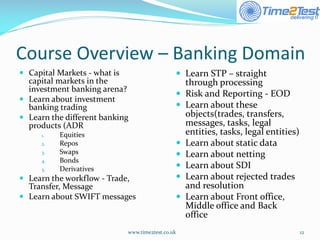

The document outlines the agenda for a two-day workshop on capital markets testing hosted by Time2test Limited and Asymilate Limited. The workshop will provide an introduction to capital markets domains, technical skills, and testing skills. It will cover topics such as banking products, trade lifecycles, cash flows, delivery concepts, and derivatives. The agenda includes sessions on the banking domain, technical skills like XML and SQL, and testing skills including test planning and defect resolution.