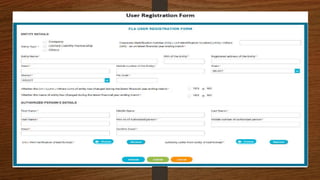

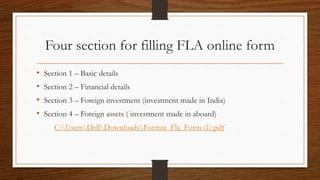

This document provides information about the Foreign Liabilities and Assets (FLA) Annual Return that must be filed under the Foreign Exchange Management Act (FEMA) by Indian companies and entities that have received foreign direct investment or made overseas investments. It outlines who must file an FLA return, the exemptions, the due date of July 15th (extended to July 31st in 2019), penalties for non-compliance, and the new online filing process through the Foreign Liabilities and Assets Information Reporting (FLAIR) system introduced by the Reserve Bank of India.