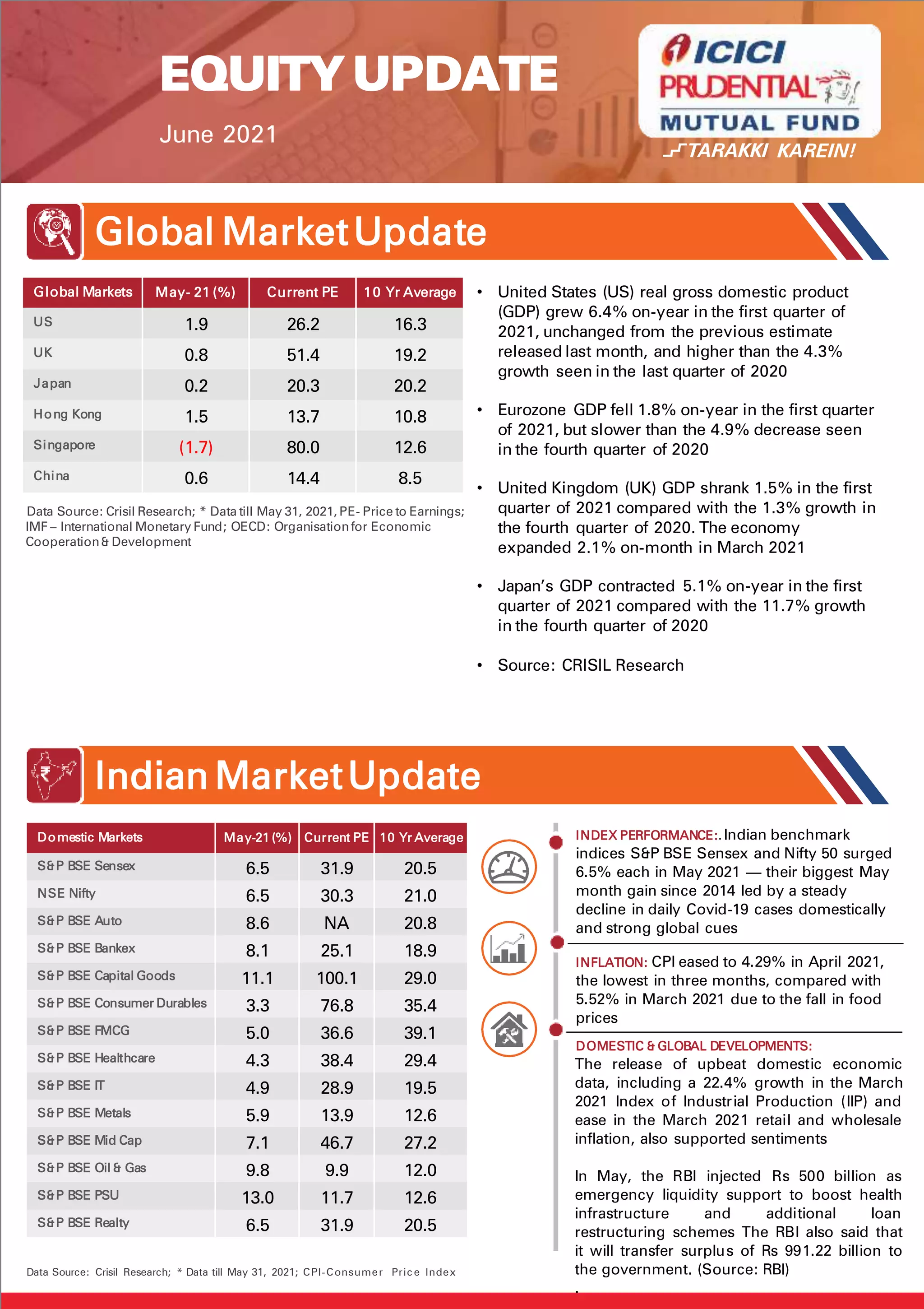

In May 2021, Indian benchmark indices S&P BSE Sensex and Nifty 50 each saw a significant surge of 6.5%, reflecting improved domestic economic conditions and a decline in COVID-19 cases. Global and domestic developments, including the Indian GDP growth and RBI's liquidity support, contributed to positive market sentiment, although cautiousness prevails ahead of the upcoming US Federal Reserve meeting. Future market trends will be influenced by policy measures, vaccination pace, and government reforms aimed at economic recovery.