This document summarizes a study examining the fiscal and social effects of state alcohol control systems in the United States. It analyzes data from the late 1970s to 2010 comparing states with alcohol monopolies to those with private license systems. Key findings include:

1) States with alcohol monopolies had lower spirits and wine consumption on average. Restricting alcohol advertising was also associated with lower consumption.

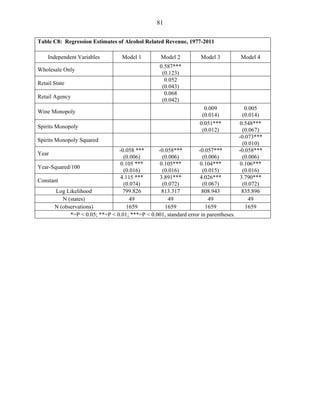

2) Alcohol monopolies generated substantially higher alcohol-related tax revenues for states than private systems. Wholesale monopolies provided the largest financial gain.

3) Alcohol monopolies were associated with lower alcohol-related traffic fatality and crime rates for some offenses like assaults and vandalism compared to license states.

![7

Agency,9

Agency Only, and License. The composite measures, Spirits Monopoly and Wine

Monopoly, each have six possible values, from 0 to 5, where 0 is a license state and 5 represents

state-owned wholesale and retail. Values for these variables were assigned based on the matrix

in Table 3.3.1. Evident from the counts in the table is the variation in retail arrangements, which

in recent history has been the main area of state divestment.

Table 3.1.1: Monopoly Strength Measure

Wholesale Ownership and Control

State Only Private Agent Private License

RetailOwnershipandControl

State Only

5

(303)

[50]

4

(N/O)

[N/O]

3

(N/O)

[8]

State and Private Agent

4

(116)

[35]

3

(N/O)

[N/O]

2

(N/O)

[N/O]

Private Agent Only

3

(63)1

[N/O]

2

(7)

[N/O]

1

(N/O)

[37]3

Private License

2

(142)

[120]2

1

(N/O)

[N/O]

0

(1,120)

[1,501]

For each cell: the top number is the assigned variable score for monopoly strength,

the second number (in parentheses) is the number of observations for spirits, and the

third number [in brackets] is the number of observations for wine. N/O indicates no

observations.

1

Includes 5 observations where a state was transitioning from public to private license, and

therefore had both types of retail stores.

2

Includes 45 observations where the state stores carried a limited number of wine products

as they phased out wine inventory.

3

All 37 observations are where the state retail stores held wine inventory during a transition

to private license.

9

States with both types of stores usually place state-owned stores in high traffic areas and agency stores

in less populated regions.](https://image.slidesharecdn.com/4c3a2046-1bd4-4f72-ba13-2376441782e9-150602012944-lva1-app6891/85/FiscalAndSocialEffectsOfStateAlcoholControlSystems-12-320.jpg)