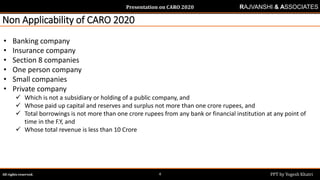

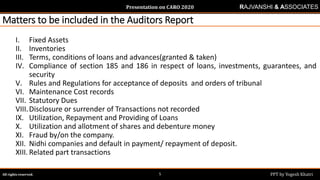

The document is a presentation on the Companies (Auditor's Report) Order, 2020 (CARO 2020) by Rajvanshi & Associates. It provides an overview of CARO 2020, including its background, applicability, and the various matters that must be addressed in auditor's reports under CARO 2020. Specifically, it outlines the 21 paragraphs of CARO 2020 that auditors must comment on, such as fixed assets, loans & advances, statutory dues, fraud, related party transactions, and internal audit. It also lists companies that are exempt from CARO 2020, such as banking, insurance and small companies.

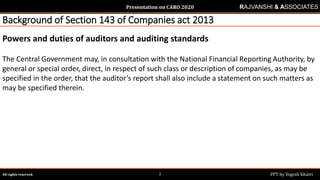

![Presentation on CARO 2020

All rights reserved. PPT by Yogesh Khatri1

RAJVANSHI & ASSOCIATES

Overview of Companies

(Auditor’s Report) Order 2020

TO BE PUBLISHED IN THE GAZETTE OF INDIA,

EXTRAORDINARY,

PART II, SECTION 3, SUB-SECTION (ii)]

MINISTRY OF CORPORATE AFFAIRS](https://image.slidesharecdn.com/caro2020-200229083514/75/CARO-2020-1-2048.jpg)