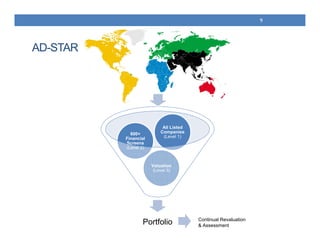

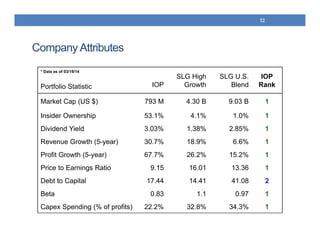

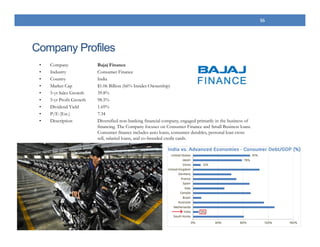

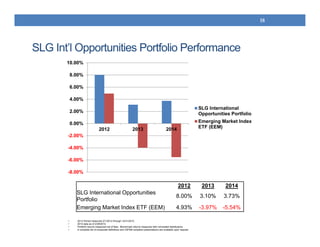

The document discusses an international opportunities portfolio that invests in high-growth companies located across 45 countries. The portfolio managers use a proprietary screening system called AD-STAR to identify companies exhibiting strong financials and operating metrics. The portfolio has outperformed emerging market indexes since inception while taking on less risk through a focus on companies with high insider ownership, strong balance sheets, and low debt levels. Several example portfolio holdings are provided that demonstrate these traits across sectors like consumer goods, retail, and finance.