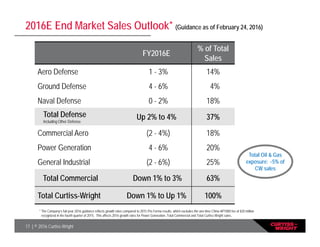

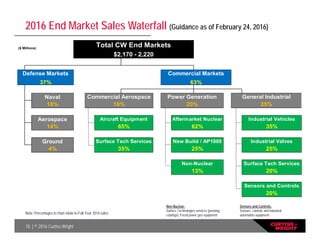

The document provides an investor overview for Curtiss-Wright Corporation for the first quarter of 2016. Some key points:

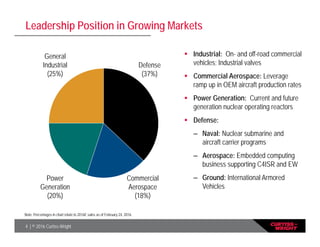

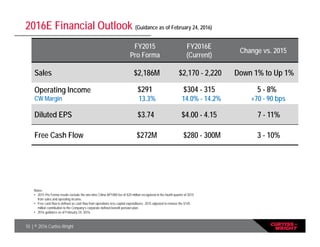

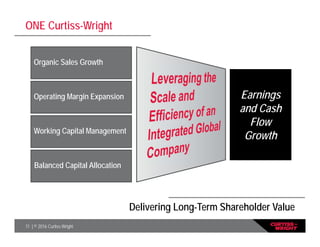

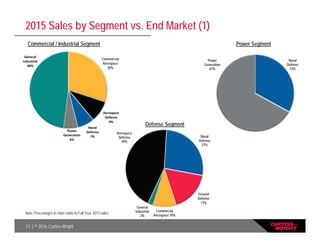

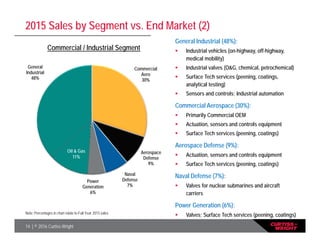

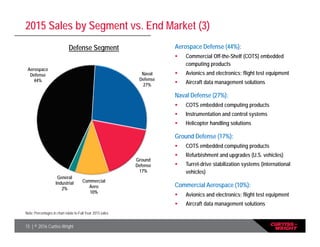

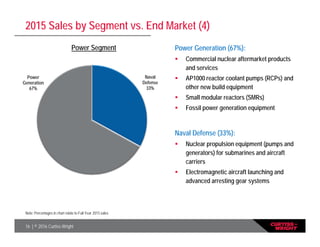

- Curtiss-Wright is a global industrial company providing highly engineered products and services to aerospace, defense, and industrial markets, with $2.2 billion in estimated 2016 sales.

- The company has leadership positions in growing markets such as commercial aerospace, power generation, and defense.

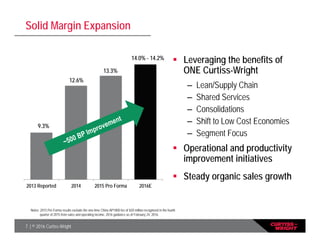

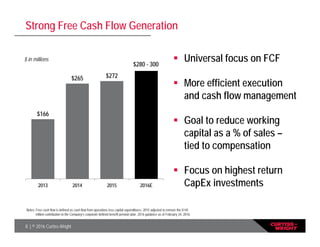

- Financial goals include 3-5% organic sales growth, over 14% operating margin, and over 100% free cash flow conversion.