Embed presentation

Download to read offline

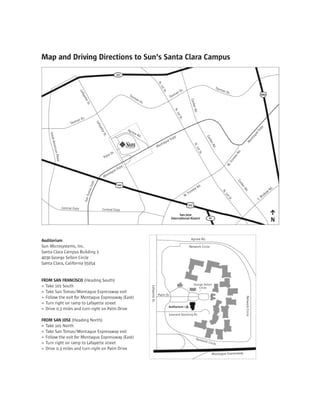

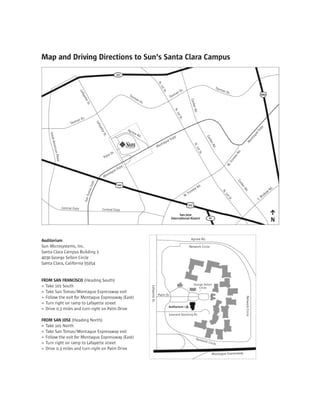

The document is a notice from Sun Microsystems for its 2007 Annual Meeting of Stockholders. It informs stockholders that the meeting will be held on November 8, 2007 at Sun's campus in Santa Clara, California. The purposes of the meeting are to elect directors, ratify the appointment of the independent auditors, approve stock and compensation plans, and consider two stockholder proposals. Stockholders of record as of September 10, 2007 are entitled to vote. Stockholders are encouraged to vote whether attending in person or by proxy.