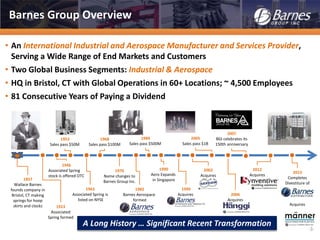

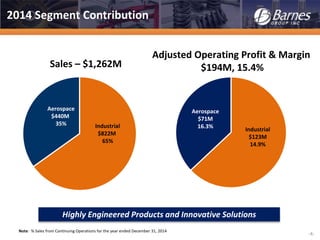

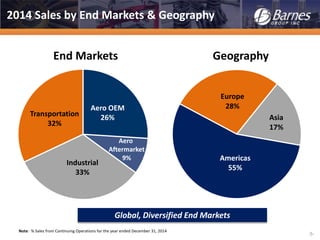

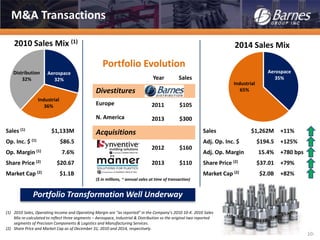

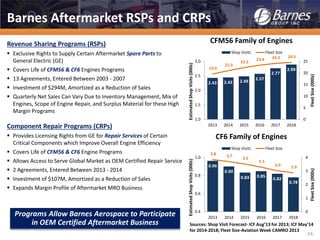

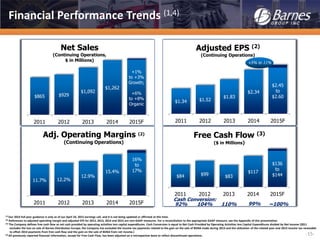

Barnes Group is an international industrial and aerospace manufacturing company with two business segments: Industrial and Aerospace. The document provides an overview of Barnes Group, including its history, business segments, end markets served, strategic focus on driving profitable growth, capital allocation approach, and evolution of its portfolio through acquisitions and divestitures. It also discusses the market environments and Barnes Group's positioning in its key industrial and aerospace end markets.