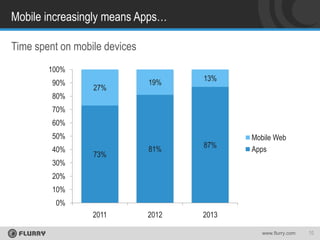

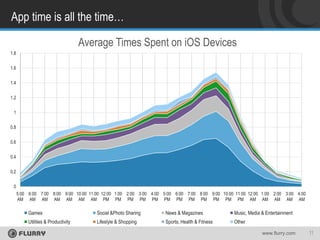

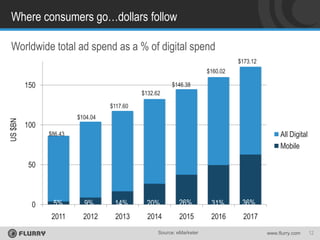

1) Mobile app usage has grown tremendously from 2009-2013 across categories like social networking, gaming, and entertainment.

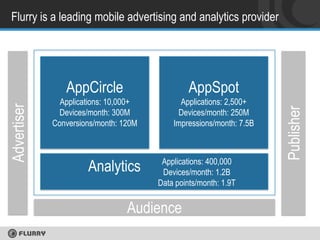

2) Flurry's platform tracks over 400,000 apps, 1.2 billion devices per month, and 1.9 trillion data points per month.

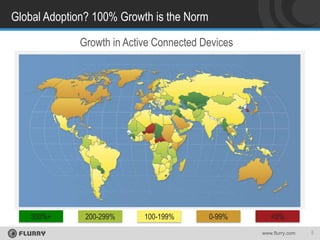

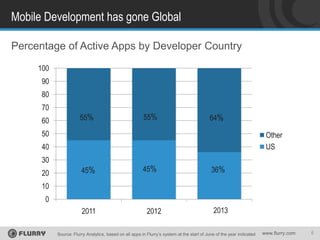

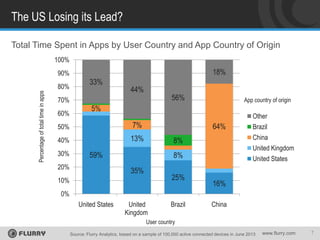

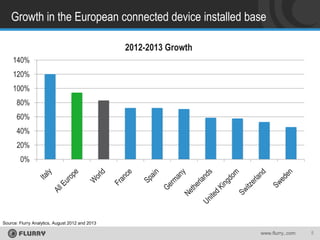

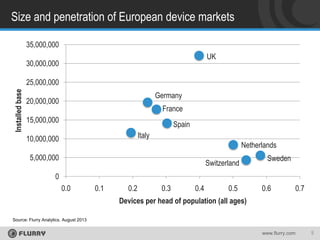

3) Global mobile growth is robust with over 100% annual growth in many regions, demonstrating how mobile has gone worldwide.