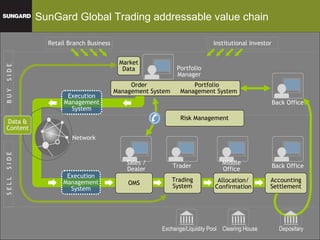

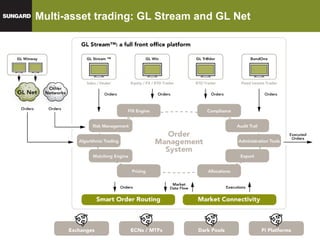

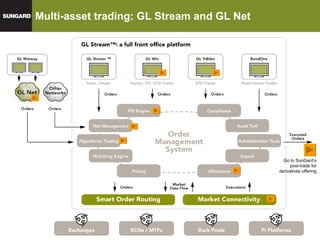

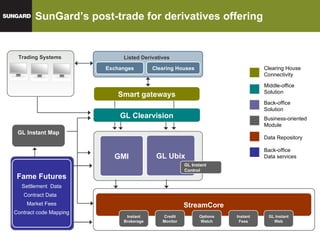

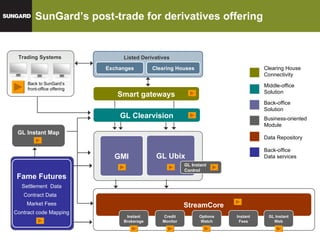

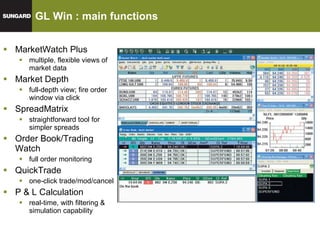

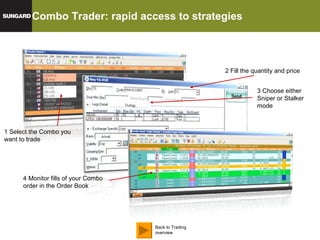

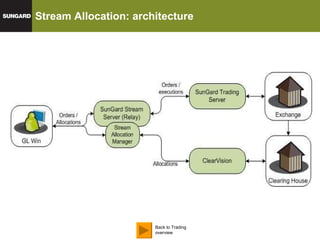

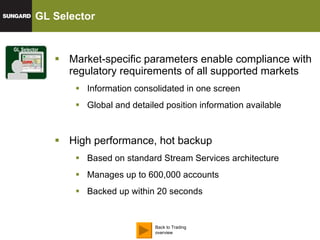

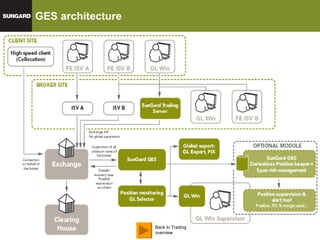

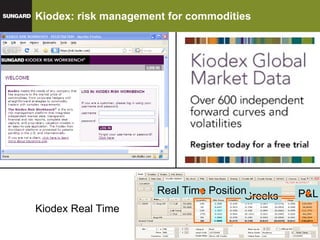

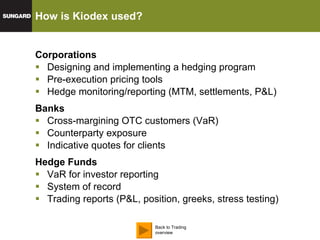

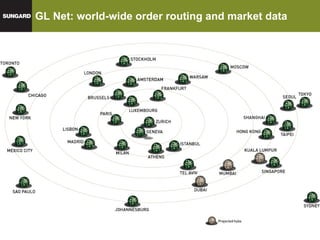

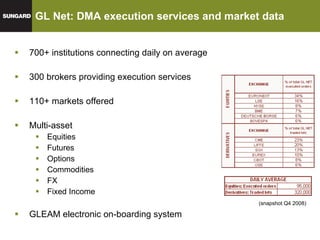

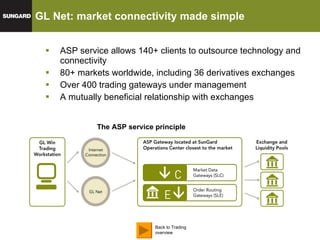

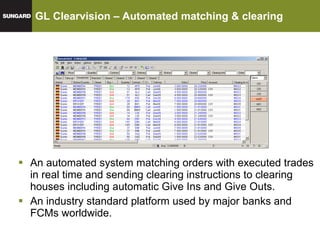

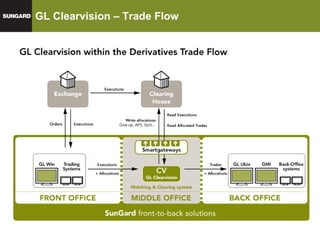

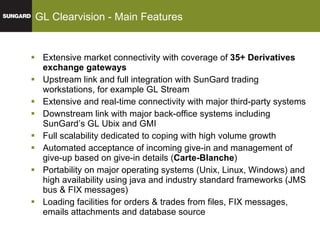

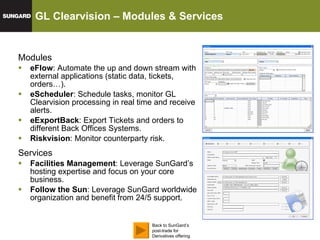

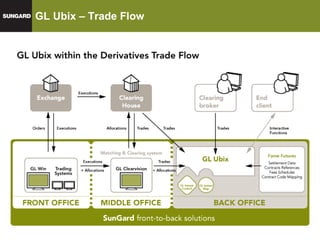

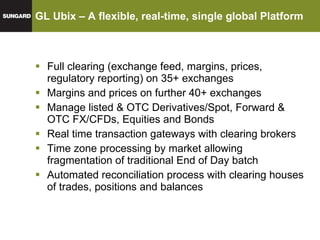

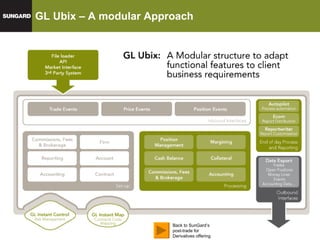

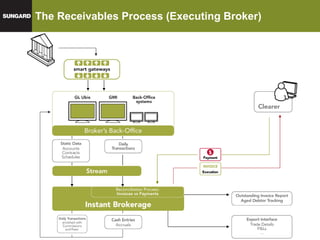

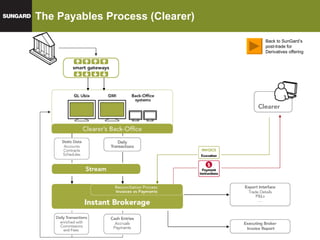

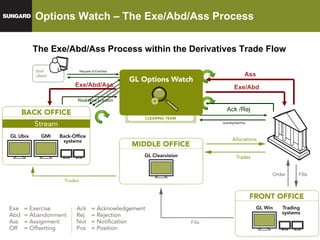

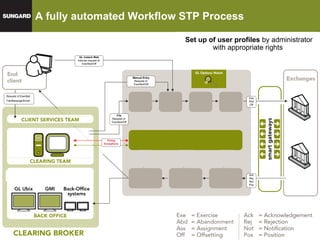

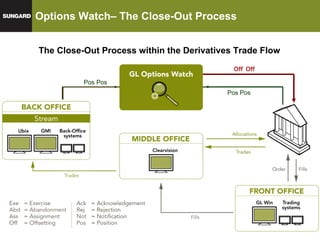

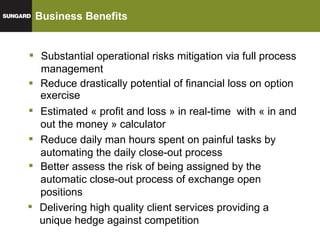

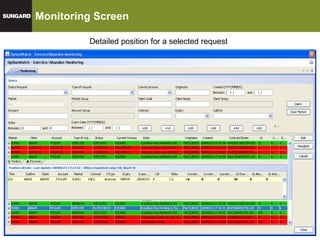

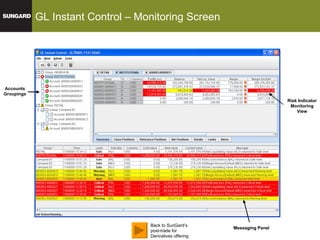

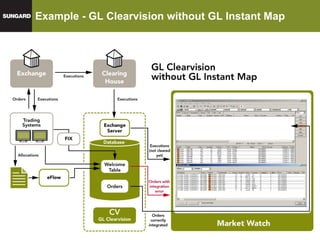

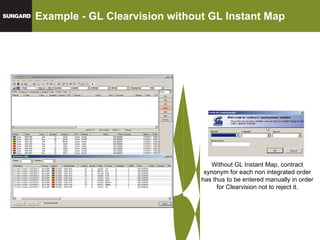

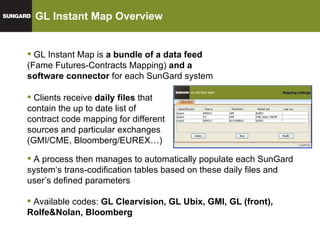

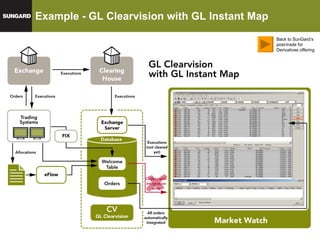

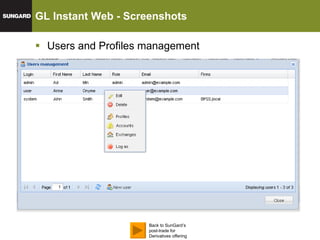

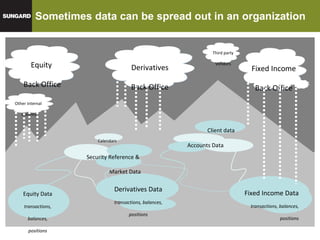

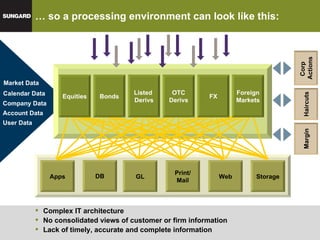

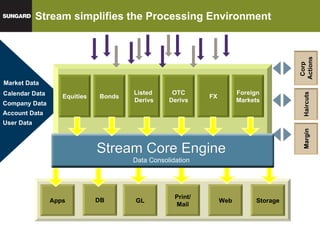

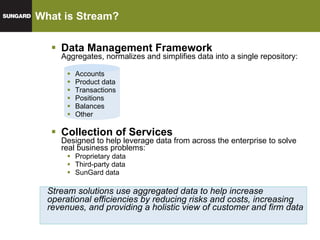

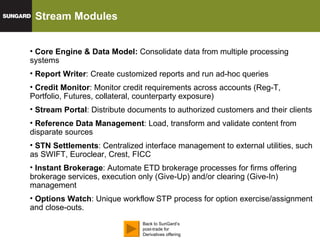

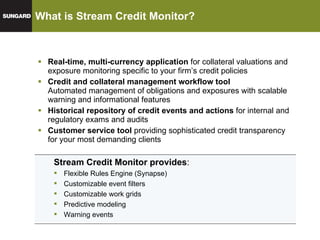

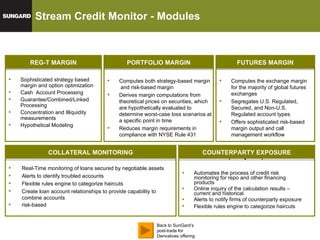

The document describes SunGard's offerings for derivatives markets, including front office trading systems, middle office post-trade processing, and back office solutions. It outlines their global presence, product lines, and integrated front-to-back workflow solutions for trading, clearing, settlement, and accounting across multiple asset classes.