FINC 355 RETIREMENT AND ESTATE PLANNING FINAL EXAMINATION I.docx

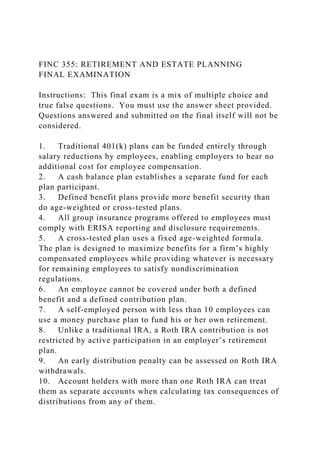

- 1. FINC 355: RETIREMENT AND ESTATE PLANNING FINAL EXAMINATION Instructions: This final exam is a mix of multiple choice and true false questions. You must use the answer sheet provided. Questions answered and submitted on the final itself will not be considered. 1. Traditional 401(k) plans can be funded entirely through salary reductions by employees, enabling employers to bear no additional cost for employee compensation. 2. A cash balance plan establishes a separate fund for each plan participant. 3. Defined benefit plans provide more benefit security than do age-weighted or cross-tested plans. 4. All group insurance programs offered to employees must comply with ERISA reporting and disclosure requirements. 5. A cross-tested plan uses a fixed age-weighted formula. The plan is designed to maximize benefits for a firm’s highly compensated employees while providing whatever is necessary for remaining employees to satisfy nondiscrimination regulations. 6. An employee cannot be covered under both a defined benefit and a defined contribution plan. 7. A self-employed person with less than 10 employees can use a money purchase plan to fund his or her own retirement. 8. Unlike a traditional IRA, a Roth IRA contribution is not restricted by active participation in an employer’s retirement plan. 9. An early distribution penalty can be assessed on Roth IRA withdrawals. 10. Account holders with more than one Roth IRA can treat them as separate accounts when calculating tax consequences of distributions from any of them.

- 2. 11. A trust cannot provide for creditor protectioninsurance 12. Including a spendthrift clause is recommended for children with money management or substance abuse problems. 13. All of the following are true regarding tax implicatons of cash balance plans, except a. employer contributions to the plan are deductible when made b. taxation of the employee on employer contributions is deferred c. the plan is not subject to minimum funding rules of the Internal Revenue Code d. certain employers who adopt a cash balance plan may be eligible for a business tax credit up to $500 e. employees may make voluntary contributions to a “deemed IRA” established under the plan 14. Which of the following is (are) true regarding elective deferrals in a Section 401(k)? a. elective deferrals are not subject to Social Security and Federal Unemployment payroll taxes b. elective deferrals are always made on an after-tax basis c. if the company elects to have a safe harbor plan, elective deferrals must meet the actual deferral percentage test d. account funds can be withdrawn without a premature distribution penalty if the employee becomes disabled or dies e. since employees elect the amount of funds to defer, nondiscrimination tests do not apply to elective deferrals 15. Which of the following types of employer plans are exempt from most or all ERISA provisions? a. plans of state, federal, or local governments or governmental organizations b. plans of churches, synagogues, or related organizations c. plans maintained solely to comply with workers’ compensation, unemployment compensation, or disability

- 3. insurance laws d. all of the above e. none of the above because no employer plans are exempt from ERISA provisions 16. Irrevocable Life Insurance Trusts (ILIT) are primarily designed to ensure that the death benefit is excludable from the insured’s federal gross estate. a. true b. false 17. Are all of the items listed below reasons why having a will is important? (True or False) · The state directs how the decedent’s property is transferred · A spouse’s share of the decedent’s estate may be equal to a child’s · Children may be treated equally although not equitably · May require the appointment of an administrator who will usually have to furnish a surety bond, thereby raising the costs of administration · The administrator of the estate is determined by the court 18. Paul owns the following property: 1. Boat (fee simple) 2. Condominium on the beach (tenancy in common with his brother and sister) 3. House and two cars with his wife, Karen (tenancy by the entirety) 4. Checking account with his son, William (POD) 5. Karate business (JTWROS with his partner, Mike) Which items will go through probate? Which property ownership could he sell without the consent of a co-owner? 19. Two brothers have consulted you about the purchase of a

- 4. lakefront cottage. The brothers plan to use the cottage on a seasonal basis. They are unsure of how they should title the property. Which of the following items of information do you need to obtain before making a recommendation? 1. The purchase price of the cottage 1. How much each brother plans to contribute toward the purchase of the cottage 1. Whether the brothers want their interest in the cottage to pass under their wills when they die 1. 1 and 2 1. 3 only 1. 1, 2, and 3 1. 2 and 3 20. Are all of the items listed below reasons why having a will is important? (True or False) · The state directs how the decedent’s property is transferred · A spouse’s share of the decedent’s estate may be equal to a child’s · Children may be treated equally although not equitably · May require the appointment of an administrator who will usually have to furnish a surety bond, thereby raising the costs of administration · The administrator of the estate is determined by the court 21. Annual additions to an age-weighted plan include a. employer contributions to participants’ accounts b. employee contributions to own account c. forfeitures from other accounts d. only a and b e. all of the above 22. Which plan has benefit levels that are guaranteed by both the employer and the Pension Benefit Guaranty Corporation (PBGC)? a. money purchase plan

- 5. b. target benefit plan c. cross tested plan d. defined benefit plan e. tax-deferred annuity 23. Advantages of defined benefit plans include all of the following, except a. defined benefit plans are easy to design and easy to explain to employees b. employees obtain a tax-deferred retirement savings medium c. retirement benefits at adequate levels can be provided for all employees regardless of age d. benefit levels are guaranteed both by the employer and, for some plans, by the PBGC e. for an older highly compensated employee, a defined benefit plan will allow the maximum amount of tax-deferred retirement saving 24. Which of the following is (are) true regarding the tax implications of having a money purchase plan? a. employer contributions and plan earnings are tax-deferred for the employee b. employers beginning a new plan are eligible for a $2,500 business tax credit in the first year to help with startup costs c. the employer tax deduction is limited to 25% of total payroll of the employees covered under the plan d. only a and b e. only a and c 25. All of the following are true regarding money purchase plans, except a. most money purchase plan benefit formulas use a factor

- 6. related to the employee’s service that favors owners and key employees b. nondiscrimination regulations provide a safe harbor for money purchase plans c. a plan benefit formula can be integrated with Social Security d. forfeitures, unvested amounts left behind by employees in their plans, can be used to reduce future employer contributions e. money purchase plan funds are generally invested in a pooled account managed by the employer or a fund manager selected by the employer 26. A tax-free rollover of a Roth IRA can be made to a. another Roth IRA b. a traditional IRA c. a tax-deferred annuity d. a and b e. a and c 27. Ways that a Roth IRA differs from a traditional IRA include: a. initial investment and earnings can be withdrawn tax-free b. Roth IRA contributions can be made past age 59½ c. Roth IRAs are never subject to minimum distribution rules d. a and b e. a and c 28. Directors of Xenon Corporation are considering changing from a traditional defined benefit plan to another type of plan. They have asked you to explain the advantages and disadvantages of such a change. You explain that if Xenon Corp. converts to

- 7. a. a defined contribution plan, most or all plan assets would be credited immediately to vested employees b. a cash balance plan, Xenon Corp. must increase the level of contribution to older employees c. a cash balance plan, Xenon Corp. would no longer need actuarial services d. only a and b e. only a and c 29. Maxton Manufacturing, Inc., uses prior year testing to monitor discrimination in its Section 401(k) plan. Last year, the actual deferral percentage (ADP) for all nonhighly compensated employees at Maxton was 4%. This year, the ADP for highly compensated employees at Maxton can be as high as a. 2% b. 4% c. 5% d. 6% e. 8% 30. The retirement plan for Bethel Shalom synagogue must adhere to ERISA reporting and disclosure rules. a. true b. false 31. Harper Engineering, Inc., offers several benefits to employees. Which of its benefits would be exempt from the ERISA reporting and disclosure requirements? a. Harper pays for life insurance to provide for employee dependents if the employee dies b. Harper gives each employee a small gift worth less than $5 on St. Patrick’s Day c. Harper has a scholarship program that pays for employee tuition for industry-relevant continuing education, based on the employee passing the course, out of the employer’s general

- 8. assets d. b and c e. a and c 32. Sentenal Corp., a restaurant supply company, is a closely held business. Tom Brady, founder and owner of the business is 59. Jeff Alcorn, age 53, is a key employee. The business employs 10 other rank-and-file employees earning an average of $30,000 per year. Both Tom and Jeff would like to contribute between $30,000 and $40,000 per year to a qualified retirement account. The advantages of using a profit sharing, age-weighted plan at Sentenal rather than a defined benefit plan include: a. the age-weighted plan is simpler to install b. the age-weighted plan is less expensive to administer c. the age-weighted plan allows more flexibility in plan contributions d. all of the above e. only a and b 33. The law firm of Willie, Cheatum, and Howe is structured as a professional corporation that has three key employees between ages 39 and 43, two law clerks in their late 20s, and two secretaries, both age 31. The three key employees earn $500,000 per year. The law clerks are paid $30,000 and the secretaries are paid $15,000 annually. Turnover for both the law clerks and secretaries has been rather high, with at least one law clerk and one secretary leaving about every 6 months for the past year. Characteristics of the firm that would make a cross-tested plan a less than optimal solution for the firm include a. the plan would have to be reconsidered at each new hire b. the plan would provide relatively few advantages given the age of the highly compensated group c. having more than one highly compensated employee makes

- 9. coverage tests related to the plan more difficult to apply d. all of the above e. none of the above 34. Shannon McDougal will retire December 31 of this year. Shannon has worked for Shamrock Construction for 30 years. During his last 5 years, he earned $40,000, $47,000, $44,000, $46,000, and $48,000. Shamrock’s retirement plan uses a unit credit formula that awards employees 1.5% for each year of service using a financial average of the last 3 years. Shannon’s annual benefit will be: a. $19,500 b. $20,250 c. $20,700 d. $21,150 e. $21,600 35. April Showers, age 30, opened the Unique Boutique 5 years ago. April has five employees ranging in age from 25 to 42. Earnings have fluctuated. Profits have been made only in the last two years. April should a. not have a defined benefit plan because it is designed for older business owners b. have a defined benefit plan because it will maximize April’s tax deduction c. not have a defined benefit plan because there are a large number of years until the owner or employees retire d. have a defined benefit plan because the owner can get $1,500 tax credit for establishing a new retirement plan e. not establish a defined benefit plan because it is not likely April can meet the annual funding requirements 36. Mandy Thomas, age 47, is the owner of The Golf Pro Shop. Mandy wants to retire at age 55. The company adopted a defined benefit plan 2 years ago, 3 years after the business

- 10. opened. Mandy wants to increase the amount that she contributes to her own retirement. Mandy can a. increase the amount without limit b. increase the amount within limits set by the Internal Revenue Code c. increase the amount, but must also contribute to all other company employee accounts by the same proportion d. increase the amount, but maximum benefit will be cut in half because the plan is less than 10 years old e. she cannot increase her contribution 37. The owner of Whitney Corporation, Inc., earned $250,000 in 2013. In the same year, three highly compensated employees earned $100,000 each. The remaining 30 line workers earn about $20,000 each, for a total payroll of $600,000 for this group of workers. Whitney Corporation made the maximum allowable contribution to each employee’s money purchase plan in 2013. In 2013, what was the total amount that Whitney Corporation contributed to their money purchase plan? a. $51,000 b. $150,000 c. $225,000 d. $276,000 e. $318,000 38. Orville Winbacher died last year at age 58, leaving $500,000 accumulated in a Roth IRA. Which of the following is (are) true? a. monies in the Roth IRA must be distributed within a year of the Orville’s death either to his estate or to a beneficiary b. distribution from the account can be made over the life of a designated beneficiary if begun within a year of Orville’s death c. initial distribution of Orville’s Roth IRA funds to a beneficiary are tax-free, but subsequent investment returns on amounts distributed are taxable

- 11. d. a and b e. b and c 39. George Flint was transferred to Chicago three years ago. When he left Detroit, he sold his home and put some of the money in a new Roth IRA. He and his wife, Wilma, have been renting a home for the past 3 years. Recently, the homeowner decided to sell. George is interested in buying the home. George can make a penalty-free withdrawal from his Roth IRA to help complete the purchase. a. true b. false 40. Brothers Tim and Jim Shanton have asked you, their financial advisor, to settle a friendly quarrel between them. Tim argues that a Roth IRA and a traditional IRA are actuarially equivalent if $4,000 is available for investing on a before-tax basis, contributions to the traditional IRA are deductible, tax rates are expected to stay the same, and both have the same interest rates. So, it makes no difference which vehicle one uses to save for retirement. Jim insists that a Roth IRA is the better investment. You tell them a. Tim is wrong; the tax deduction available for a traditional IRA allows more money to work for the contributor b. Jim is wrong; at least for some low-income individuals, the traditional IRA is a better investment because of its relatively lower tax rates c. Tim is right; the two investments are equivalent in every respect when considered at the end of an investment horizon at least 10-years long d. Jim is right; the ability to make tax-free withdrawals from a Roth IRA gives a greater return even when contributions and interest rates are equivalent over time e. both are right; the two investments are actuarially equivalent, but absence of a minimum distribution date and more liberal penalty-free withdrawal options may make the Roth

- 12. IRA more attractive 41. Which of the following statis is (are) NOT correct? a. A durable power of attorney for health care is always a direct substitue for a living will. b. A living will only covers a narrow range of situations. c. A living will must generally meet the requirements of a formally drafted state statue. d. Many well-intentioned living wills have failed because of vagueness and/ or ambiguities. 42. A __________ is a legal request for how one’s estate should be distributed upon death a. Letter of last insturction b. Will c. Asset distribution d. None of the above 43. The person transferring asssets to antoher person in a trust is called the a. Trustee b. Grantor c. Executor d. None of the above 44. A ______________ is a legal documemnt created by indiviudals to specify their preferences if they become mentally or physically disabled a. Power of attorney b. Living trustr c. Codicil d. Living will 45. A _____________ trust, the grantor is no longer the owner of the assets in the trust disabled

- 13. a. Living b. Revocable living c. Irrovocable living d. Non of the above 46. Which of the following is not true regarding estate taxes? a. They are dependent on the value of an estate b. Any funds that are provided as a result of a life insurance policy are counted as part of the state for tax purposes c. All the assets in an estae can be distributed tax-free to children or others d. All of the above are true 47. Which of the following situaitons would NOT constitute a transfer that comes within the gift tax statues? a. Robin creates a trust under the terms of which her daughter is to get income for life and her granddaughter the remainder at the daughter’s death. b. Robbie purchases real propety and has the title conveyed to himslef an to his brother as joint tenants. c. Randal creates an irrovocable trust giving inocme for life to his wife and providing that at her death the corpus is to be distributed to his son. d. Ray purchases a U.S. savings bond made payable to himself and his wife, Raquel. Raquel cashes the bond to be used for her own benefit. e. Rose creates a joint bank account for herself and her daugher. There have been no withdrawls from the account. 48. A living trust is one in which the grantor creates an inter vivos trust that is funded with part of all of the grantor’s property. a. True b. False

- 14. 49. Which of the following transfers qualify for the unlimited marital deduction? a. Outright bequest to resident alien spouse b. Property passing to citizen spouse in QTIP c. Income beneficiary of CRT is a nonresident alien spouse (trust is not a QDOT) d. Outright bequest to resident spouse who, prior to the decedent’s death, was a noncitizen bu who after the decedent’s death and before the estate return was filed, became a U.S. citizen. e. b and d 50. The generation-skipping transfer tax (GSTT) is in addition to the unified gift and estate tax and is designed to tax large transfers tht skip a generation (i.e. from grandparent to grandchile). The purpose of the tax is to collect potentially lost tax dollars from the skipped generation. Which of the following transfers qualify for the unlimited marital deduction. a. True b. False 1 FINC 355: RETIREMENT AND ESTATE PLANNING FINAL EXAM ANSWER SHEET WEEK 8 Here is the Final Exam Answer Sheet that you should submit to your Final Exam Folder. Please submit this answer sheet in MS Word format with the following file name: LastNameFirstInitial_FinalExamAnswerSheet.docx. For example, if you name is John Smith, the file name of your Answer Sheet should be SmithJ_FinalExamAnswerSheet.docx. If you have any questions or comments, please do not hesitate to contact me.

- 15. NAME: _____________________________________ Question Number Answer Question Number Answer 1 26 2 27 3 28 4 29 5 30 6 31 7 32 8

- 18. 1