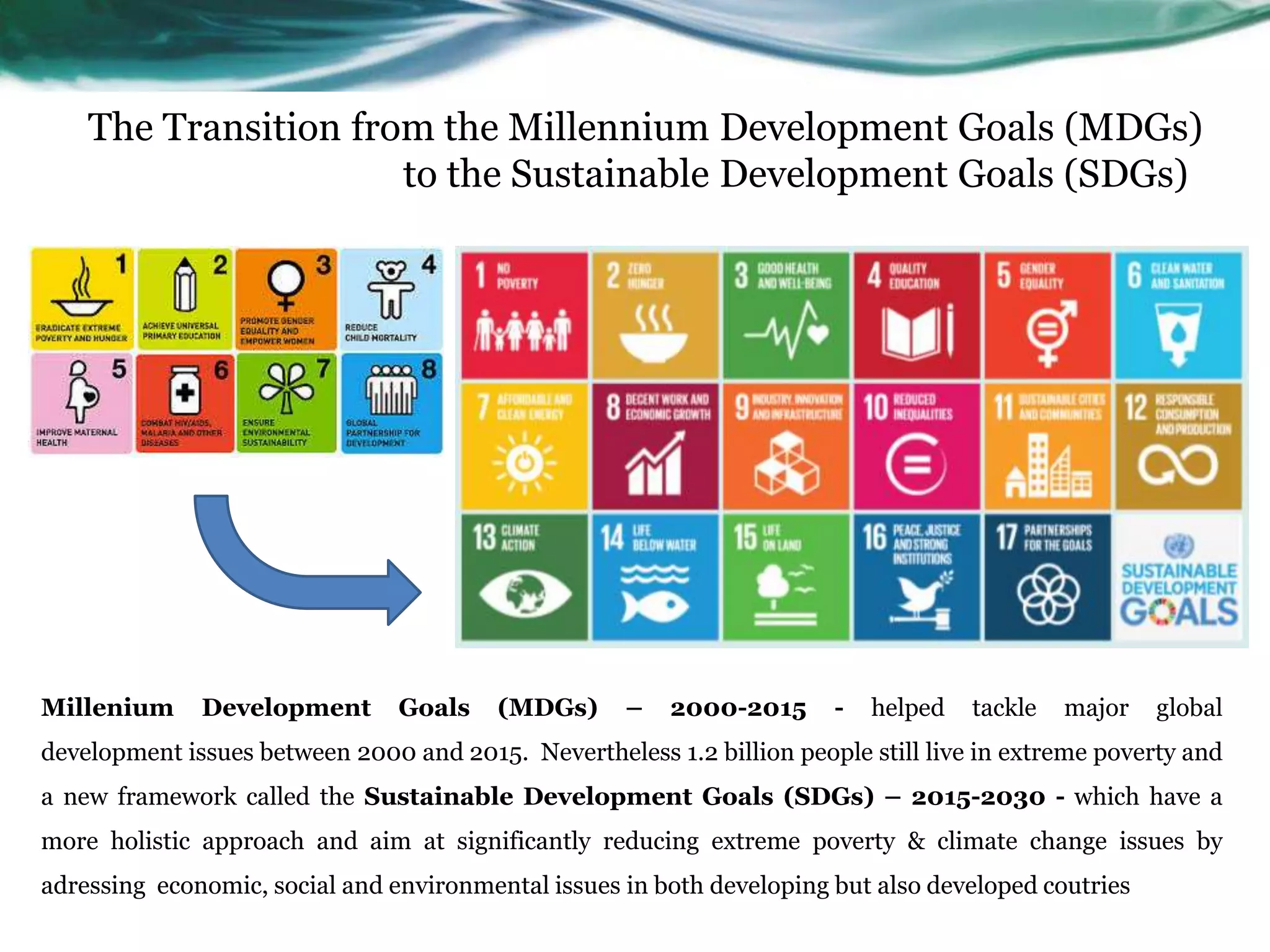

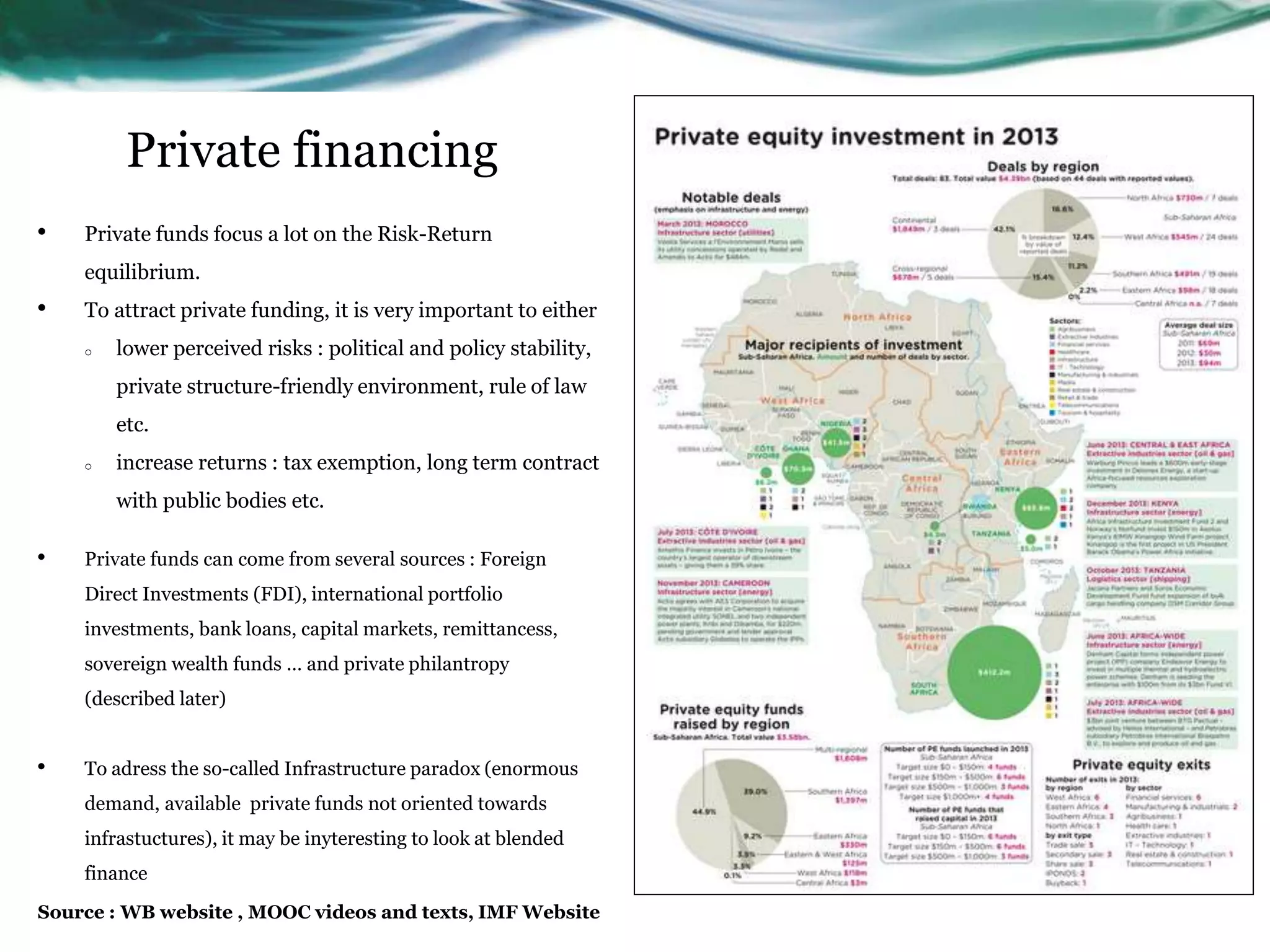

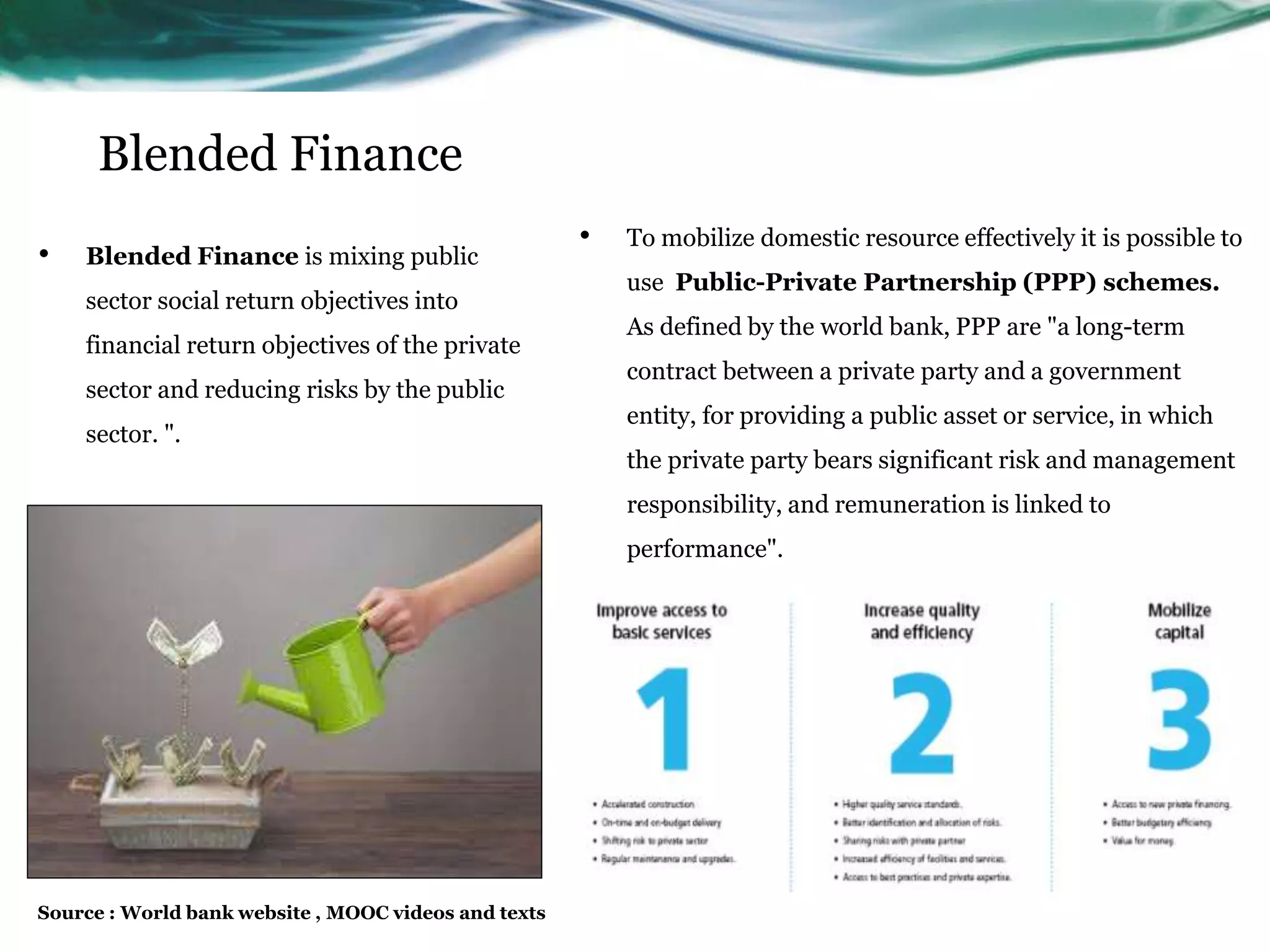

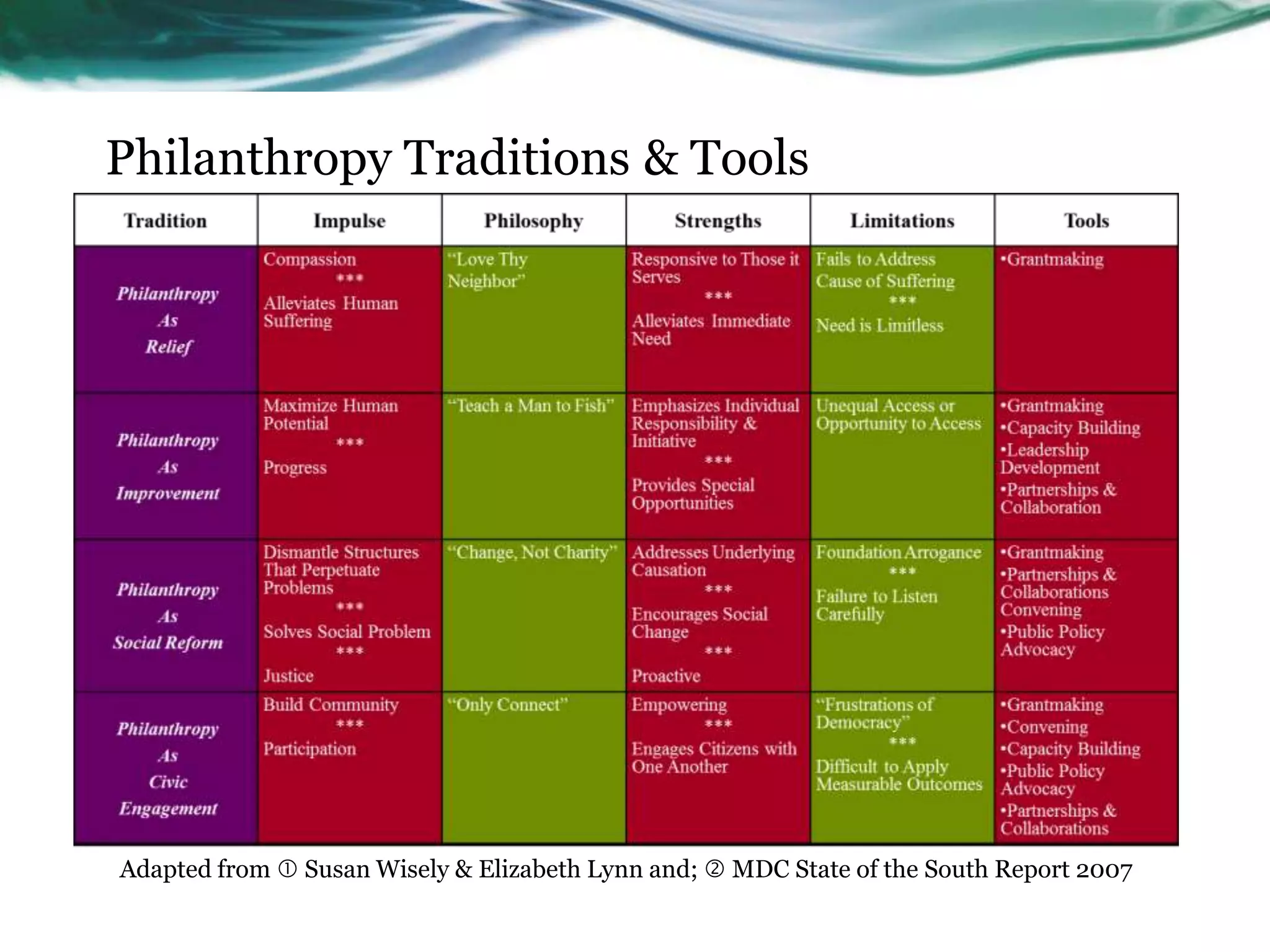

The document discusses financing for development and the transition from the Millennium Development Goals (MDGs) to the Sustainable Development Goals (SDGs). It states that an estimated $3-4 trillion annually is needed from public and private sources to adequately address the SDGs. Public financing focuses on social returns, and comes from domestic sources as well as foreign aid. Private financing prioritizes risk-return, and can be increased through lowering risks, raising returns, and blended finance which mixes public and private objectives. Blended finance and public-private partnerships are discussed as mechanisms to mobilize resources. Private philanthropy is described as targeting higher-risk projects not addressed by traditional private or public funds.