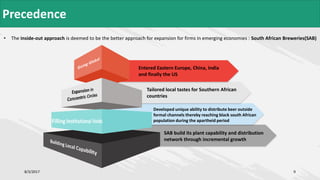

The document discusses the challenges and competitive strategies of emerging market companies, particularly in countries like China, India, and Brazil, as they strive to compete with established multinational corporations. It highlights how these companies leverage local market knowledge and adapt to institutional voids to gain a competitive edge. Additionally, it notes several successful firm examples, along with the importance of understanding the unique dynamics of emerging markets in contrast to developed markets.