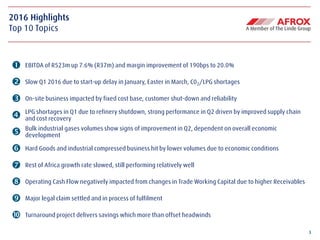

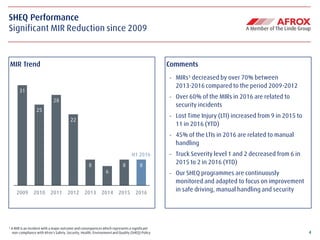

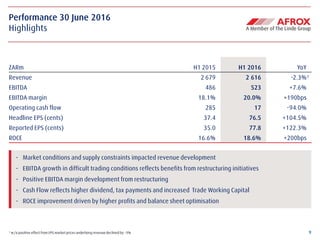

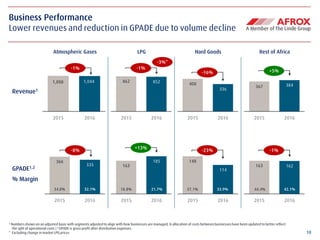

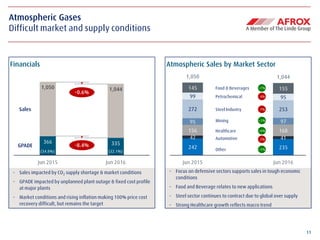

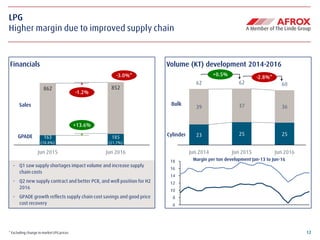

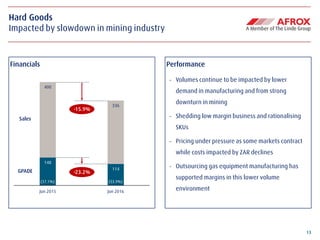

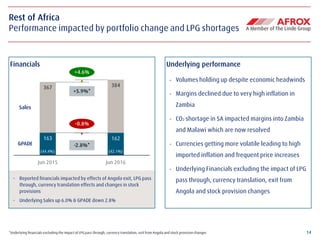

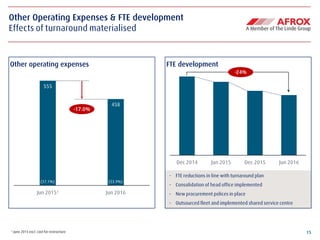

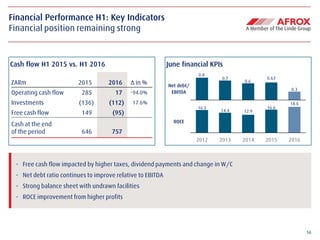

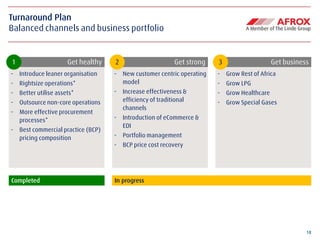

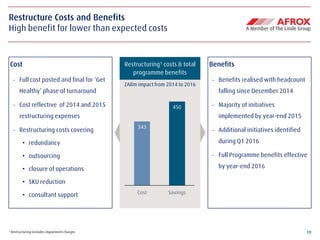

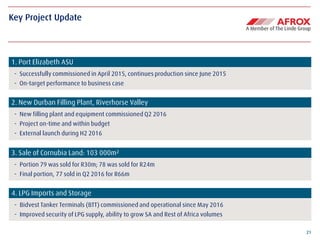

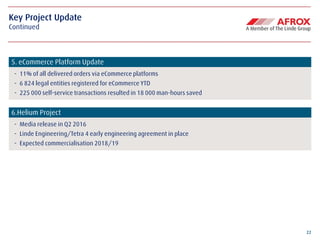

The document provides a detailed analysis of Afrox's financial performance for the first half of 2016, highlighting a 7.6% increase in EBITDA, despite various operational challenges including CO2/LPG shortages and economic conditions impacting sales. It outlines the company's strategic initiatives aimed at improving efficiency and profitability, such as restructuring, enhancing logistics, and implementing e-commerce solutions. The report also discusses a turnaround update with specific projects and plans for growth across different segments, despite ongoing market pressures.